< From Overseas Office > [ U.S.A. ] What the US Market Needs from Japanese Electric Vehicles

- Release date: Jun 15, 2023

- 3615 Views

What the U.S. market is looking for in Japanese BEVs (Battery powered Electric Vehicles) is an "Affordable and Reliable" Japanese style.

The BEV expansion period that is expected to arrive in the next five years is the biggest and last chance for Japanese car makers (who have lagged behind).

(1) Current status of the EV (Electric Vehicles)market in the U.S.

In Los Angeles, where the author resides, BEV(Battery powered Electric Vehicles)are becoming increasingly popular under the aggressive policies of the California government, and EV chargers have been installed in many parts of the city, with the BEV share of new car sales exceeding 5% by 2022.

We feel that we are approaching the stage where new BEV sales are moving into an expansion phase ahead of the rest of the U.S.

Photo: Parking lot in a shopping mall near Los Angeles, Tesla Charger (20 cars in parallel) (photo by the author)

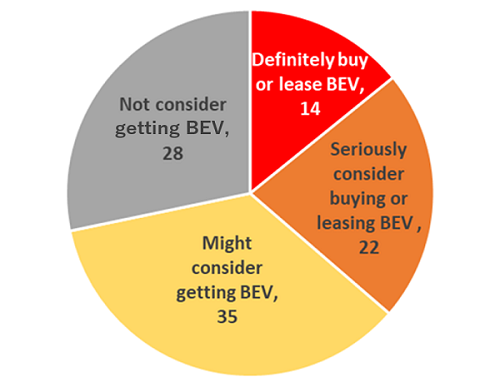

According to the results of a national survey conducted by Consumer Report, the largest non-profit consumer organization in the U.S., in FY2022, 71% of American drivers are considering BEVs as their next vehicle purchase, and given the American car-buying cycle, a major demand period for BEVs is expected to occur in the next five years.

71% are considering a BEV as their next vehicle purchase

出典:Consumer Report, BEV National representative survey(January/February 2022) -Q6

On the other hand, it is also true that Japanese automakers are lagging behind in the major trends of the EV market.

At the LA Motor Show in 2022, American, European, and Korean automakers presented new BEV models that attracted much attention, while Japanese automakers focused mainly on hybrid/PHEV vehicles. Journalists also pointed out it gave the strong impression that Japanese automakers were behind in the development of BEVs.

(2) What are the chances for Japanese car makers?

The author predicts that Japanese car makers, who have been slow to capture early adopters in the U.S. BEV market, will not stand a chance if they start now to pursue innovative technologies and high-end class vehicles that will surprise the world.

On the other hand, for Japanese automakers, which have always been strong in the mass-market and mid-class gasoline vehicles, the current timing is the best and last chance to expand the share of BEV vehicles as well, looking ahead to five years from now, when the market will shift to the early majority market and consumer needs will shift more toward mass-market vehicles.

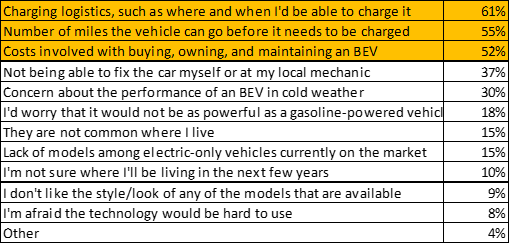

The same Consumer Report survey results show that "Charger Location," "Driving Range," and "Price" are the main points for U.S. consumers when purchasing a BEV. Looking at the breakdown of "price," the top two are "vehicle price" and "maintenance price.

What factors are preventing you from purchasing your BEV vehicle?

出典:Consumer Report, BEV National representative survey(January/February 2022) -Q8

To those who answered "cost" above, which point specifically?

Even in the U.S., where BEVs are becoming increasingly popular, it is clear that the lack of BEV vehicles that are "reasonably priced," "have sufficient driving range," and "have no maintenance concerns" is still a bottleneck in the purchase process for the average consumer.

For the majority of Americans, the current BEVs are still too expensive and "wanted but hesitant".

On the other hand, these pain points overlap with the current strengths of Japanese carmakers in the gasoline vehicle market.

In other words, we believe that Japanese automakers have a great opportunity to capture BEV market share in the upcoming BEV expansion period if they can offer middle-class BEV models that are "affordable" and "durable and of high quality" in the same way as their gasoline-powered counterparts.

Living in the U.S. today, I see more advertisements for new BEV models by Hyundai and Kia than ever before, and in fact, I see more and more Kia BEV vehicles on the streets.

For Japanese car makers, there may not be much time left to compete in the next phase of expansion.

In the absence of a definitive middle-class BEV vehicle as yet, we are watching with great anticipation for one of the Japanese carmakers to announce a BEV model that will be a game-changing symbol.

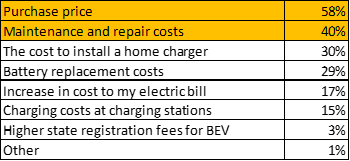

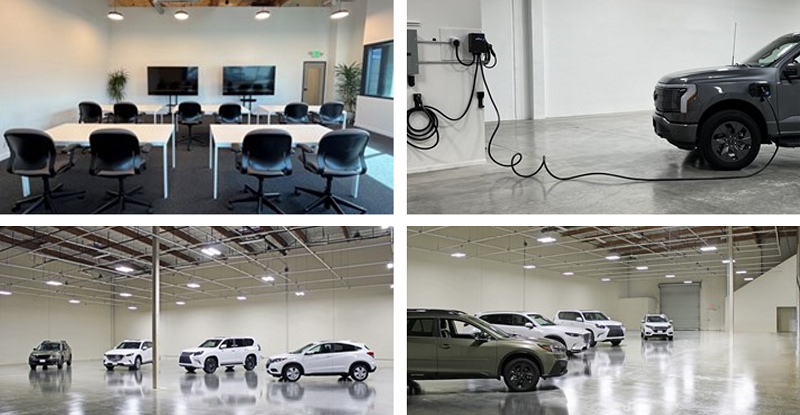

(3)Introduction of Intage USA's own LA facility

Against the backdrop of the recent increase in the number of BEV new model evaluation test surveys (car clinic surveys, etc.) in the U.S., Intage USA opened the "LA Product Studio" in Los Angeles, the largest BEV market area in the U.S., in October 2022, as a large-scale research venue optimized for vehicle testing.

The facility is equipped with a 5,000sqft exhibition area, as well as lighting facilities for vehicle exhibits and EV chargers, and can accommodate large-scale vehicle exhibition surveys with ease.

If you are considering a marketing research survey in the U.S., please contact an INTAGE representative.

Introduction of our facilities HP:https://laproductstudio.com/

For those interested in learning more about the “average American lifestyle,” please also check out this article.

What's the average American's life like? Understanding the “average” of America's diversifying consumers

・America that values the individual

・America that seeks rationality and efficiency

・Values placed on durable goods

etc.

-

Author profile

(Mr.) Masashi Sunazuka

Lives and works in Los Angeles, USA. Head of Automotive Research Team at Intage USA, Inc.

Based on his research experience in both Japan and the U.S., he provides real information about the U.S. from his own perspective.

Global Market Surfer

Global Market Surfer CLP

CLP