Understanding Generation Z Around the World: Country-Specific Trends Through Values and Daily Life

- Release date: Oct 06, 2025

- Update date: Oct 06, 2025

- 76 Views

- Usage and altitude

- Beauty

- Singapore

- China

- Thailand

- Indonesia

- Korea

- Hong Kong

- Malaysia

- Philippines

- Taiwan

- Generation Z

- Viet Nam

Generation Z (born 1996–2010, aged 15–29 in 2025) accounts for about a quarter of the world's population and is gaining attention as the largest future consumer group. What values do Generation Z members in various countries hold? What do they seek? And are there commonalities that transcend national borders?

This article uses Intage's Global Viewer* consumer database to compare Generation Z across 10 Asian countries, explaining their commonalities and differences.

For the comparative data, countries are classified into three groups based on per capita GDP: “Advanced Countries,” “Semi-Advanced Countries,” and “Developing Countries.”

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

目次

1. Generation Z Values: Criteria for Judging Things

(1)Generation Z Values: Perspectives on Health

(2)Generation Z Values: Perspectives on Parenting

(3)Generation Z Values: Perspectives on Their Own Future

(4)Generation Z Values: Perspectives on Material Possessions

(5) Generation Z Values: Attitudes Toward Shopping

2. Generation Z's “Food, Clothing, and Shelter” Around the World

(1) The State of Clothing ~ Adornments for the Body ~

(2) Food Situation: What Fills Our Stomachs

(3) Housing Situation ~ Where We Live ~

3. Summary

1. Generation Z Values: Criteria for Judging Things

First, we will compare the values of Generation Z across Asian countries using quantitative data from Intage's “Global Viewer”*.

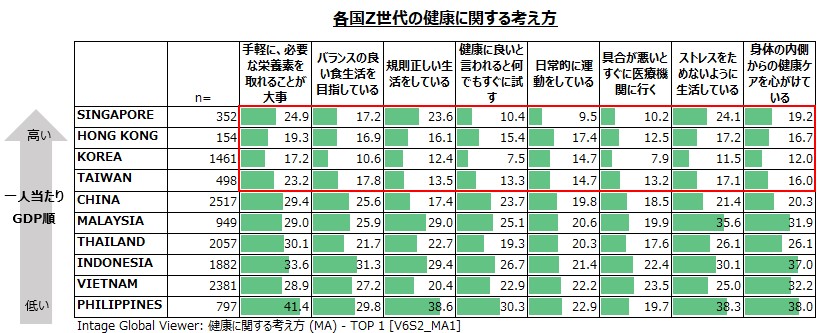

(1)Generation Z Values: Perspectives on Health

Survey results regarding “health” indicate that while people in developed countries tend to be less conscious of healthy habits, those in developing countries show a tendency to routinely manage aspects like their diet. This is thought to be related to the level of development of healthcare systems. In developed countries, a sense of security likely plays a role—the expectation that health maintenance and longevity can be reasonably anticipated without requiring special effort.

While health awareness is considered relatively low in South Korea, manufacturers' innovations are spreading products that enable effortless health management. As a result, “healthy pleasure”—enjoying health-conscious activities—has become a trend, driving increased health consciousness, particularly among Generation Z.

A prime example is OLIVE YOUNG, Korea's largest health and beauty store with over 1,300 locations nationwide. Since the pandemic, it has expanded its lineup of women's health products (W-care), supplements, inner beauty products, and health foods, strengthening its strategy of prominently featuring wellness. Consequently, the store's sales of health functional foods in 2023 grew by over 45% compared to the previous year.

Recently, “dual-formulation” multivitamins combining liquid and tablets (supplements) in one bottle have become increasingly common on store shelves and are gaining popularity among young people. Among these, “I'm vita Immune Shot” (34,900 won / approx. $36) stands out, offering 18 nutrients in one dose: 10 vitamins, 7 minerals, and beta-carotene. approx. ¥3,600 / 16 bottles) and “orthomol immune Multivitamin & Mineral” (34,900 won / approx. ¥3,600 / 7 bottles) from a premium German health supplement brand are particularly well-received.

Related Article: [Asia's Generation Z] South Korea's Gen Z: Managing Health Easily and Enjoyably

Among South Korea's Gen Z, a style is spreading where they explore health management that suits them, incorporating it effortlessly and enjoyably. We introduce “OLIVE YOUNG,” South Korea's largest health & beauty store, which created this trend. We also cover the marketing of “healthy pleasure,” evolving as a new trend and taking root in Gen Z's lifestyle.

