[Japan] Category Growth in YTD 2020 – what changed with COVID-19

Like the rest of the world, Japan was heavily affected by the COVID-19 throughout the year in 2020. The FMCG market was no exception in Japan.

What was the most sales growth in the consumer goods category based on Intage SRI?

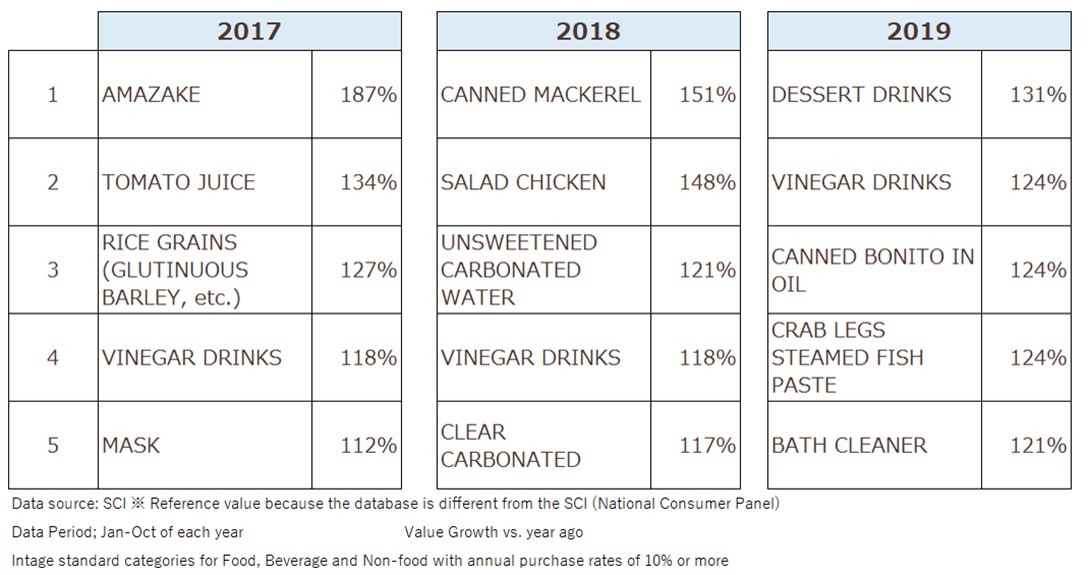

The table above shows the ranking of sales value year over year through YTD 2020. IKG announces the ranking of products sold every year. Until 2018, many foods and beverages that are known to be good for you were at the top of the list. In 2019, DESSERT DRINKS took the top spot, driven by the popularity of tapioca.

However, this year, due to COVID-19, what was sold changed dramatically, as did people's lives. The first place is MASK. Sales amount was 425% of the previous year. Is it smaller than you expected?

For a while, the shortage of masks became a major social issue and was broadcasted on TV every day. The shortage of masks continued from February to April. In previous years, there has been a certain level of demand for masks to prevent influenza and hay fever, and the market has been expanding for the past 10 years, so this year's sales of masks were more than four times higher than a year ago. Considering that there are now fewer people in the city who are not wearing masks, masks are truly the symbolic category of the year.

The second place is DISINFECTANT, which account for 302% of the previous year. Especially when limited to hand antiseptics, except for the disinfection of wounds, the number jumped even higher to an astounding 910%.

Hand sanitizers are used much more frequently than they were pre-COVID, and they have become an integral part of our new lifestyle. Hand sanitizers can be carried by individuals or placed at the entrance of public facilities, restaurants, supermarkets, etc. Some data indicate that approximately 90% of the purchasers of Hand sanitizers were new purchasers who did not purchase them in the previous year. Hand sanitizers have established a large market, as more people have access to them than ever before, and their sales value has increased more than 9 times.

Incidentally, considering that last year's No. 1 DESSERT DRINKS was 131% and the year before last's No. 1CANNED MACKEREL was 151%, we can see how rapid the growth was for these categories.

Top-ranking hygiene products - How big is their continuing impact?

