[Thailand] Thailand Health Trend 2024 (Part 1)

- Release date: May 30, 2024

- 18801 Views

Introduction

Thailand, a home to almost 70 million dwellers marks to be one of the largest country in Southeast Asia. As one of the regional hub in the SEA, Thailand boasts a great opportunities for brands to launch in. However, local practices, consumer understanding, and huge differences in Greater Bangkok consumers and Upcountry consumers has made Thailand quite challenging for marketers.

In 2019, the value of Thailand’s health and wellness market is at 1.5 trillion Thai Baht (Figure comprise of values from wellness tourism, health F&B, and beauty markets) (*1). The market itself sees great future growth value based on 4 megatrends that is currently shaping Thai consumer behaviour.

These 4 mega trends are what we believe is shaping the overall behaviour of Thai consumers.

1. Aging Society – Pushing the needs for health and wellness in multiple dimensions as businesses needs to support these growing needs and these silver-gen people are the one with spending power.

2. Consumer’s reception to health importance since COVID-19 – After COVID, consumers give much higher importance towards health which is reflected in their decision criteria and thus the products developed by manufacturers

3. Higher rate of Non-Communicable Diseases (NCDs) – With alarming increase of NCDs, this sparks increase in health and wellness services from insurance to consumable products

4. Government Subsidy – As government aim to push Thailand to be Medical Hub in terms of Wellness and Medical service hub. This greatly impact the medical and wellness industry with several laws waiting to be unlocked to help their business.

This article would aim to cover some emerging trends in the market, opportunities, consumer preferences, and health concerns that are currently shaping Thailand’s health and wellness industry.

Traditional Thai Health Practices

Before walking into the modern world, some background knowledge of Traditional Thai health practice that helps to shape some beliefs. Traditional Thai medicine also blends into some of today’s health care remedies that local Thais practices which are divided into 4 aspects. However, out of the 4, we find that only 2 has high effect in today’s world – Thai herbs and Thai massage.

Thai massage has been boasts as one of the must do activity for tourists visiting Thailand. Although many massage parlour has closed during Covid, but as it subsides people are heading back to these services. On average, Thai people would go for a massage 1-2 times per month. The trend is more prominent among gen Y consumers (*1).

The usage of Thai herbs are often used in conjunction with western medicine to cure sickness and improve one’s health. Big Thai local brands are rebranding to make the appearance more modernize. For example, Ouyontosod, one of the long-standing Thai herbal brand since 1947 has rebranded themselves and are now available in capsule bottles and sachets which enabled them to be sold in modern pharmacy and even convenience stores.

อ้วยอันโอสถ จากร้านขายยา 2 คูหา สู่ธุรกิจรายได้ 300 ล้านบาท - MarketThink เอ่ยชื่อ “อ้วยอันโอสถ” หลายคนอาจคุ้นหู...

MarketThinkさんの投稿 2021年2月7日日曜日

Even large multinational brands like Unilever are integrating traditional Thai herbs into their products to find new proposition. Sunsilk, one of Thailand’s leading haircare brand launched herbal range that uses Thai herbal as one of the key hero ingredient. One of the best-selling item is Ginger & Yanang leaf combination that claims to help with dandruff and itchiness, something the herb is quite well known for among those who practices Thai medicine.

Factors Shaping Consumer Perception Towards Health

1. Dangerously Sweet

Majority of Thai has sweet tooth and it all started when they were young. Statistics shown that one-third of Thai kids drink sweet milk and consume snacks on daily basis while one-fifth of Thai kids consume sweet drinks / CSDs on daily basis (*3). In the long run, we fear that NCDs will come sooner for those consuming at this pace.

In a summer country like Thailand, the need for sweet drinks to quench the thirst is extremely high. As CSDs are known as bad guys from fizziness and high sugar content, marketers find other products that would tackle into this opportunity, and comes in Ready to Drink tea. RTD tea is positioned as a better alternative to CSD with benefits from tea itself. However, some variant boast extremely high sugar content (For example, honey lemon flavor has 22 grams of sugar). Content creators try to help promote awareness on this with contents showing how much sugar are used in these beverages. Although it has good awareness in urban area, there are still challenges to retrieve information to rural areas.

#ลีนกว่าเดิมแค่กินโปรตีนเพิ่ม 🥩 #ผอมได้ไม่ต้องอดแค่ปรับสารอาหาร ❗️ #เพิ่มโปรตีนในมื้ออาหารอิ่มนานกว่าเดิม 🔥 #สาระล้วนๆ...

แหมทำเป็นฟิตさんの投稿 2020年11月20日金曜日

As consumers are becoming more aware about sugar content, brands are now trying to release 0% sugar variants and uses sweetener to provide sweet taste instead.