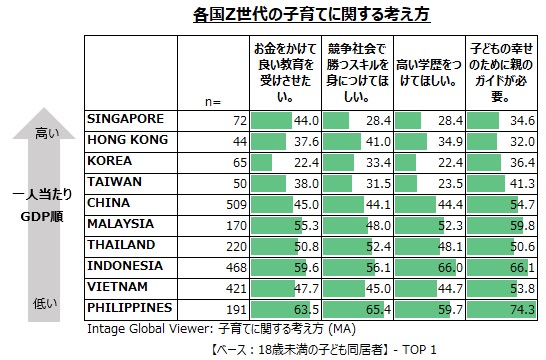

(2)Generation Z Values: Perspectives on Parenting

In surveys regarding parenting attitudes, parents in developed countries tend to show relatively low willingness to invest heavily in their children's education, possibly influenced by their own satisfaction with their current circumstances. In contrast, many parents in semi-developed and developing countries actively invest in education, sports, and other areas, aiming to enhance their children's skills.

Related Articles:[Generation Z in Asian countries] Characteristics of Generation Z in each country: Generation Z's view of their own future.

Analyzing Generation Z's future outlook from four perspectives—“personal financial situation one year from now,” “health,” “desired assets,” and “child-rearing philosophy”—revealed a strong preference for stability in developed nations, with many wanting to “maintain their current lifestyle.” In developing countries, a more forward-looking mindset stood out, with a desire to “improve their situation.” This demonstrates that the values and behaviors Generation Z prioritizes vary significantly depending on a country's stage of development.

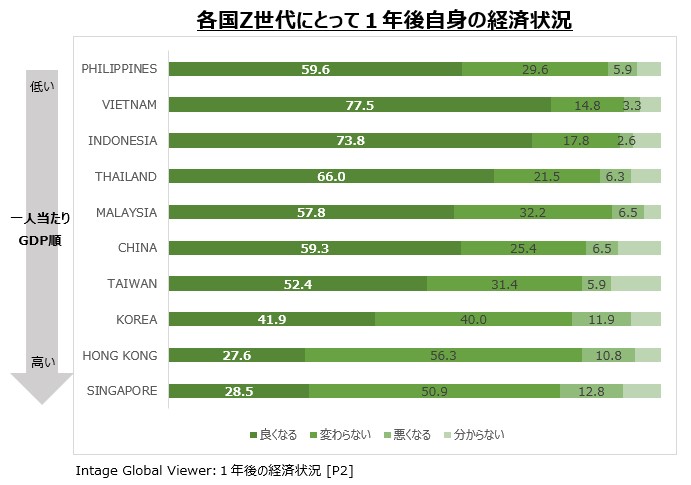

(3)Generation Z Values: Perspectives on Their Own Future

A survey on “How do you envision your personal financial situation one year from now?” revealed contrasting trends between developed and developing countries. While Gen Z in developed countries showed a strong preference for stability, expressing a desire to “maintain their current lifestyle,” Gen Z in developing countries held a more positive outlook, expecting their situation to “improve compared to now.” A common thread across both groups is that they generally perceive their future financial situation as relatively bright and stable.

In Thailand, where many Gen Zers believe their economic situation will “improve,” young people pursuing entrepreneurship and new challenges stand out. For example, the cosmetics brand “LOVE POTION,” owned by a woman in her 20s, achieved rapid growth by leveraging its TikTok account (3.3 million followers: @lovepotion_officialth) and selling products through live streams. The brand began when its owner, at age 17, wanted to “deliver high-quality products at affordable prices.”

https://www.instagram.com/p/DC84oJWTx7p/?hl=en&img_index=5

Related Article: [Generation Z Across Asia] Thailand Edition: The Work Styles Generation Z Seeks - Focus on Young Women Entrepreneurs

Cosmetics brand “SRICHAND” surged to the top spot in Thailand's “Top 55 Companies to Work For,” surpassing popular IT firms and domestic conglomerates. How do they perceive Thailand's economic growth, and what kind of work styles does Generation Z seek? Based on Thailand's job popularity rankings, we explore the reality of Generation Z's ideal work styles.

