Anticipating the lifestyle and consumption trends of China's new consumer demographic! Will China's silver-haired generation (silver market) become a blue ocean? (Part 2)

- Release date: Sep 24, 2024

- Update date: Aug 07, 2025

- 3926 Views

In this article, we examine whether China's silver-haired population (silver market), which has been attracting attention in recent years, will become a blue ocean market, based on market data and the results of a survey conducted by Intage China.

In the first part, we introduced the current state of the market, their profiles, how they spend their free time, and their active participation in activities such as travel.

In the second part, we will introduce their behaviors related to health and appearance care, as well as their values.

Consumer insights among senior citizens

◆Health

Let's take a look at the health status of the new senior population. They do not have many chronic illnesses, but they want to maintain their health and prevent illness before it occurs. They believe that if they are going to spend money, it is better to use it for prevention rather than treatment or medication. For preventive purposes, nearly half of households own home medical devices, with an average of 3.7 devices per household. They take preventive measures even if they currently have no issues, such as using supplements to prevent joint/bone deterioration or chronic illnesses, reflecting their high preventive awareness.

In addition to supplements, from a health management perspective, the new senior generation demonstrates a generally positive attitude toward exercise, dietary balance, and mental care. Regarding exercise, in addition to traditional activities like walking and jogging, they actively incorporate popular activities among younger generations such as cycling, mountain climbing, and yoga. They do not hesitate to spend money on the necessary equipment and clothing for their “health” and “hobbies.” Social sports like badminton and table tennis are also popular.

◆Care for Appearance

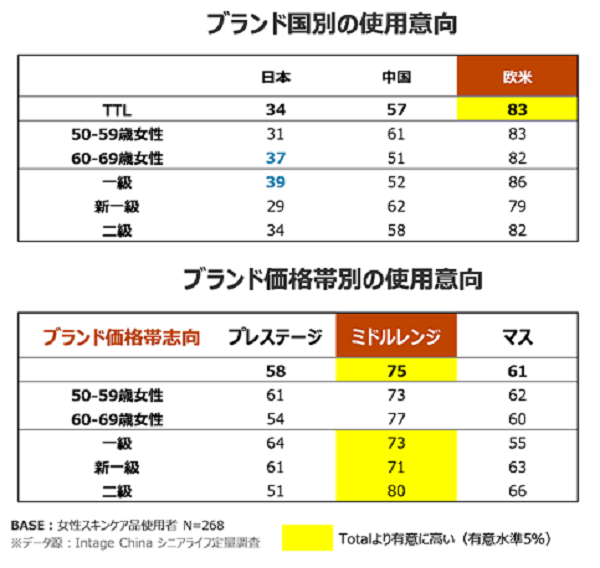

While maintaining physical health, there is also a noticeable focus on facial care. Ninety-five percent of the new senior demographic uses skincare products such as facial cleansers and moisturizers, indicating a level of skincare awareness that is more mature than expected. Additionally, their high awareness of UV protection is noteworthy, with most using mid-priced products. Such healthy skincare habits are inseparable from their mindset. They have the mindset of “accepting aging without anxiety, but wanting to delay it” and “not seeking to be like young people, but wanting to look younger than their peers,” which is why they invest time and effort into skincare. Regarding preferences for skincare brands, European and American brands are preferred over Chinese and Japanese brands, with Japanese brands accounting for approximately 30% of preferences.

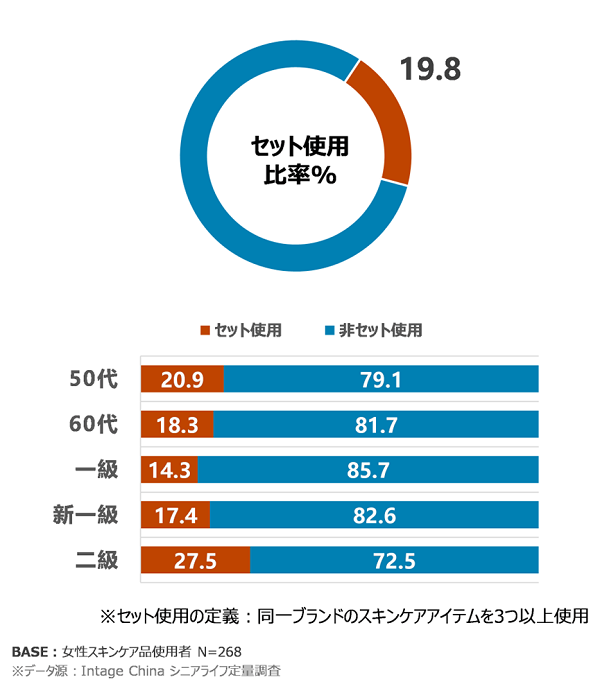

The new senior demographic tends to repeat purchases of products they like and has high brand loyalty. The data (see figure below) shows that second-tier cities have the highest percentage (27.5%) of consumers who use multiple items from the same brand in combination, compared to first-tier cities and new first-tier cities. Conversely, first-tier and new first-tier cities have a higher percentage of consumers who freely combine star products from multiple brands. For brands, it is expected that the cost of educating the new senior demographic will increase accordingly.

Everyone loves beauty, and seniors are no exception.