เริ่มดูแลตัวเองกับ โออิชิ ฮันนี่เลมอน สูตรน้ำตาล 0%มาเติมสิ่งดีๆ ให้ตัวเองกัน! ใหม่ โออิชิ ฮันนี่เลมอน น้ำตาล 0% อร่อยหวานน้อยกำลังดี กับรสชาติที่คุ้นเคย จากคุณประโยชน์ของคาเทชินในชาเขียวแท้ ผสานน้ำผึ้งเฮียกขะมิทสึและเลมอนชั้นดี ให้คุณสดชื่นได้เต็ม 100 ดื่มได้อย่างสบายใจ! หาซื้อได้แล้ววันนี้ที่ 7-Eleven และร้านค้าชั้นนำทั่วไป #โออิชิฮันนี่เลมอนน้ำตาล0 #เติมสิ่งดีๆให้ตัวเองทุกวัน

Oishi Drink Stationさんの投稿 2022年4月7日木曜日

2. PM 2.5 and it’s long term effect

“You are what you breathe” is probably what best describe the situation currently happening in Thailand.

According to Department of Health, Statistics from Year 2018 – Y2021 from Department of health shows higher number of people with critical illness sourced from air pollution. It ranges from heart diseases, stroke, lung diseases, and lung cancer and the trend is rising as seen.

Currently, consumers can only take preventive action by wearing surgical mask during periods with high PM 2.5. Unfortunately, there are no other solutions known that can directly help removing these particles and strengthens the body against the long term effect.

3. Need for Speed

As trends emerge faster, so does the consumer’s demands. Consumers these days are looking forward to see the end benefit as quick as possible, challenging the brands to find formulation and conduct tests that can ascertain those claims.

Commonly seen in the skincare market are products that claims to brighten your skin within certain period of time.

เซรั่มลดรอยสิว(ซองเขียว) เป็นเซรั่มที่มีวิตามินบี 3 เข้มข้น ช่วยลดรอยดำรอยแดงจากสิวภายใน 7 วัน อ๊อฟแนะนำพอสิวหายทิ้งรอยปุ๊บให้ทาปั๊บเลย มันจะช่วยให้รอยแดงจากสิวจางลงไวมาก ยิ่งทาเร็วเท่าไหร่รอยสิวก็หายไหวเท่านั้น เนื้อเซรั่มเค้าบางเบาไม่เหนียวเหนอะหนะ pic.twitter.com/26mHuq2wMZ

— อ๊อฟเฉยๆ ไม่ใช่อ๊อฟฟี่นะ (@iloveadayblog) December 1, 2020

Meanwhile, in the food and beverage industry, especially in the energy space there are high needs for products that can instantly wake you up whether it’s for studying or continuing the day. These products has quickly gain popularity especially among students during exam period.

3 Trends regarding health

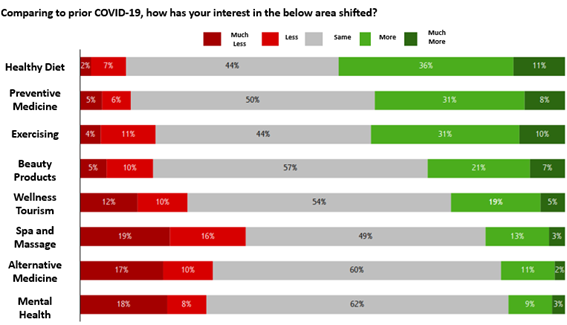

Post Covid-19, we do see some shift in consumer interest towards health and wellness. Majority has their interest towards shifted, especially among the 3 aspects in which we will be covering in the below sections – Food and beverage trend, exercise trend, and beauty trends.

Source: (*1)

1. Healthy Diet and Food & Beverage Trend in Thailand

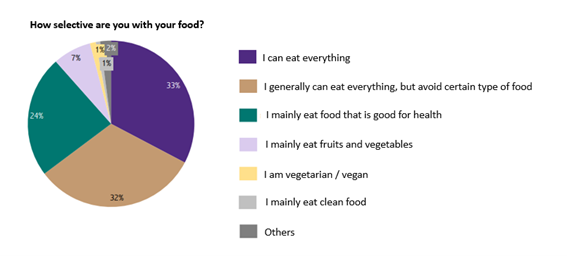

Source: (*1)

When it comes to food, most Thai people avoid certain types of cuisine and are quite selective, focusing on ingredients considered good for health. This tendency is especially pronounced among the baby boomer generation and those who are conscious about maintaining their body shape. In terms of food consumption, most consumers either cook for themselves (64%) or eat freshly prepared meals at restaurants (59%), while only about 30% regularly rely on convenience stores or street stalls in their daily lives (Note 1).

As consumers become increasingly selective about their diets, manufacturers are seeking to capitalize on these trends by offering alternative health-focused food products. Taking the dairy industry as an example, many brands in recent years have been competing intensely by launching plant-based and other alternative milks. Some are introduced by long-established manufacturers already active in the market, while others are launched as part of efforts to expand product portfolios.