Third place went to thermometers, up 249% from the previous year. Hygiene products followed in fourth place with GARGLES (220%), fifth place with WET TISSUES (179%), and seventh place with HAND SOAP (143%). All of these growth rates are above the first in previous years.

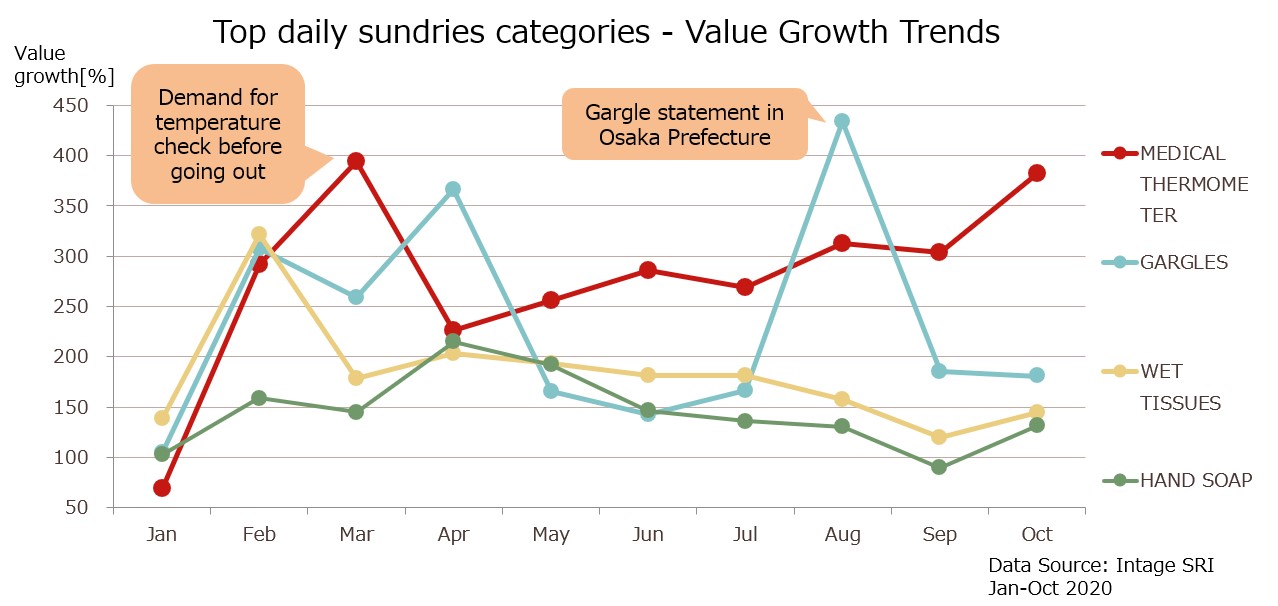

The table above tracks the yearly change in sales value of these categories by month. Demand for MEDICAL THERMOMETER flooded in, and they were temporarily in short supply. This is because the main symptom of COVID-19 is fever, and temperature measurement is increasingly becoming a requirement for going to work or school.

Sales of GARGLES temporarily increased significantly after being featured in a press conference held by the Osaka prefectural government and have since continued to grow by more than 180% year on year.

Sales of WET TISSUES and HAND SOAP have been gradually calming down since April, when a state of emergency was declared for the whole of Japan, but they still remained much higher than the previous year.

Hand washing and gargling are effective ways to prevent COVIDs, as well as avoiding the “SAN-MITSU,” which means hermetic, dense, and close. The sales data showed that many people continue to actively wash their hands and gargle.

Food Market Affected by Changing Lifestyles

While the categories related to measures against COVID-19 were lined up at the top of the list, the sixth-ranked CONFECTNRY WITH TOY stood out. That's a significant increase of 153% over the previous year. CONFECTNRY WITH TOY driven by products with the national hit movie "Kimetsu-No-Yaiba".

