< From Overseas Office >[Thailand] Thailand is Shifting to Electric Vehicles

- Release date: Oct 12, 2023

- 10131 Views

Thailand Automotive Industry From ICE to BEV For New Driving Experience

Since the Thai government approved the incentive package for electric vehicle proposed by the National Electric Vehicle Policy Board (EV Board) in 2022 to promote EV production and purchase; especially the investment package, import duty reduction, excise tax cut and price subsidization for BEV car with the condition that the car manufacturer must build BEV car manufacturing plant in Thailand and make the BEV cars to compensate all imported BEV car units within 2025. The EV policy and packages have attracted new investment from EV car manufacturers. In particular, Chinese EV car manufacturers who also enjoy the free import duty under the ASEAN-China FTA agreement.

The rapid climbing of new BEV passenger car (BEV car) registration in Thailand have demonstrated that BEV car is gaining popularity among Thai car owners who have overwhelmingly accepted BEV cars and positively responded to the incentive/ subsidy package and Chinese BEV brands (currently in the market are MG, GWM, BYD, Neta, GAC Aion, Wuling and Volt. Changan, Geely and Chery will be available in late 2023 to early 2024). From January – August 2023, BEV car has 9.18% market share from total new passenger car registration of 470,313 unit, increased from 0.76% for the same period of 2022. As the BEV car sales volume in the first half of 2023 is much higher than initially forecasted, the Automotive Industry Club of the Federation of Thai Industries has adjusted the BEV car sales forecast to reach 60,000-70,000 units in 2023 (Ref. Automotive Industry Club, The Federation of Thai Industries).

Beside the incentive/ subsidy package from the government, BEV growth and popularity is driven by other important competitive factors in the market and EV Ecosystem development. There are more BEV car makers in the market from diverse nationalities and brands with various models, body types and segments. BEV car brands also offer attractive pricing and value for money with innovative features, ADAS (Advanced Driver Assistance Systems), safety features, driving comfort features and connectivity. BEV brands that offer long warranty period for the car and battery. EV car parts and stocks.

The improvement of EV Ecosystem development undoubtedly play the important role to boost the BEV car ownership. The expansion of charging stations (AC or DC) in the petrol stations, shopping complex, community malls, car dealership, hotels, office buildings and governmental offices have responded to the new life style in Thai society.

Data from the Electric Vehicle Association of Thailand (EVAT) indicates that the number of charging stations increased from 855 charging stations with 2,459 outlets in 2022 to 1,482 charging stations with 4,628 outlets as of May, 2033. The figures exclude public charging stations that serve only specific EV owners e.g., Tesla Supercharger, MG Super Charge etc.

Since the introduction of BEV car to Thai market, BEV car creates the new driving experience for Thai owners. Not only BEV car provides connectivity capability to access functions and control of the car such as remotely lock and unlock, locate and finding car and turn on air conditioner. But BEV car also changes the driving habit and use of the car as working space, camping with V2L or in-car overnight sleeping space.

