化粧品の使い方や買い方 日本とアジア各都市でどう違う?~アジアインサイトレポート~

- 公開日:2018/03/06

- 3375 Views

Asia Insight Researchでは、

上海(中国) バンコク(タイ) ジャカルタ(インドネシア) ホーチミン(ベトナム) デリー(インド)

の5都市と日本全国の20-30代女性の美容意識をインターネット調査で聴取しています。

調査は、各国で生活レベルが高いクラスに相当するSEC(Social-Economic Class)A,Bの人を中心に行っています。

アイメイクとリップメイク 両方バッチリするのはどこ?アジア5都市の化粧品使用実態

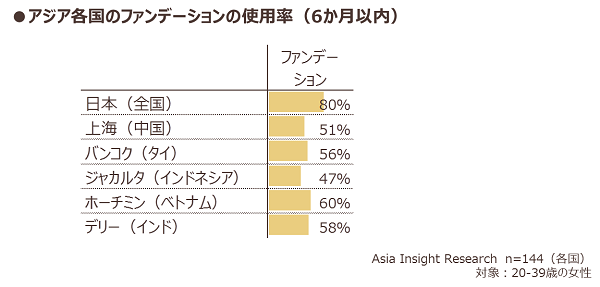

まず、各都市の女性の化粧習慣を比べてみましょう。図表1はメイク用の化粧品の使用率を並べた結果です。(図表1)図表1

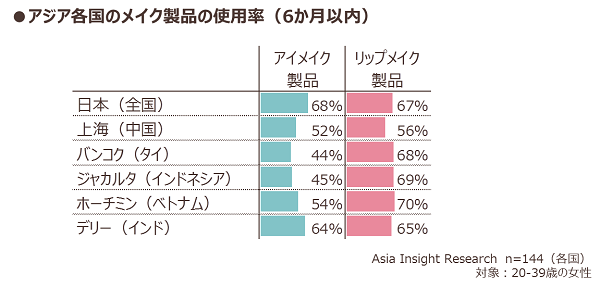

次に、ポイントメイクに使用するアイメイク製品、リップメイク製品の使用率を各都市間で比べてみましょう。(図表2)

図表2

一方アジア各都市を見てみると、日本と似た傾向にあるのがデリーで、上海、バンコク、ジャカルタ、ホーチミンではリップメイク製品の使用率がアイメイク製品の使用率を大きく上回っています。

インドでは「化粧は身だしなみであり、社会ステータスを示すものである」という考え方の基に、毎日化粧をするわけではなくても、特別な日にはアイメイクもリップメイクもしっかりとして身だしなみを整える、という習慣があります。デリーでアイメイクとリップメイクの使用率がほぼ同じであるのはこのためと考えられます。

他の都市でリップメイク製品の使用率の方が高い理由は様々です。たとえば、タイやインドネシアではナチュラルメイクが流行しているため、目元の化粧をする人が少ないということが理由として挙げられます。また、インドネシアではもう一つ、イスラム教の礼拝の度に顔を洗う必要があるため、化粧直しが手軽にできるリップメイクのみにする、という理由もあります。

これらの都市ではファンデーションの使用率よりもリップメイクの使用率が高くなっています。ファンデーションを塗らずに手軽なリップメイクのみ、といった人も多いようです。