✨ อยากมีผิวสวย สุขภาพดีใช่ไหม? เนรมิตความสวยจากภายในได้ง่ายๆ แค่บำรุงด้วย 3 สิ่งนี้ทุกเช้า เท่านั้น❗️ 🌞 เซรั่ม /...

Glico THさんの投稿 2023年9月10日日曜日

Thai Glico launched “Almond Koka” as an extension of its snack product line, leaving a strong footprint in the health beverage market.

อยากดื่มนมโปรตีนสูงแบบสบายท้องมากกว่าเดิมใช่ไหมครับ? แอดขอแนะนำให้ลอง เมจิ ไฮโปรตีน สูตร Zero Sucrose...

Meiji High Proteinさんの投稿 2021年1月22日金曜日

Meiji, one of the leading beverage manufacturer in Thailand launches the high protein variant in an attempt to target fitness lovers as it adds protein and other nutrition to support the needs of those consumers.

รีวิว : น้ำมะเขือเทศดอยคำ 99% สูตรโซเดียมต่ำ ผู้ผลิต : บ.ดอยคำ โรงงานหลวงส่วนพระองค์(แม่จัน) ราคา : 17 บาท ...

Nune noppaluckさんの投稿 2016年10月22日土曜日

Doikham, leading fruit juice manufacturer in Thailand release a low-sodium version of their renown tomato juice in response to changing consumer trend.

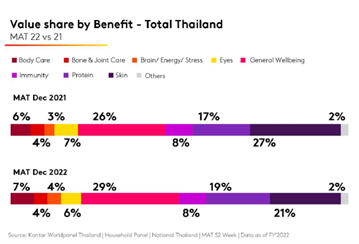

Apart from getting good nutrition from regular food and beverages, majority of Thais are also taking supplements on daily basis. Accorrding to Kantar World Panel (*2), majority of the market value in this market comes from Greater Bangkok area (33%) with main shopper age ranging from 35+. There are also high growth among those age above 50.

Income-wise, the need is prominent across all income level. With this, some manufacturers create a small sachet for single consumption and sold in convenience store at a cheap price (20 THB or 100 Yen) in order to capture those seeking convenience and those with lower cash outlay.

7 เรื่องที่คุณอาจไม่เคยทราบเกี่ยวกับ Ener-G 1. ชาร์จความสดชื่นด้วย Ener-G ให้ร่างกายสดชื่น ตื่นตัว คลายจากความง่วง...

Ener-Gさんの投稿 2016年10月1日土曜日

Source: Kantar World Panel “Health is Wealth, Thailand’s Supplement market 2023 report”

In terms of consumer needs, general health and immunity have emerged as one of the top priorities for Thai consumers. As COVID-19 has subsided and people have returned to going out, working, exercising, and resuming daily routines, demand for protein products and body care has increased.

Meanwhile, interest in skin care and beauty has declined somewhat, but it remains one of the leading categories.

2. Fitness and Excercise Trend in Thailand

Moving into the fitness industry we see that almost half of Thais exercises less than 4 times per month. Majority would spend roughly 30 minutes to 1 hour per session. Looking into the activities they do during the exercise, majority (61%) of those who exercises would mention walking while about one-fifth of the consumer would choose running (*1).

Frequency of exercise also yields different type of activities conducted. Study shows that those who frequently exercises focuses more on continuous type of exercises such as yoga/pilates and going to the gym. Also, majority (94%) of the consumers doesn’t hired fitness trainer. Out of those that hire the trainers are mostly those who is under weigh control. Wearable technology that assists in exercising also sees good penetration (38%) among Thai consumers as well with mostly buying smart watch and headphones (*1).

This concludes the first section for this article. Please stay tune for second part where we will be updating about Skincare and Beauty Trends in Thailand.

References

*1) SCB Economic Intelligence Center, “An In-Depth Study of Health and Wellness Trends in Thailand: Emerging Business Opportunities”

https://www.scbeic.com/th/detail/product/health-wellness-261223

*2) Kantar Worldpanel, “Health Is Wealth: Thailand Supplement Market Report 2023”

https://www.global-market-surfer.com/report/detail/226

*3) Thai Health Watch 2024 – “Next-Generation Living”

https://resourcecenter-uat.thaihealth.or.th/article/‘thaihealth-watch-2024-next-gen-living-คุณภาพชีวิตในอนาคต’-ตามติด-7-เทรนด์สุขภาวะแห่งปี-ให้พร้อมรับมือได้ดีกับทุกการเปลี่ยนแปลง

Thai Beauty Trends (Kantar Report)

https://www.ocean.co.th/articles/thai-traditional-medicine

https://www.bangkokbiznews.com/corporate-moves/business/business/1096846

-

Author profile

Chaiyoot Chulphongsathorn

With experience from both research agency side and client side, Chaiyoot (Top) has used his knowledge to help turning insights into business action. He mainly takes care of FMCG and retail client at both local and regional level.

-

Editor profile

Intage Inc.

***

Global Market Surfer

Global Market Surfer CLP

CLP