<Report from overseas office> [Vietnam] What is the potential of the Vietnamese market? The presence of Korean companies

- Release date: Oct 31, 2019

- 8316 Views

1: Feel Korea in Ho Chi Minh City

May 17, 2019, 2:00 PM.The sight of my arrival at Ho Chi Minh City Airport is still vivid in my mind. Of all the foreigners waiting for immigration, half were Koreans like me.

This was the moment when I realized firsthand what I had read in the article that there are 96 international flights a week between Ho Chi Minh City and Seoul Incheon International Airport, more than twice as many as between Ho Chi Minh City and Narita/Haneda.

Two months have passed since then.

I am now enjoying the flavors of my homeland at a Korean restaurant in District 1 of Ho Chi Minh City.

Here, it hardly feels like I am in Vietnam at all—the only language I hear around me is Korean.

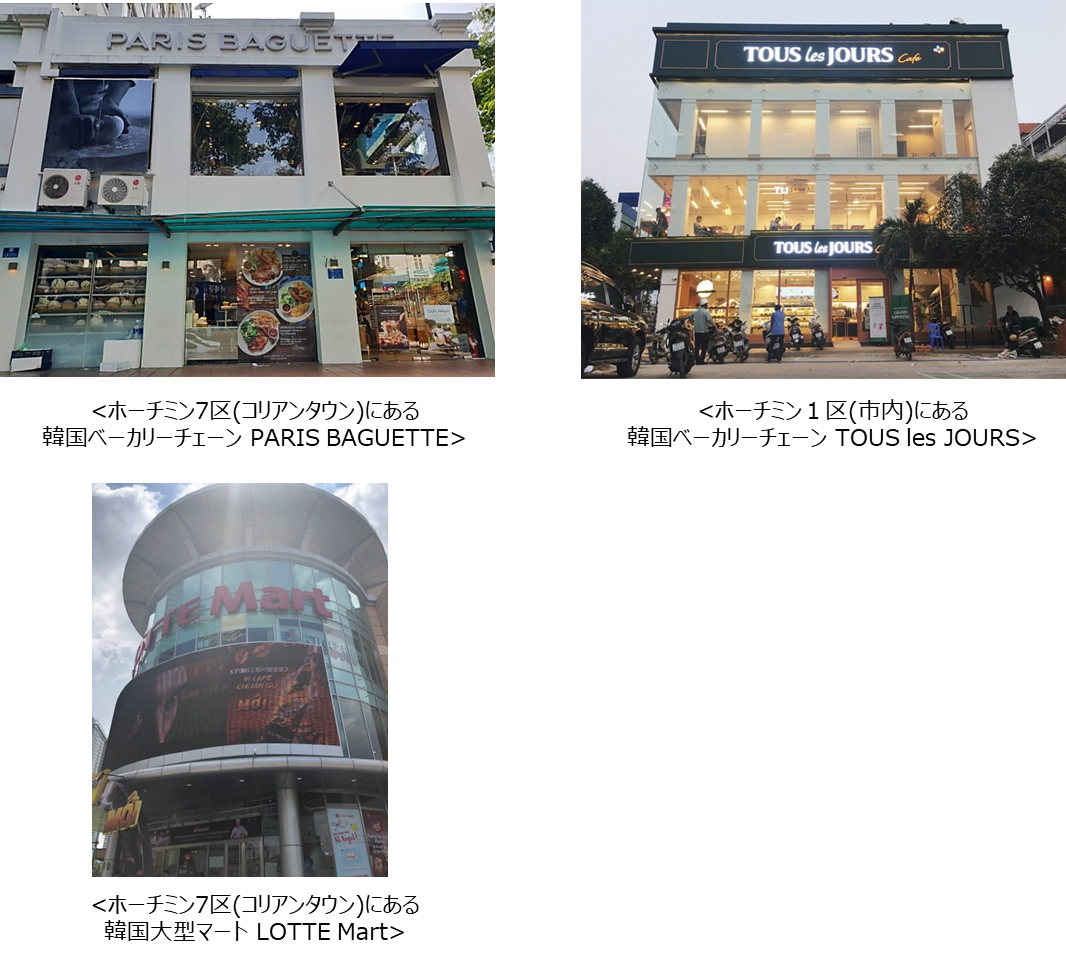

Well-known Korean-style bakery chains such as Tous les Jours and Paris Baguette, both operated by South Korean conglomerate CJ Group, have blended seamlessly into the cityscape. This presence is even more pronounced in District 7, often referred to as Ho Chi Minh City’s Koreatown.

