[Japan] Category Negative Growth in YTD 2020 – what changed with COVID-19

- Release date: Mar 10, 2021

- 7326 Views

Intage Knowledge Gallery (IKG) - Japan consumer insights on 07 December, 2020

Like the rest of the world, Japan was heavily attacked by COVID-19 throughout the year in 2020. The FMCG market was no exception in Japan. Which categories were affected by COVID-19 negatively in 2020?

1st as LIP STICK and other 4 categories from cosmetics ranked within top 10 stroke categories

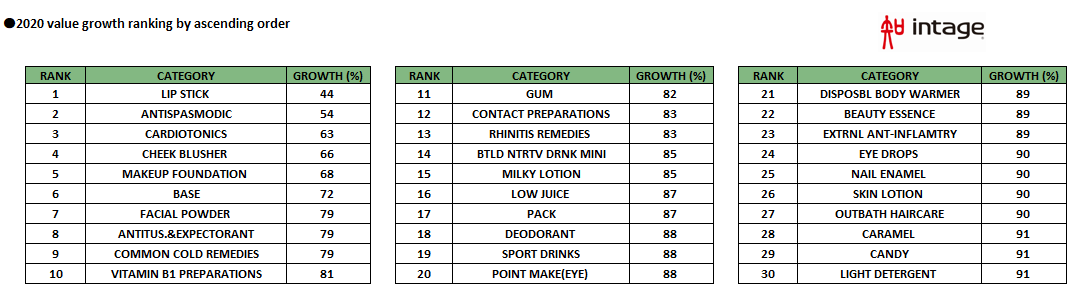

While categories such as masks, disinfectants, and thermometers which sales value increased significantly due to the influence of COVID-19, there are also categories that struggled in sales due to changes in behavioral patterns called “New Normal”. We would like to introduce negative sales impact rankings influenced by various factors such as refraining from traveling, fewer opportunities to go out, thorough hand washing and gargling, wearing masks, and encouraging work from home. Chart 1

Index: Growth rate in sales value (100=previous year sales)

Target: INTAGE standard categories such as food, beverages, and daily consumer goods

*Ranking that takes into account the decimal point Chart 2

2nd place- The ANTISPASMODIC is hit due to self-restricted travel and people movement.

