<Report from overseas office> [China] Accelerating Digital Society in China, the World's Number One Mobile Payment Country

- Release date: Nov 18, 2019

- 7800 Views

The world's largest mobile payment country

In Japan, the consumption tax was raised to 10% in October 2019. Along with this tax increase, measures such as point rewards or cashback of 5% or 2% on purchase amounts were introduced, and this is expected to accelerate the adoption of cashless payments, including mobile payments, across the country.

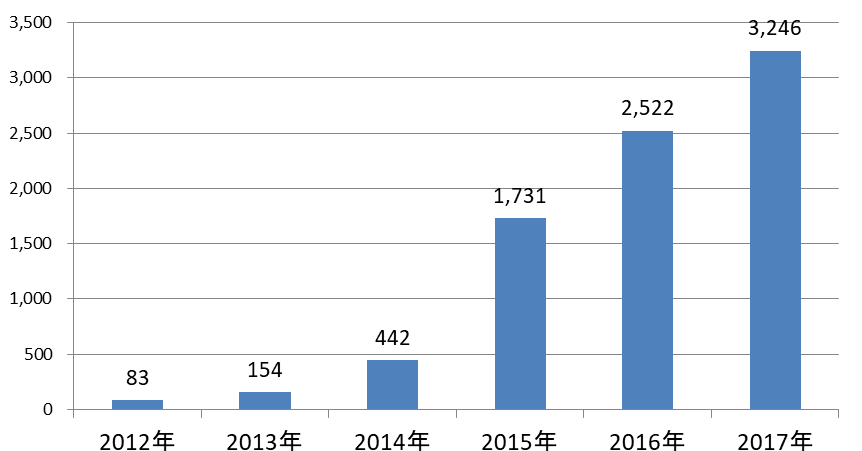

In China (Shanghai), where I am currently stationed, the use of mobile payments has expanded rapidly since around 2014, driven by government initiatives. As shown in the figure below, mobile payment transaction value increased nearly fourfold in just one year between 2014 and 2015, and the total amount grew from 83 trillion yen in 2012 to approximately 3,246 trillion yen in 2017, representing an almost 40-fold increase.

In addition, the number of users is said to have reached around 600 million. With continued improvements in mobile payment services and shifts in consumer awareness, mobile payments are expected to become even more widespread, with transaction volumes continuing to grow.

* Excerpt from ii Media Research (艾媒諮詢) Unit: trillion yen

On the other hand, in the Japanese market, the size of the Japanese mobile payment market was 1,256.648 trillion yen in fiscal 2017, and is expected to expand to 4 trillion yen in fiscal 2023 (according to Yano Research Institute, Inc.), but this is an overwhelmingly small market compared to China.In China, the use of mobile payment is rapidly expanding at a rate that exceeds that of developed countries such as Japan, and it has deeply penetrated every aspect of the social economy, becoming an indispensable infrastructure for daily life.

Background Behind the Widespread Adoption of Mobile Payments

It is said that there are three main reasons behind the widespread adoption of mobile payments, as outlined below.

Reason 1: Smartphones Are More Affordable Than PCs

In China, internet usage via personal computers did not spread as widely as in advanced economies. As a result, smartphones became widespread before PCs.

One reason is cost: purchasing a PC typically costs 4,000–6,000 yuan, whereas a Chinese-made smartphone can be bought for around 2,000 yuan, making it accessible to a much larger portion of the population.

Reason 2: Cash Was Not Trusted

In China, counterfeit goods and fraudulent transactions have persisted despite tighter government regulation. Counterfeit banknotes have also circulated, meaning that cash has not enjoyed the same level of trust as in Japan.

Against this backdrop, mobile payments (QR code payments) were rapidly adopted. These app-based services were originally developed with peer-to-peer transfers between SNS users in mind, but once QR code–based in-store payment functions were added, they spread explosively across China.

In China, both Alipay, provided by Alibaba, the largest e-commerce company, and WeChatPay, provided by Tencent, are leading the way in mobile payments and are also useful as a means of sending money between individuals.As long as the fee-free limit is not exceeded, there is no fee for person-to-person remittance and money can be sent at any time. In China, mobile money transfer can be used to split the cost of a meal, or to give a New Year's gift or congratulatory gift.

Reason 3: Introducing mobile payment (QR code) is easy for businesses.

IC payment systems such as Suica, which are used by many people in Japan, are said to have high barriers to entry for individual stores due to the introduction of terminals and screening.On the other hand, businesses need only a smartphone and a piece of paper with a QR code printed on it to introduce QR code payment, which makes it easy for businesses to introduce it.