In addition to numerous Korean restaurants, familiar retailers like Lotte Mart are bustling with mothers chatting as they shop—much as they would back home in Korea.

2: History of Korean companies' expansion into Vietnam

In Ho Chi Minh City, eating the same Korean food as in your home country is a no-brainer.As a matter of fact, as of May 2019, there are 160,000 Koreans living in Vietnam.

There are currently 8,000 Korean companies operating in Vietnam.

Recently, more than 1,000 new corporations are being created annually. Compared to Indonesia, which has been called the largest market in Asia, the number of companies entering Vietnam is more than three times greater and the number of corporations established each year is more than ten times greater.

Let’s take a look back at the history of Korean companies’ expansion.

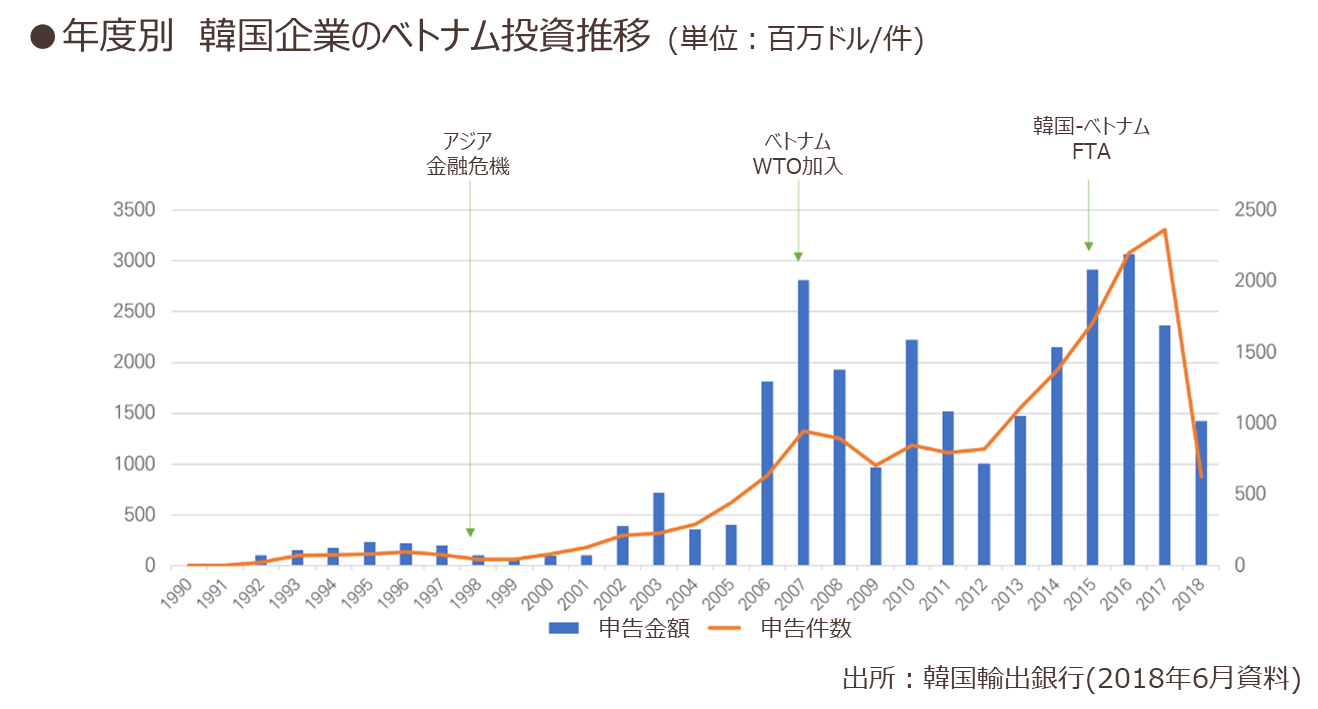

Following the normalization of diplomatic relations with Vietnam in 1992, Korean companies began to expand into the country in earnest. This expansion was led mainly by large corporations, with a focus on heavy industries such as consumer electronics and steel.

Investment in manufacturing rapidly increased, especially in labor-intensive industries such as textiles, sewing garments, and shoes, taking advantage of Vietnam's low labor costs. In addition, with Vietnam's accession to the WTO in 2007 and other developments, South Korean companies have further accelerated their expansion.