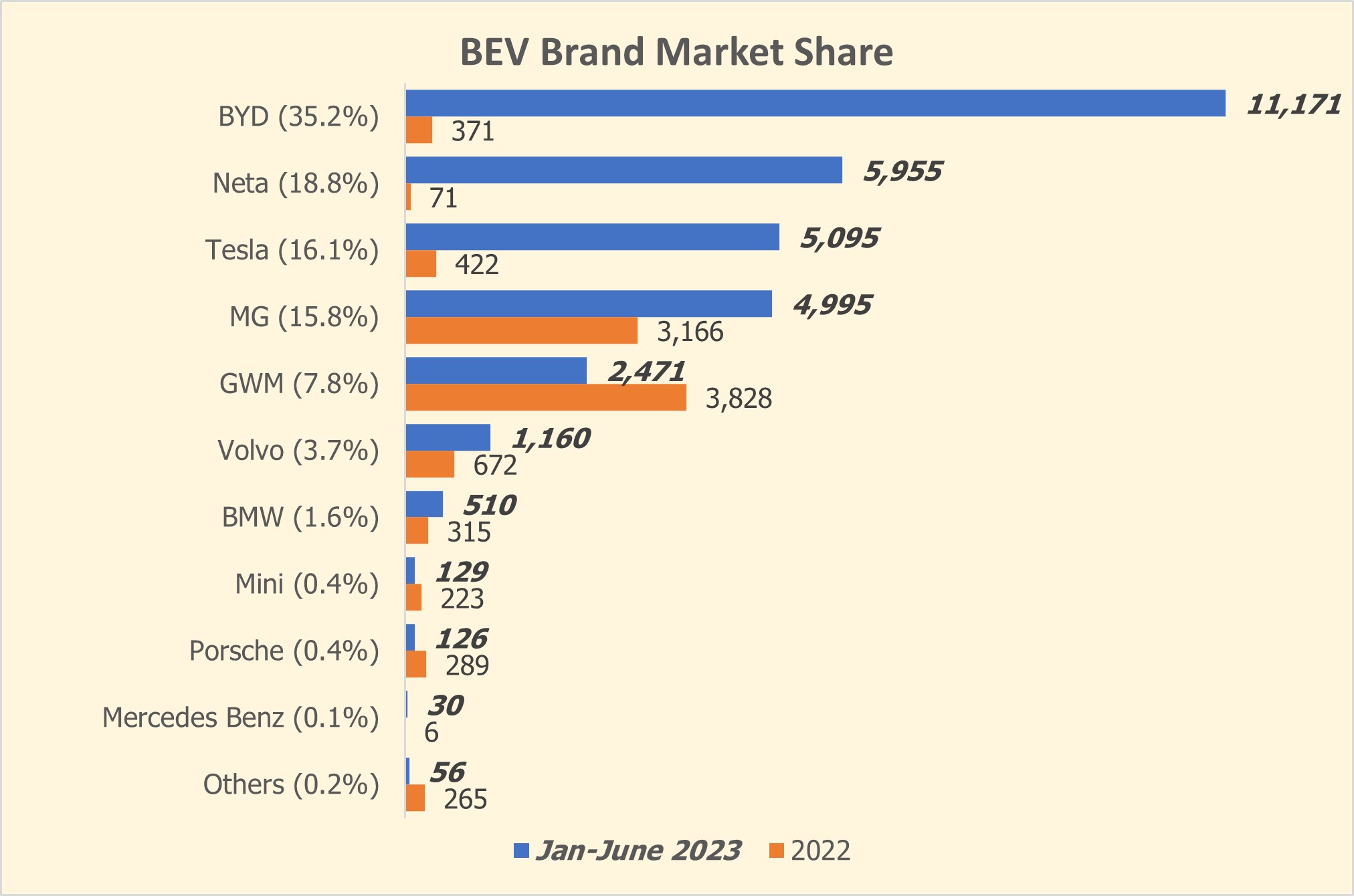

For the 1st half of 2023, BYD is clearly the BEV champion in Thailand with 11,171 units sold, followed by Neta (5,955 units) and Tesla (5,095 units). Chinese BEV brands dominate the BEV market in Thailand with combined market share of 77.6%.

Source: EIC Siam Commercial Bank

BEV car competition has become more aggressive because of current automotive manufacturers and new contestants, new models and body types and segments are to be launched in the market. Although Chinese brands have early hands to capture high BEV car market share in Thailand, Chinese brands may run into hard wall in next couple of years because Thai owners would consider more conditions and factors, including competition from other nationalities brands. To be successful in Thai market, BEV car manufacturer must have strong brand, sales and service strategies and put more investment in after sales service to build up skills and knowledge of technicians and electricians to provide quality and reliable service with fast turnaround time in maintenance and parts replacement.

To provide continued support to Thailand ambitious plan to become EV hub, the government has recently approved the THB 1.024 billion budget to subsidy the purchase of BEV according to the EV 3.0 package which will be expired at the end of 2023. The package would encourage and build public confidence to continue production and buying BEV. The Excise Department will use the money to provide subsidy to EV buyers at THB 18,000 – 150,000 as followed.

· A THB 70,000 subsidy for each BEV unit for passenger cars not more than 10 seats with 10 to 30 kWh battery capacity and MSRP (Manufacturer Suggested Retail Price) not more than THB 2 million.

· A THB 150,000 subsidy for each BEV unit for passenger cars not more than 10 seats with 30 kWh or higher battery capacity and MSRP (Manufacturer Suggested Retail Price) not more than THB 2 million.

- An THB 18,000 subsidy for BEV motorcycles MSRP (Manufacturer Suggested Retail Price) not more than THB 150,000.

-

Author profile

Weerhawitt Neeyomesunthi

Weerhawitt (Witt) has over 20 years of experience in Consumer Product, Real Estate and Research. He brought his solid experience to the industries and research studies.

He has extensive knowledge and experience in quantitative research. He has taken care of major Automotive, FMCG, Telco, Pharmaceutical, Finance and Retails accounts, both local and multi-country research studies -

Editor profile

Intage Inc.

***

Global Market Surfer

Global Market Surfer CLP

CLP