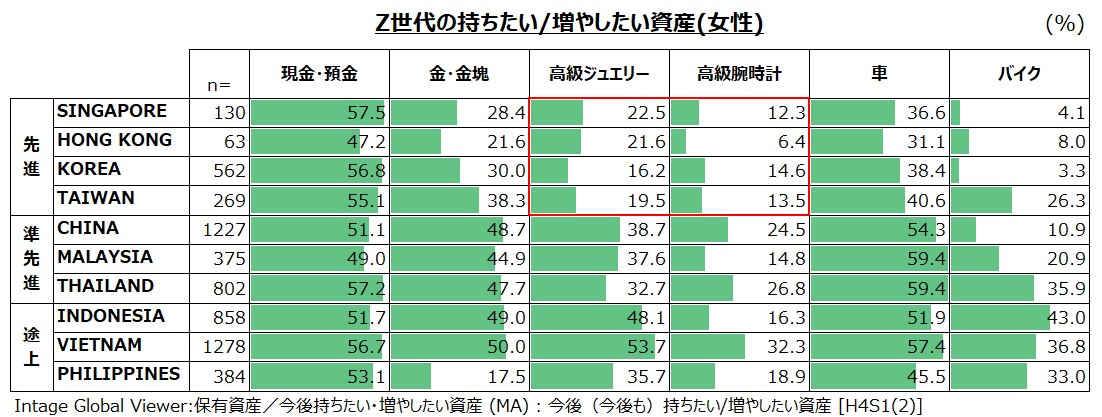

(4)Generation Z Values: Perspectives on Material Possessions

A survey of Gen Z women across countries regarding “assets they wish to acquire or increase in the future” revealed that the higher a country's level of development, the lower the tendency to desire so-called luxury goods. While interest in luxury watches and high-end jewelry is relatively low in developed nations, interest in tangible assets like gold, gold bullion, and cars is strongly evident in semi-developed countries.

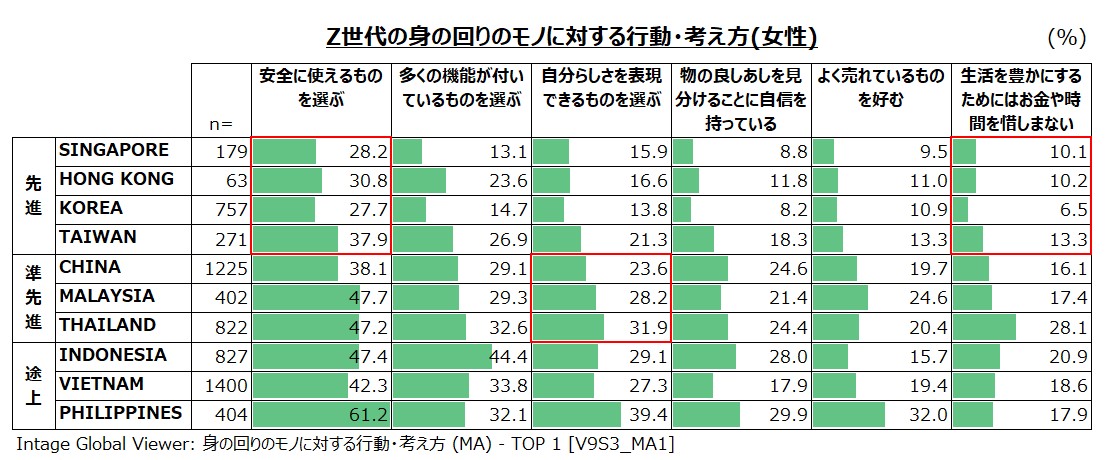

Next, while Generation Z is often described as having low material desires, how do they feel about the items in their personal lives? A survey by “Global Viewer”* found that female Gen Zers in developed countries tend to have relatively less attachment to their personal belongings, whereas in emerging and developing countries, there is a stronger tendency to want to improve their lives through possessions.

Furthermore, examining purchasing criteria reveals that in developed countries, safety, security, and functionality are prioritized. In semi-developed countries, consumers favor products that express their individuality. In developing countries, safety and functionality tend to be the primary considerations.