化粧品のオンライン購入が進んでいる都市は?アジア5都市の化粧品購入チャネル

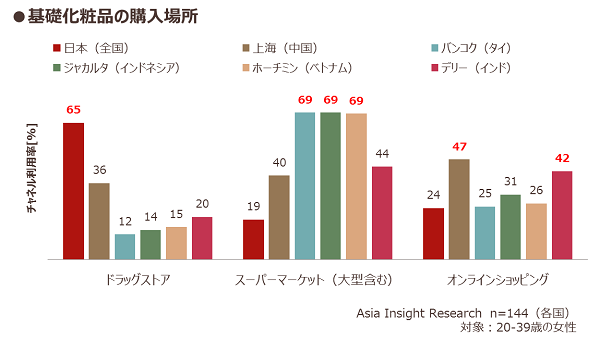

では、化粧品の買い方はどう違うのでしょうか?ここからはお肌のケアに用いる基礎化粧品について見ていきます。まずは購入場所を比べてみましょう。(図表3)図表3

日本でのドラッグストア利用が特徴的に多いことや、上海、デリーではオンラインショッピング化が進み、購入チャネルが多様化していることがわかります。

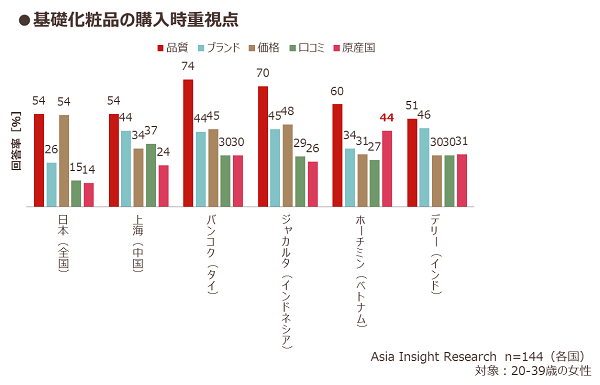

化粧品を買うなら自国産?輸入品?化粧品購入で重視すること

品質が一定保障され、プチプラコスメなど「安くてよいもの」が評価を得ている日本では「『ブランド』にこだわらずにコスパを考えて買う。」といった人が多く、上海、デリーでは「『ブランド』によって品質が保証されるならば価格は重視しない。」という人が多いようです。

上海では『クチコミ』も『価格』より重視されていました。他の都市と比べてクチコミの重視度が高いことがわかります。前述のとおり、オンラインショッピングの利用者が多く、購入チャネルが多様化しているさまが見えた上海の化粧品ユーザーですが、さらによりよい化粧品を求めて様々な視点から吟味する姿が浮かびます。

唯一、ホーチミンでは品質の次に原産国が重視されていました。

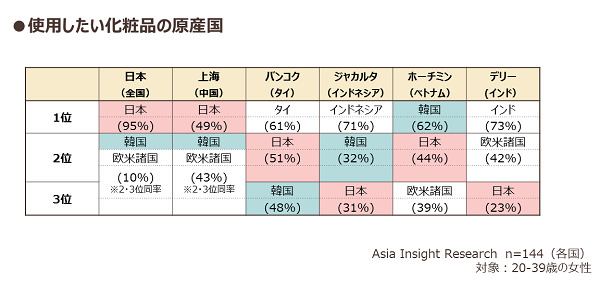

そこで、使用したい化粧品の原産国がどこか、を聞いてTOP3を示した結果が図表5です。

図表5

ベトナムに限らず、東南アジア女性にとって、日本女性や韓国女性の美肌・美髪は憧れです。欧米ブランドに比べて商品が手に入りやすいこともあり、ホーチミン、バンコク、ジャカルタで日本産と韓国産が好まれていることがわかります。

韓国産が好まれる理由としてはもう一つ、韓国が国策として、政府と企業でタッグを組んでいる影響も大きいと見受けられます。日本と同様、各国でK-POPや映画などの韓流ブームが起きましたが、その影響も残っているようです。

とはいえ、多くの国では自国産の化粧品が選ばれています。たとえば、イスラム教徒が約87%(2013年 外務省ホームページより)と大多数を占めるジャカルタでは、ハラル認証を受けた海外製の化粧品が少なく、ワルダーという自国製のブランドがシェア売上1位となっています。デリーではハーバルおよびアーユルヴェーダ化粧品の需要が増加しており、それらに対応している自国製を好みます。その国の文化に根ざしている商品であることが選ばれる要因になっているようです。

バンコクでタイ産が1位となっている理由としては、人気の日本製や韓国製商品の値段が高くて手が伸びにくい、ということがあります。自国産の商品で一定の品質が担保されているため、品質の次に価格を重視するバンコクの人たちは、価格が安い自国産商品を選ぶことが多いようです。

アジア各都市の化粧品使用・購入実態比較からは、自己表現としての化粧行動、宗教に関係する化粧行動といった文化の違いや、オンラインショッピングや市場に出回る商品の品質といった生活者が置かれている買い物環境の違いが見えてきました。 この分析は、インテージグループが、毎年実施しているAsia Insight Researchという自主企画調査の結果を基に、各国で活動しているインテージグループメンバーの現地知見を反映しています。Asia Insight Researchではアジア各都市の生活・消費実態を明らかにすべく、生活者の日用品、耐久製品、サービスの消費、及び利用状況、普段の買い物や情報接触に関する行動、価値観を聴取しています。

-

執筆者プロフィール

インテージ

***

-

編集者プロフィール

インテージ

***

Global Market Surfer

Global Market Surfer CLP

CLP