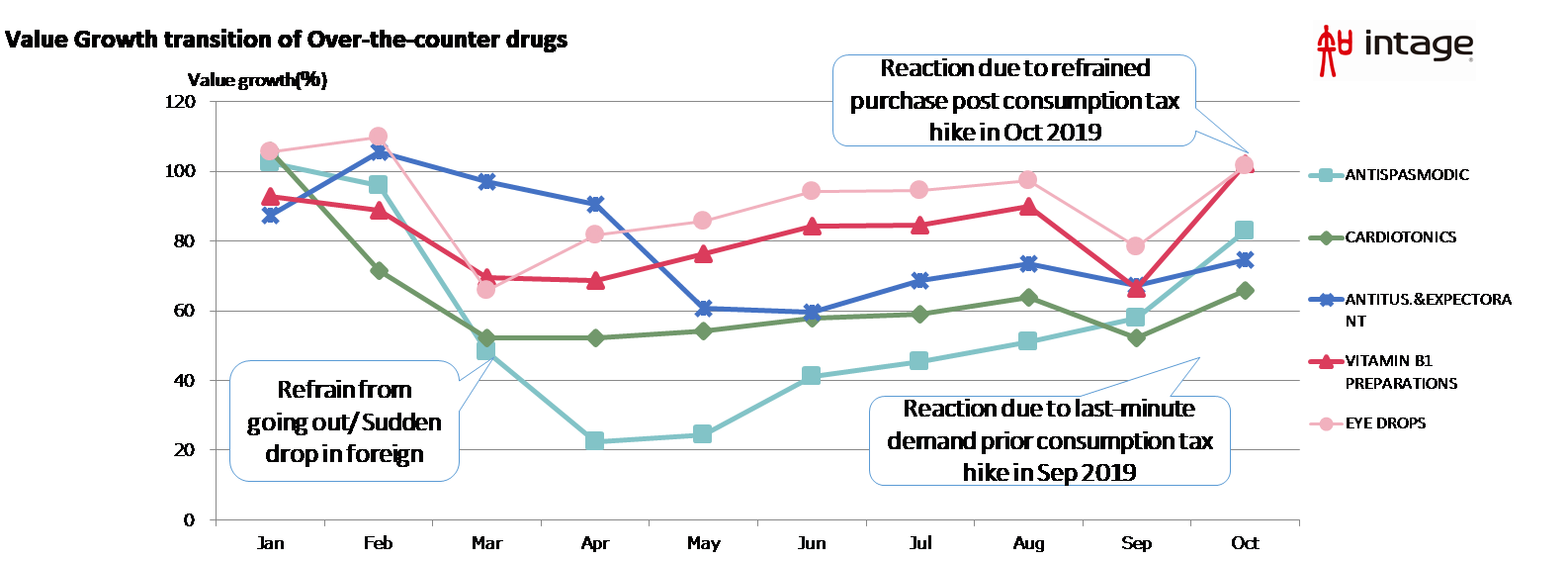

There have also been major changes in the over-the-counter drug category. The second-ranked Antispasmodic is a drug that suppresses symptoms such as dizziness and also prevents motion sickness, accounts to 54% from previous year’s sales. There were also weeks that sales dropped to less than 20% level from previous year sales due to overlapped with the state of emergency declaration thereby impacting the sales, especially during the Golden week from latter half of April to first week of May which were originally people usually travel. After July, because the infection subsided, and measures such as “Go To Travel” campaign were taken, there was a time when the category recovered to some extent. However, overall it still remained half level from previous year (Chart 3). Chart 3

Tabulation period: January-October 2020

Index: Growth rate in sales value (100=previous year sales)

Target: OTC drug categories which value growth rate are lower than OTC total It was often reported that there were few people who caught cold this year, this can be proved by the sales value of COMMON COLD REMEDIES which is in 9th place with 79% from previous year. By age group, we can also see that the purchase rate has declined in all age groups (Chart 4). COVID-19 countermeasures such as wearing mask, washing hands and gargling, can also be used as preventive measures for other infectious diseases. It also brought down the number of influenza patients to an exceptionally low level this year. The hygiene categories such as masks, disinfectants, thermometers, mouthwash, and wet tissues dominated the top-selling rankings this year, the result in turn reflects the current social situation. Chart 4 Data: SCI

Tabulation period: 2019, 2020 (Jan to Oct of each year)

Measure : Penetration, Purchase value per purchaser

Target: Purchase of common cold medicine for personal & common use (Excludes use by others)

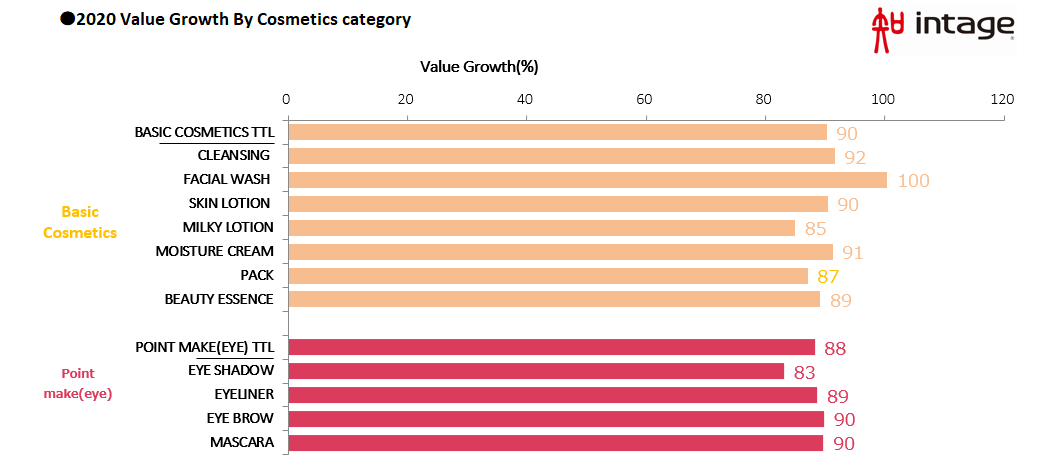

Changes showed in a wide range of categories due to less opportunities to go out, working from home, etc.

2020 was a year of turmoil. Pandemic on a global scale has significantly changed people's lives and behaviors. While there are concerns about the spread of infection in Japan during winter, development of vaccine around the world came as a good news. If this brings us back to normal life to some extent, we can expect a sharp recovery in demand even in categories where sales were not doing well. There are possibility that new demand will be created by the development of new products born by COVID-19, such as lipsticks that doesnt stick to masks etc. At the end of next year, we plan to look at changes in Japan from perspective of purchase situation, to see what kind of year 2021 will be. Please also refer to article: [Japan] Category Growth in YTD 2020 – what changed with COVID-19https://www.global-market-surfer.com/pickup/detail/155/Japan+Category+Growth+in+YTD+2020+%E2%80%93+what+changed+with+COVID-19.html What is Intage SRI?

https://www.intage.co.jp/english/service/platform/sri/

What is Intage SCI?

https://www.intage.co.jp/english/service/platform/sci/

-

Author profile

Mr. Toshimitsu Kiji

After working for a consumer goods manufacturer of beverages and food industries, currently in charge of INTAGE PR.

-

Editor profile

Ms. Makiko Futaba

A point of contact for the FMCG industry in Japan.

Global Market Surfer

Global Market Surfer CLP

CLP