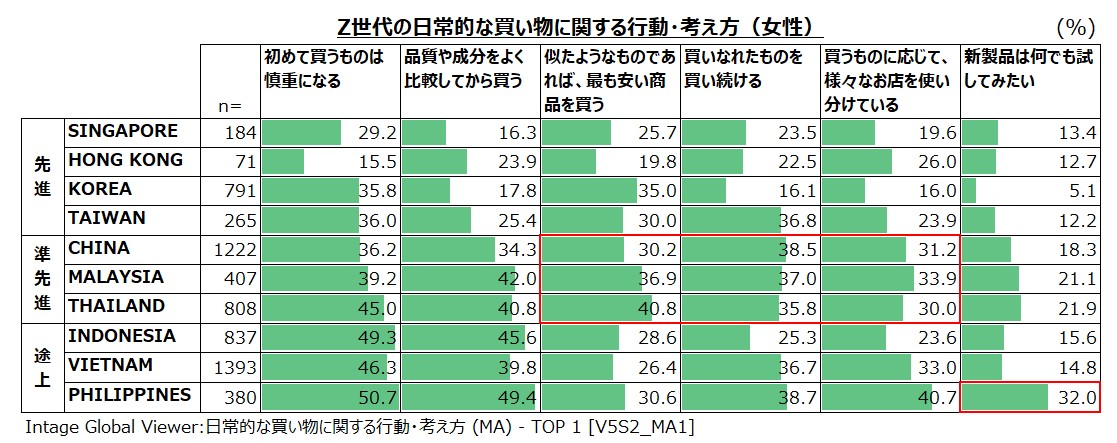

(5) Generation Z Values: Attitudes Toward Shopping

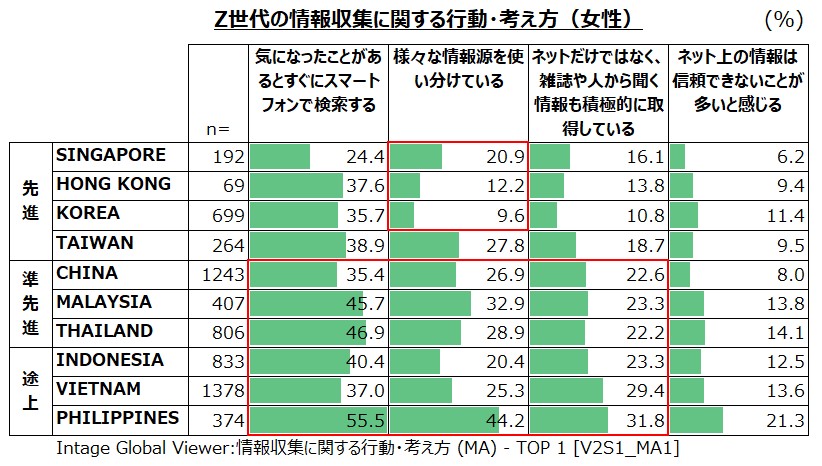

Surprisingly, survey results on “information-gathering behaviors and attitudes” showed that consumers in developed countries (excluding Taiwan) did not exhibit a strong tendency to actively seek information. Conversely, consumers in emerging economies and developing countries demonstrated a strong inclination to proactively gather multifaceted information on topics of interest.

What about everyday shopping?

Generation Z in developed countries tends to be relatively less cautious when purchasing items for the first time, due to stable product quality. Conversely, in semi-developed and developing countries, a clear tendency emerged to make careful decisions, considering not only quality and ingredients but also price.

Related Article: [Generation Z Across Asia] Attitudes Toward Personal Possessions: Advanced-Nation Gen Z Women Show Less Material Desire~

Even among Generation Z, values and lifestyles vary significantly by country. The survey divided countries into three groups based on GDP and analyzed Gen Z characteristics from four perspectives: “Behaviors and Attitudes Toward Personal Possessions,” “Behaviors and Attitudes Toward Information Gathering,” “Behaviors and Attitudes Toward Everyday Shopping,” and “Assets They Wish to Own in the Future.” Through these viewpoints, we reveal the values guiding Gen Z's daily lives and what they prioritize.

2. Generation Z's “Food, Clothing, and Shelter” Around the World

Next, we will introduce trends observed among Generation Z across Asian countries regarding the essentials of daily life—“clothing, food, and shelter”—using specific examples based on Intage's consumer database “Global Viewer”*.