Since 2013, the quality of investment has changed, as the investment area has been expanded to include the parts and materials industry, led by Samsung, and the investment field has become more sophisticated and diversified.

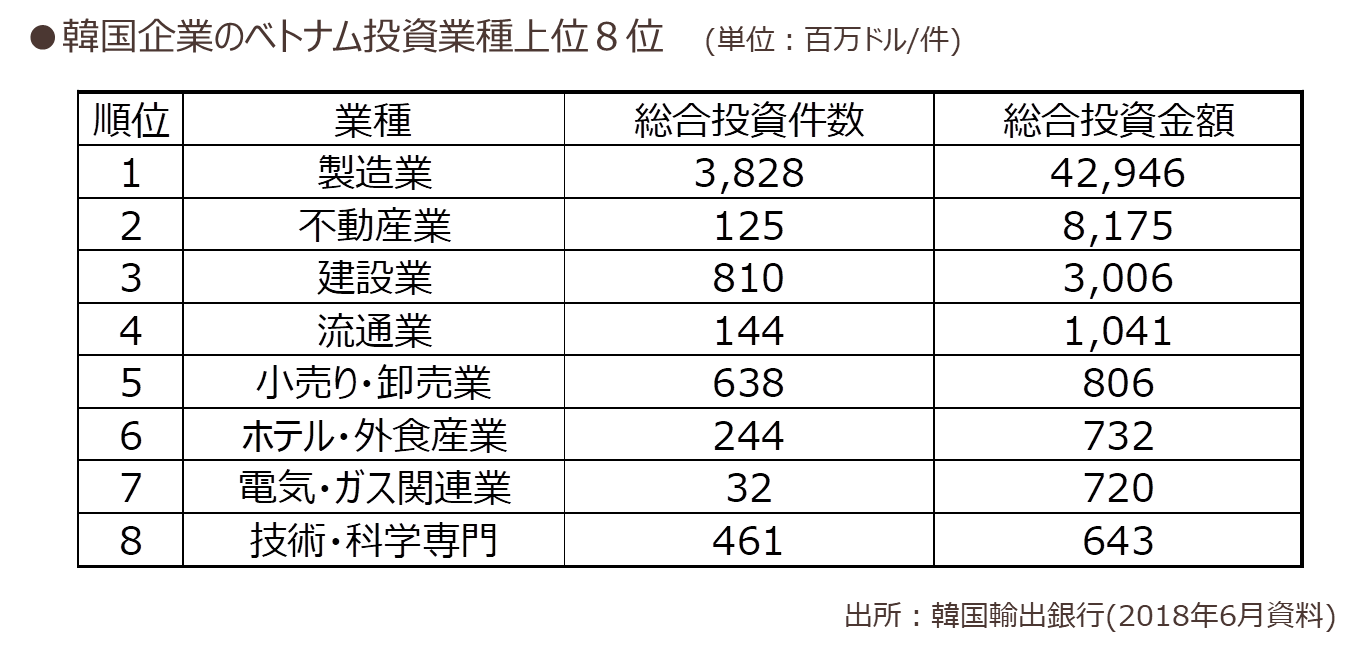

Looking at the current investment landscape by industry, manufacturing is by far the dominant sector, followed by real estate and construction.

One reason for this is that, from July 2015, foreign individuals and institutions were allowed to own and inherit residential property in Vietnam, which triggered an investment boom led mainly by major Korean real estate developers and investment firms.

In addition, after a change in the South Korean administration in March 2017, taxes related to domestic real estate ownership and inheritance nearly doubled compared with the previous government. This sharply accelerated real estate investment in Vietnam—particularly in Hanoi and Ho Chi Minh City. Even HanaTour, South Korea’s largest travel agency, began offering “Hanoi–Ho Chi Minh City real estate tours,” and this real estate boom continues to this day.

3: The Presence and Influence of Korean Companies as Seen Through Magazines for Koreans in Vietnam

The investment situation by industry is well illustrated by the advertisements of companies in magazines for Koreans in Vietnam. The advertisements of the companies that appeared in the May issues of Sinchao and Good Morning, which have high recognition and subscription rates among Koreans and expatriates living in Ho Chi Minh City, had the following characteristics.First, looking at the share of corporate advertisements, excluding job postings, recruitment ads, and restaurant ads, small and medium-sized manufacturing companies account for the largest proportion. This is followed by small and medium-sized companies in real estate and construction, mirroring the earlier results showing the top investment sectors of Korean companies in Vietnam.