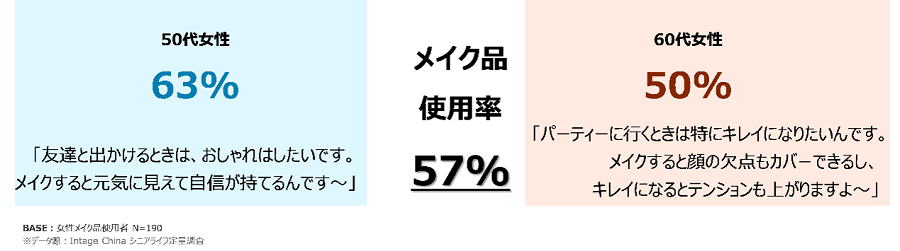

The percentage of women who use makeup is 57%, which is a big difference from the old image of seniors as “sloppy and unkempt.” Today's seniors are confident and care a lot about looking good to others, so they think of makeup as a form of etiquette, and their attitude toward makeup is almost the same as that of young people.

As mentioned earlier, the new senior female demographic's approach to aging is not to strive to be the same as younger people, but rather to be better than those around them. In addition to using skincare and makeup products, they are actively trying out “mini-beauty treatments.” Recognizing the anti-aging effects of beauty treatments, they prefer entry-level soft models rather than high-level hard models like young people. By city, users in first-tier cities are the most numerous. Furthermore, through mini-beauty treatments, they aim to achieve visual “rejuvenation” and gain joy and mental satisfaction.

◆Purchasing behavior

When it comes to purchasing channels, there is little difference between young people and older generations.

They are not limited to traditional offline channels but also turn to online channels. Online usage surpasses offline, allowing them to easily purchase products with a single click from home. Within online channels, in addition to official flagship stores, emerging channels such as overseas e-commerce, live commerce, and WeChat purchases are also thriving. Furthermore, they are willing to register as paid members to enjoy high-quality experiences and services. Women in second-tier cities and new first-tier cities who enjoy videos and dramas are proactive in purchasing memberships on video websites. New seniors in first-tier cities seeking high-quality lifestyles and differentiated services have a much higher membership utilization rate at high-end supermarkets compared to other cities.

Values of the senior generation

Through analyzing the attributes, daily lives, mindsets, consumption structures, and consumption channels of the new senior demographic, I believe you can see that they differ greatly from the traditional image of seniors. The fundamental reason for these “differences” may be related to the values of the new senior demographic that we are focusing on.

The new senior demographic, who possess a youthful mindset, are not truly elderly but rather young people who are “aging.” They have shifted from prioritizing their grandchildren, as was customary in the past, to prioritizing themselves. As the focus of their lives has shifted from their children back to themselves, they maintain a sense of distance from younger generations, and family relationships have evolved from the traditional “dependence” and “control” to mutual ‘respect’ and “support.”

Another value is the emphasis on one's own mental satisfaction and well-being. This has also led to an increase in consumption trends related to mental health and interests. The new senior generation, who actively socialize, communicate, and seek attention from others, believe that being the first to know information, experience things, and recommend them to others is proof of their vitality among friends.

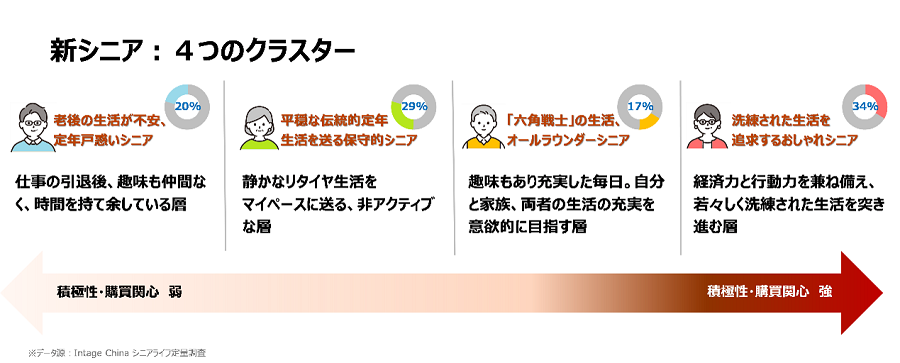

Through cluster analysis, the new senior demographic has been categorized into four types. From left to right, the lifestyle attitudes become more proactive, and consumption interests increase. The two clusters on the right account for over 50% of the new senior demographic, and they seek a high quality of life with strong consumption desires. Their motivation, action, and consumption power are nearly indistinguishable from those of younger generations.

New opportunities in the senior economy

The silver market has already attracted a great deal of attention, and its popularity can be seen from the fact that many investment banks have entered the market. According to statistics from third-party organizations, the investment field is shifting from traditional elderly care to health-oriented travel and healthy living. The silver market is currently experiencing a tailwind. With investment funds entering the market one after another, it is predicted that the number of players will increase and the market will become even more active in the future.

-

Author profile

Intage China Independent Research Team

A team composed of young researchers at Intage China.

Intage China conducts several independently planned surveys each year to train young researchers and disseminate information to the outside world. The column article written this time is also a masterpiece compiled by young researchers, who took the lead in gathering information and conducting independent surveys. -

Editor profile

Intage.inc

***

Global Market Surfer

Global Market Surfer CLP

CLP