(1) The State of Clothing ~ Adornments for the Body ~

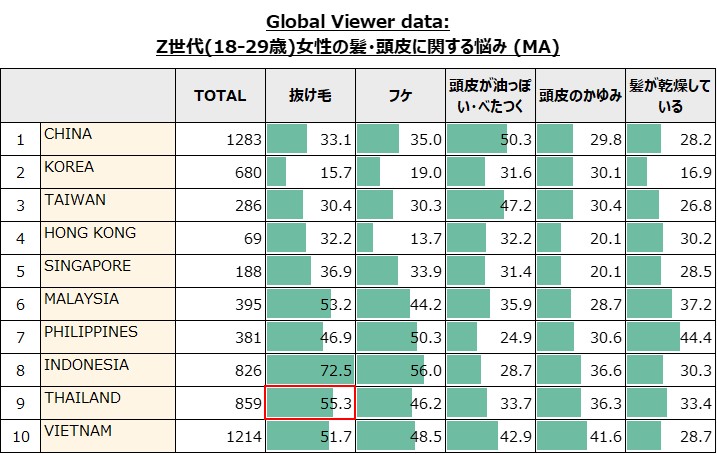

First, let's examine trends in hair care and makeup cosmetics as “clothing (items that adorn the body).” For example, in Thailand, 55% of Gen Z women are troubled by “hair loss,” highlighting a noticeable focus on hair care from a young age. Responding to these needs, many products using natural ingredients tailored to individual constitutions have also emerged.

One example of our products is the hair and body care brand “Kaff & Co.,” which uses extracts of kumquat, ginger, and aloe. This brand offers products tailored to various concerns, such as scalp type (normal or oily), dandruff, and hair loss.

Related Article: [Generation Z Across Asia] Thailand Edition: Hair Care Products & Protein-Infused Milk Popular Among Young Women

More companies in Thailand are capturing the hearts of Gen Z by turning “I wish there was a product like this” into reality. Particularly, hair care brands incorporating Thai herbs and natural ingredients are emerging one after another as solutions for “hair loss,” a concern shared by 55% of Gen Z women.

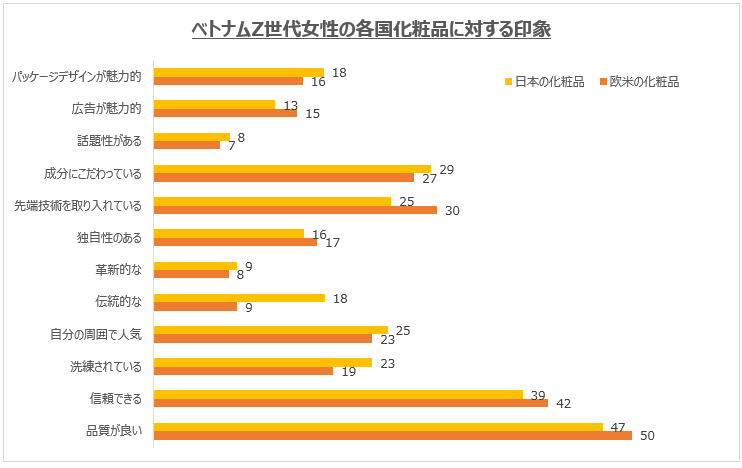

In Vietnam, where awareness of beauty and health is high, vegan cosmetics are gaining popularity. Fifty-one percent of Gen Z women responded that they “carefully research ingredients and effects when purchasing cosmetics,” indicating a preference for ingredients and efficacy over brand names. What's interesting is that vegan products are accepted not just as an “ethical” choice, but also as ‘stylish’ and “trendy.” Adopting them as a trend could eventually become a catalyst for raising awareness about environmental issues. Furthermore, it's clear that Western brands are more highly regarded in the market than Japanese brands.

https://tgmresearch.vn/tgm-pro-vietnam-bao-cao-phan-loai-rac-tai-nguon.html

Related Article: [Generation Z Across Asia] Vietnam's Health- and Environment-Conscious Gen Z ~ The Rising Trend of “Vegan Cosmetics” ~

In Vietnam, where interest in ‘beauty’ and “health” is strong, vegan cosmetics are currently gaining significant attention. There's a noticeable trend of prioritizing ingredients and effects that suit individual needs, rather than sticking strictly to domestic brands. While environmental awareness is growing in major metropolitan areas like Ho Chi Minh City and Hanoi, the country as a whole is still in a developing stage.