By contrast, advertisements featured on the front and second pages of magazines are dominated by large corporations, such as Samsung TV and refrigerator ads and promotions for emerging financial services. In particular, Samsung advertisements not only occupy full front pages in magazines aimed at Koreans living in Vietnam, but also take up entire front pages of Vietnam Airlines’ in-flight magazines.

This strongly conveys the overwhelming presence of Samsung, which is Vietnam’s largest foreign investor, employs 160,000 workers, and in 2018 exported USD 60 billion worth of goods from Vietnam, accounting for one quarter of the country’s total exports.

4: Behind Vietnam’s Rapidly Growing Film Industry Are Korean Companies

The presence of Korean companies is not limited to manufacturing industries such as Samsung and LG.The whirlwind of the Korean Wave in Vietnam cannot be underestimated.

The South Korean film “Parasite,” released on June 21, overtook Toy Story 4 by its fourth day in theaters and reached number one at the Vietnamese box office within its first week. Within two weeks, it surpassed USD 1.95 million in revenue, becoming the highest-grossing Korean film ever released in Vietnam.

Behind Vietnam’s seemingly exceptional reception of this Korean film and the intense media attention lies CJ Entertainment, a major Korean entertainment company affiliated with the Samsung Group. In July 2011, CJ acquired Megastar, Vietnam’s leading multiplex operator at the time, laying the groundwork for the country’s modern film market. The success of Parasite reflects not only its storyline, which resonates closely with local Vietnamese audiences, but also CJ Entertainment’s long-term efforts to grow the film industry itself.

Since entering Vietnam in 2011, CJ Entertainment has steadily implemented a strategy of partnering with Vietnamese film companies to strengthen local content. In a market once dominated almost entirely by Hollywood films, CJ promoted content diversification by expanding the distribution and screening of Vietnamese commercial and art films, deliberately programming local films more intensively.

Furthermore, CJ worked closely with production companies across the entire process—from planning and production to marketing and exhibition—building a feedback system that helped raise the overall quality of local films.

As a result, the number of local audiences watching Vietnamese films has increased significantly. In 2011, the year CJ entered the market, only 11 local films were screened. Just seven years later, by 2018, that number had quadrupled to 40 films.

5: Opportunities and Potential of the Vietnamese Market for Japanese Companies

From the number of flights between South Korea and Vietnam to investment volumes and cultural content such as food culture and films, Korean companies have established an overwhelming presence in the Vietnamese market. Against this backdrop, where do business opportunities for Japanese companies lie?

South Korean companies are likely to break away from the speed-only strategies they have used in the past in order to grow steadily in the Vietnamese market. This is supported by the fact that, according to the editor-in-chief of Sinxiao Vietnam, many Korean companies are now feeling the limitations of managing their business with a bowl of rice, and are increasingly asking for marketing data and statistical information. They are in need of fact-based planning and long-term strategies. While examining the successes and failures of Korean companies as leading indicators, it would be possible to re-examine low-risk entry and local management. We also believe it is important to analyze the internal management in the Vietnamese market of Korean companies that have entered the market earlier.When offering products and services to Vietnamese consumers, it would be wise to ride the wave of the “experience-based consumption” (koto consumption) boom. The health sector, in particular, still has significant room for growth. Concrete opportunities include air purification solutions to address air pollution, food safety, education for children, supplements and the fitness industry aimed at healthy longevity, and the insurance sector to prepare for economic uncertainty.

Affluent consumers, in particular, place the highest priority on safety and security for their children, which aligns closely with Japan’s widely held image of reliability, safety, and peace of mind. In addition, amid the growing boom in travel to Japan among Vietnamese people, there is strong potential for leveraging Japan-based branding to expand products and services in the Vietnamese market going forward.

-

Author profile

Ryu Pogiru

A male researcher from South Korea living in Vietnam. He does everything from sales to research with his natural vitality. He specializes in analyzing consumer insights and has worked on a wide range of projects not only in Japan, Korea, and Vietnam, but also in Europe, the United States, and the Middle East.

-

Editor profile

INTAGE

***

Global Market Surfer

Global Market Surfer CLP

CLP