Related articles:

【Japan】Sells like HOT CAKES – collaboration with "Kimetsu no Yaiba"(URL)

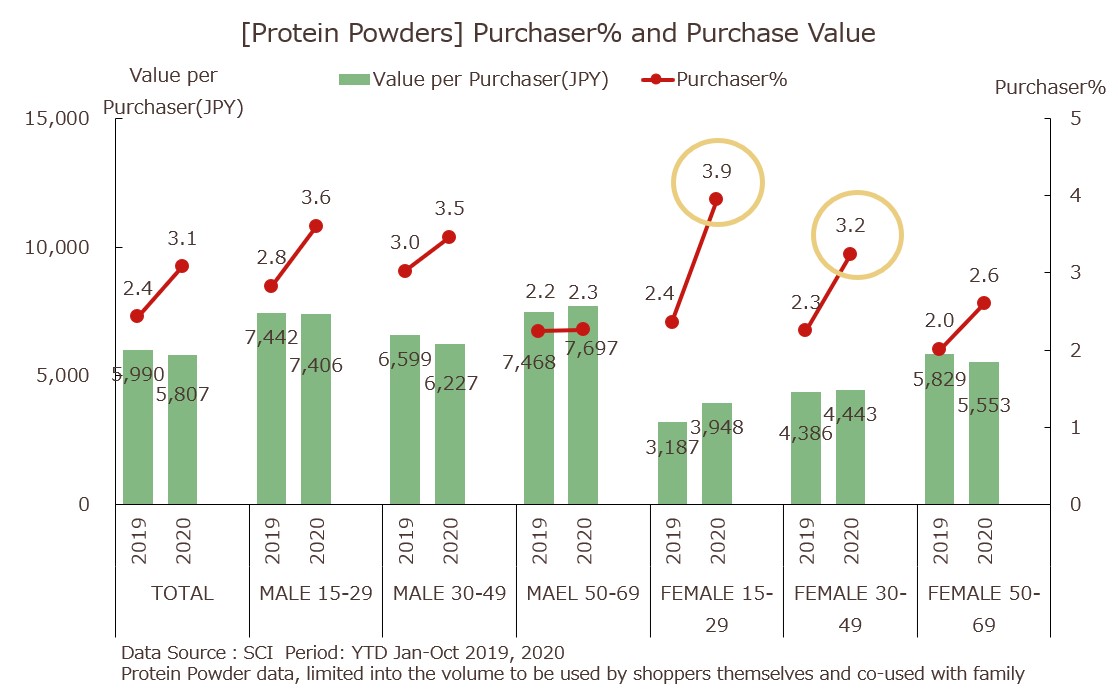

PROTEIN POWDER, which ranked eighth, is a hidden hit category with 139% year-on-year growth. This has increased, especially among women. In particular, the sales of soy protein, which is made mainly from soybeans, increased. There seems to have been a great deal of support from people who were concerned about their beauty and health as they had fewer opportunities to go out and exercise due to COVID-19.

Many food categories ranked in the top 30, perhaps due to the impact of COVID-19 that caused people to go out less and eat out less. Frozen seafood, ranked 9th, was boosted by its popularity as it is easy to have at home, to go well with rice and staple foods, and to be stored for a long time. In terms of long-term preservation, FROZEN FRUIT/VEGE (No. 24), CANNED FRUIT (No. 28), and CANNED MEAT (No. 30) would also do well.

PRE-MIXED FLOUR, which are ingredients for pancakes and cookies, ranked 10th, WHIPPING CREAM 12th, and EXTRACT 15th. These are due to the behavioral change of making sweets at home during the period of NEW NORMAL. These have continued to grow as of October and appear to have established themselves to some extent. Spaghetti and other staple foods also saw a large increase in sales.

This year's ranking shows an unprecedented move. The result was symbolic of 2020, when the world was swept away by COVID-19. While some categories such as hygiene products saw a significant increase in sales, others struggled in the face of new lifestyles such as reduced outings. IKG will publish the rankings soon as well. Look forward to it!

What is Intage SRI?

What is Intage SCI?

-

Author profile

Mr. Toshimitsu Kiji

After working for a consumer goods manufacturer of beverages and food industries, currently in charge of INTAGE PR.

-

Editor profile

Ms. Makiko Futaba

A point of contact for the FMCG industry in Japan.

- Dec 07, 2020

- 6844 Views

Global Market Surfer

Global Market Surfer CLP

CLP