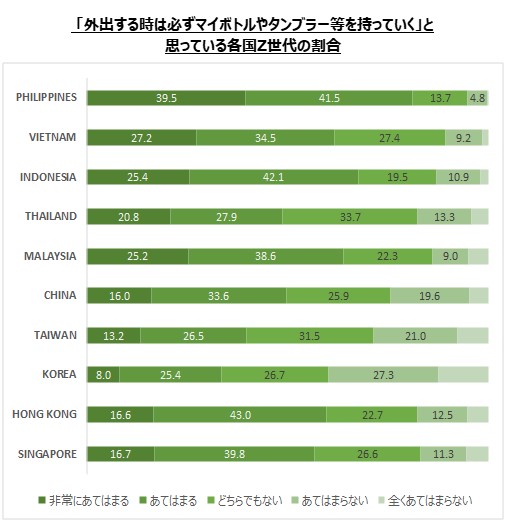

In the Philippines, Vietnam, and Indonesia, many Gen Zers carry their own water bottles or tumblers when going out.

In Indonesia especially, personal water bottles have become a habit not only for eco-consciousness but also as a fashion statement expressing individuality. With vending machine and convenience store infrastructure not as developed as in Japan, making it difficult to easily purchase drinks while out and about, personal bottles serve as a practical means of hydration. Against this backdrop, more Gen Zers are seeking designs that suit their personal style.

Related Article: [Generation Z Across Asia] Indonesia Edition: Fusion Coffee & My Bottle Supported by Gen Z

Gen Z tends to prefer cold beverages, and fusion-style drinks combining coffee with spices or fruits are popular. Alongside natural ingredients, halal certification, and health-consciousness, bringing your own bottle has become established due to environmental awareness. High-end stainless steel tumbler specialty shops and local coffee shops offering discounts for bringing your own bottle are also gaining support.

Meanwhile, in South Korea, reusable water bottles aren't widely used among Gen Z. Card-sized compact wallets and mini bags that hold only essentials like lipstick are popular, and carrying a reusable bottle in a tote bag tends to be frowned upon as “disrupting the outfit's balance.”

Related Article: [Generation Z Across Asia] Korean Gen Z's Attitudes Toward Beverages and Their Relationship to Trends

With approximately twice as many cafes as convenience stores, Korea is called a “Cafe Nation.” Cafes offering affordable, delicious drinks and diverse menus are popular among Gen Z. However, reusable water bottles haven't caught on due to clashing with the mini-bag trend, leaving Korea lagging behind other countries in eco-consciousness.

(2) Food Situation: What Fills Our Stomachs

Next, let's look at “food.”

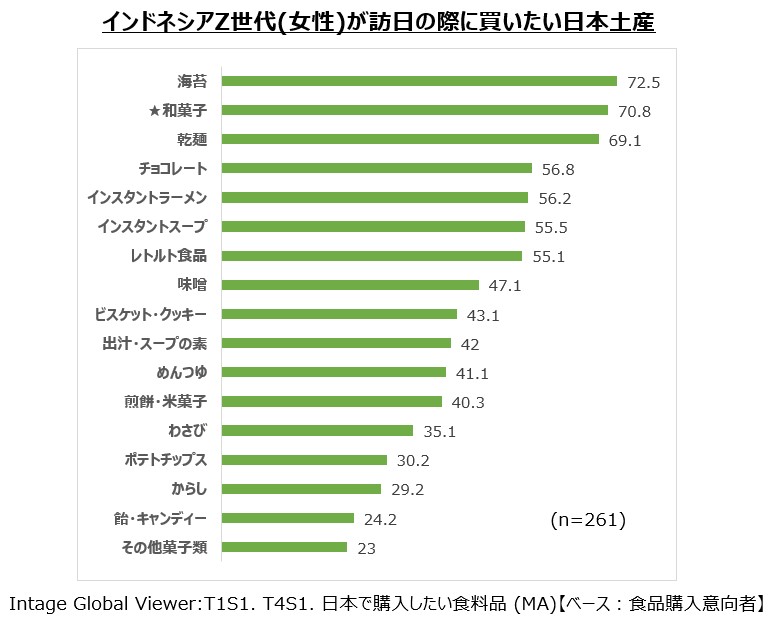

Japan-related products are popular in Indonesia and Vietnam. In Indonesia, driven by the increase in visitors to Japan, interest in Japanese sweets is growing, particularly among Generation Z. Indonesia already has its own traditional sweet called “KUE MOCHI,” making Japanese “DAIFUKU” easily accepted, and it is expected to gain even more traction going forward.