In this way, cashless payments via QR codes, enabled by smartphones that virtually everyone carries, are now used everywhere in China, from major fast-food chains to small street stalls. This is not a future vision—it is what is happening in China right now.

China has become a true “digital powerhouse,” and many Japanese visitors who travel there are struck by the country’s level of digital advancement.

With the emergence of mobile payment services, going out without cash has become an everyday thing for Chinese and expatriates alike. I no longer carry a wallet with me when I go out.Lastly, I would like to introduce how I usually use mobile payment services.

Acceleration of a Digital Society Driven by the Spread of Mobile Payments

In China today, smartphone-based payments are so widespread that it is fair to say there is almost no need to carry cash at all. Cashless payment is available at nearly every store. Not only at supermarkets, department stores, hotels, and restaurants, but also when paying taxi fares, renting bicycles, paying utility bills or rent—in virtually every aspect of daily life—all you need is a smartphone with either WeChat Pay or Alipay installed. Simply scanning a QR code enables instant payment or money transfer, even at small street stalls when buying something as minor as a single bottle of water.

With the advent of mobile payment services, going out without carrying cash has become routine for Chinese people and for expatriates like myself. I no longer carry a wallet when I go out.

Finally, I would like to share the situations in which I personally use mobile payments in my daily life.

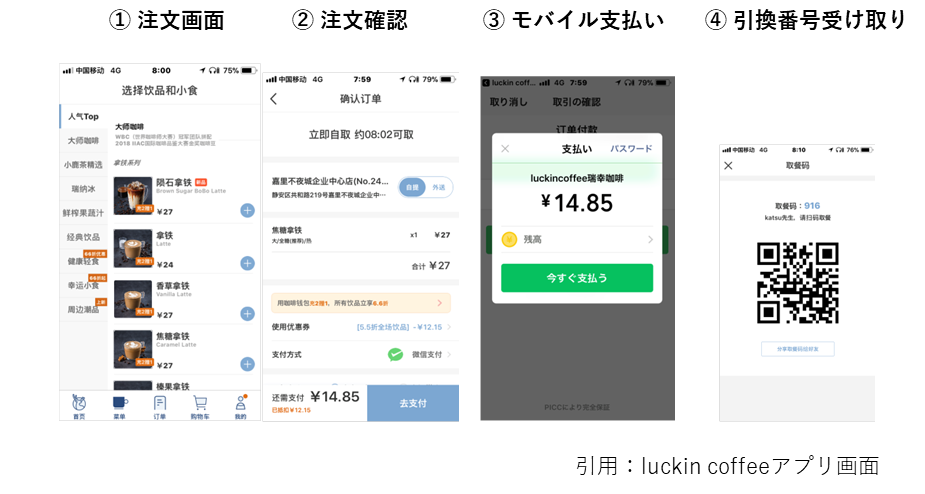

- Buy Coffee -

When I arrive at the station closest to my office, I use an app to order coffee in advance. By the time I reach the shop, the drink is ready for pickup, so there is no waiting time. Payment, of course, is made via mobile payment at the time of purchase.

If you've ever bought coffee at Starbucks in Japan, you'll know that there are always four to five staff members at the store, including the staff who check the bill and the staff who make the coffee, and it may take 10 to 15 minutes to buy coffee when the store is crowded.At luckin coffee, the store I use is always staffed by two people, and there are no customers waiting for their coffee to be ready. There are no customers waiting for their coffee to be ready. The shop is run by two staff members, one who prepares the ordered items and the other who checks the order form and puts the finished items on the shelf. I am impressed with this very convenient and efficient system.

It opened in January 2018 and, within the same year, expanded to over 2,000 stores nationwide. In July, it became a unicorn company—an unlisted firm valued at over USD 1 billion—the fastest in Chinese history to do so.

The flow from ordering to payment is as follows.

You will receive a notification on the app when the product is ready, and you will receive the product by holding the QR code displayed on the app over the reader installed in the store by yourself.