Related Article: [Generation Z Across Asia] Japanese Sweets & Halal Cosmetics Popular Among Indonesian Gen Z

Japan has become a popular travel destination in Indonesia, leading to an increase in visitors. Attention to Japanese sweets is also growing due to social media influence and their affinity with traditional Indonesian confections. In October 2024, halal certification labeling became mandatory, driving popularity for natural ingredients and halal cosmetics, where price, texture, and comfort are also highly valued.

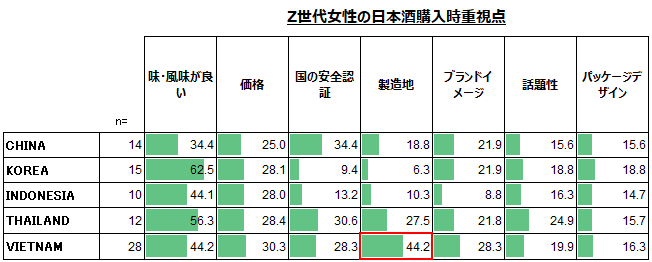

Among Vietnamese Gen Z women, beverages combining sake and matcha are popular. Amidst a health-conscious trend to avoid additives, sake is gaining attention due to its clear production origins, coinciding with the sushi boom. Furthermore, influenced by social media, “appearance” is also valued, leading to support for “matcha × coconut juice.” Matcha is widely accepted as a healthy, high-quality beverage.

Related Article: [Generation Z Across Asia] Vietnam Edition: Popular Beverages Among Gen Z Women ~ Fusion with Japanese Origins ~

In Vietnam, Southeast Asia's most dynamic nation with a population exceeding 100 million, matcha-based beverages are popular among health-conscious Gen Z. When choosing drinks, “clear origin” and “natural ingredients” are prioritized. Sake enjoys higher support than in other countries due to its reliability and pairing with sushi.

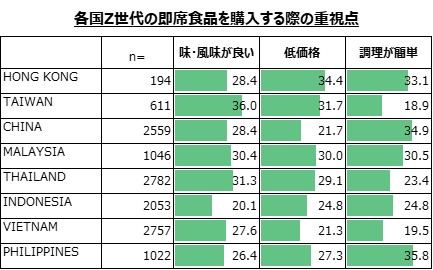

Since the COVID-19 pandemic, frozen foods and instant noodles—convenient meals that can be easily prepared at home—have gained popularity in Taiwan. Their accessibility at supermarkets and convenience stores aligns well with consumer needs. However, beyond mere convenience, data reveals a distinct characteristic: Taiwanese consumers place a stronger emphasis on the taste and flavor of instant noodles compared to other countries.

The rising health consciousness among Gen Z is also impacting instant noodles. The new “25% Less Sodium Scallion-Braised Beef Noodles” product from “Manhan Grand Feast,” launched in November 2024, is drawing attention as the first “reduced-salt, health-conscious” product in Taiwan's instant noodle market.

Related Article: [Generation Z Across Asia] Taiwan Edition: Popular Instant Noodles and Cookies Reflecting Gen Z Values

Instant noodles are deeply ingrained in daily life in Taiwan, with approximately 900 million servings consumed annually. Driven by health-conscious trends centered around Gen Z, low-sodium and vegetarian options have emerged. Social media also sees sharing of creative ways to enjoy instant noodles on a budget. Additionally, high-quality cookies are gaining significant attention, becoming so popular that numbered tickets are issued for purchases.

Additionally, frozen foods are gaining popularity in Taiwan. With many dual-income households leading busy lives, frozen meals that can be easily prepared by simply heating them in the microwave have become indispensable, with annual consumption reaching 45 billion servings. The “Spicy Pork Skin” product developed in collaboration with popular gourmet YouTuber “Chien Chien” has been well-received for its spicy flavor that pairs well with rice or alcohol, along with its tender pork skin. Offering an easy way to consume collagen, it gained strong support, particularly among Gen Z women. From September 2023 to May 2024, it sold 300,000 bags (49 yuan per bag, approximately 240 yen).

Related Article: [Asia's Generation Z] Taiwan Edition: Frozen Foods and Craft Beer for Gourmet Home Enjoyment

Taiwan's Generation Z is focusing on frozen foods and craft beer that offer “casual enjoyment at home.” With many people pressed for time, the frozen food market is expected to continue expanding even after the pandemic. Convenience stores are also launching collaboration products, seeing strong sales targeting Generation Z. Amid rising prices driving demand for home drinking, local craft beers are also popular. Designs that look great on social media, unique flavors, and high-alcohol products (9.99% ABV) are particularly in demand.

For Generation Z in the Philippines, meals are one of the most important aspects of daily life and a key source of entertainment and enjoyment. Due to the influence of the English-speaking world and America, Western cuisine is naturally accepted when dining out, and delivery services are well-established. On the other hand, when cooking at home, 50% responded that they eat “reliable home cooking = Filipino cuisine.” Influenced by past Spanish and American rule, Filipinos show high flexibility in embracing other cultures, leaving room for Japanese cuisine to gain further traction in the future.

Related Article: [Generation Z Across Asia] Filipino Gen Z's Food Preferences Reflect National Character ~ Western Cuisine vs. Japanese Cuisine~

For Gen Z, eating is one of life's great pleasures. Western cuisine is widely accepted for dining out, with many restaurant chains visible. For takeout and delivery, Western options like hamburgers (McDonald's, Burger King), sandwiches (Subway), fried chicken (KFC), and pizza (Shakey's, Pizza Hut) are frequently chosen. Meanwhile, home cooking centers around Filipino cuisine, with many proudly stating “our national dishes are the tastiest.”

(3) Housing Situation ~ Where We Live ~

Finally, regarding the “living” environment, let's discuss “fragrance.”

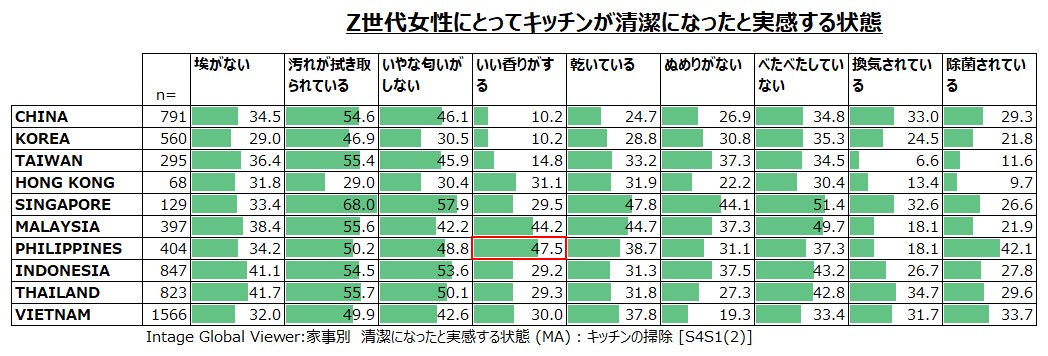

A survey on perceptions of “cleanliness” among Generation Z in the Philippines revealed a tendency to feel ‘cleaner’ through smell when the “pleasant scent” of detergent lingers in spaces like the living room, bathroom, toilet, and kitchen. Filipinos have a strong preference for “pleasant scents,” and using foreign products is sometimes seen as “a sign of one's standard of living.” It can be said that the entire nation possesses a culture that values fragrance.

Related Article: [Generation Z Across Asia] Filipino Gen Z Values “Pleasant Scents”

Filipino Gen Z women prioritize “pleasant scents” above all else as an element that makes them feel clean. Cleaning is considered the maid's job, and there is a custom of leaving behind a scent. Particularly in the kitchen, the place that should maintain the highest level of cleanliness, the strong scent of dishwashing detergent is seen as a “sign of cleanliness.” Furthermore, using foreign products is also consciously regarded as a symbol of living standards and status.

3. Summary

A survey by “Global Viewer”* reveals that Generation Z across Asia exhibits significantly different values and behaviors depending on their country's economic conditions and living environment.

In developed nations, they tend to be less particular about health and possessions, showing a strong preference for stability. Conversely, in developing countries, they are more proactive about consumption, actively investing in themselves and gathering information.

Regarding clothing, food, and housing: - In Thailand and Vietnam, natural materials and vegan cosmetics are popular. - In Indonesia and Vietnam, reusable water bottles are favored due to health-consciousness and eco-awareness. - In Taiwan, frozen foods, instant foods, and craft beer appear to be becoming central to household consumption. - In the Philippines, enjoyment of life and status expression through food and fragrance are emphasized.

Thus, even among the same Generation Z, analysis tailored to each country's GDP and lifestyle is crucial.

-

Editor profile

Chew Fong-Tat

A Malaysian who has lived in Japan for 14 years. He is in charge of creating the Global Market Surfer website.

Global Market Surfer

Global Market Surfer CLP

CLP