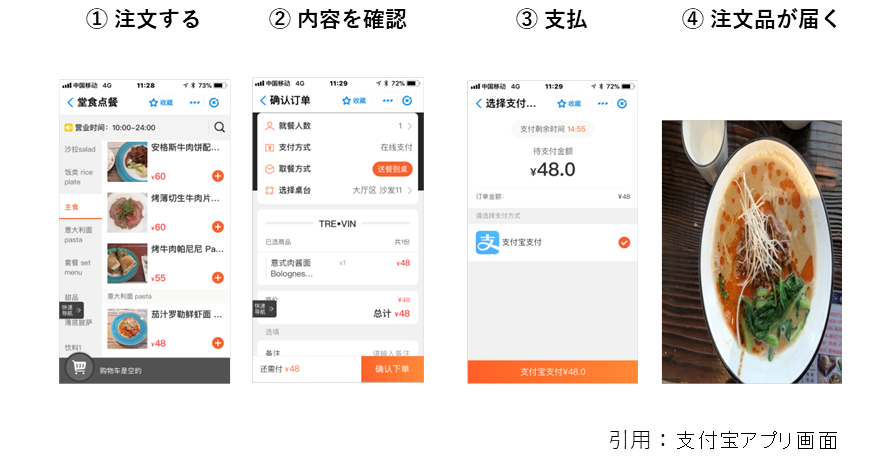

- Paying at Restaurants -

For lunch, I go to restaurants near my office, and most places now require customers to order and pay at the same time using their smartphones. As a result, floor staff mainly focus on delivering the food that customers have ordered.

I was a little confused the first time I used this system, but there are no ordering mistakes or billing errors, which makes it reassuring. From the restaurant’s perspective, it also helps reduce staff workload and labor costs, making it an extremely efficient system, which I find impressive.

The process from order to payment is as follows.

- Calling a Taxi -

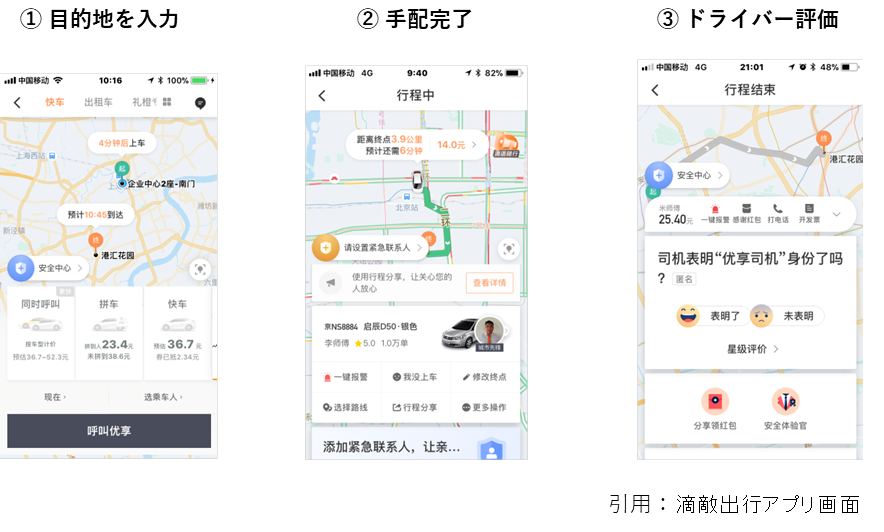

In Shanghai, where I am stationed, public transportation such as trains and buses, as well as cabs, are very cheap. In Shanghai, where I am stationed, public transportation such as trains and buses, as well as taxis are available at very low prices. However, cabs are often hard to catch on the street, so I usually use apps to arrange a cab.Taxi booking process:

1. Enter your current location and destination, and an estimated travel time and fare are displayed.

2. After requesting a taxi, the app shows how long it will take for the driver to arrive at the pickup point.

3. Once you get in, you ride to your destination, and payment is processed automatically via mobile payment upon arrival.

The app also includes a rating system that allows users to evaluate the driver’s manners and service after the ride, which has contributed to improving overall driving etiquette among taxi drivers.

As mobile payments have become usable for virtually every type of transaction, they have brought about new changes in everyday lifestyles.

In recent years, China as a nation has been actively promoting digital transformation. The widespread adoption of mobile payments is a key component of this progress toward a digital society. While significantly reshaping Chinese lifestyles, it is also contributing to greater convenience and efficiency across society as a whole, driving broad and fundamental social change.

Translated with AI Translator-

Author profile

Katsuhiko Saitou

4 years in Shanghai, 40s, male researcher. He has worked on more than 1,000 projects in Japan and overseas (mainly in Asia). He has worked on more than 20 projects related to product launches in various fields. Conducted several workshops on physician and patient insight research, market forecast research, and positioning creation, both in Japan and overseas.

-

Editor profile

INTAGE

***

Global Market Surfer

Global Market Surfer CLP

CLP