[Generation Z in Asian Countries]Thailand: Hair care products & protein milk favored by young women

- Release date: Feb 19, 2025

- 6968 Views

Over the past decade or so, a diverse range of products have emerged from domestic start-ups in Thailand, capturing the hearts and minds of Generation Z youth. Products that capture the pain points of young consumers from a unique Thai perspective and give shape to “what I wish I had” are appearing one after another. We will introduce brands that are gaining support in Thailand, along with survey data.

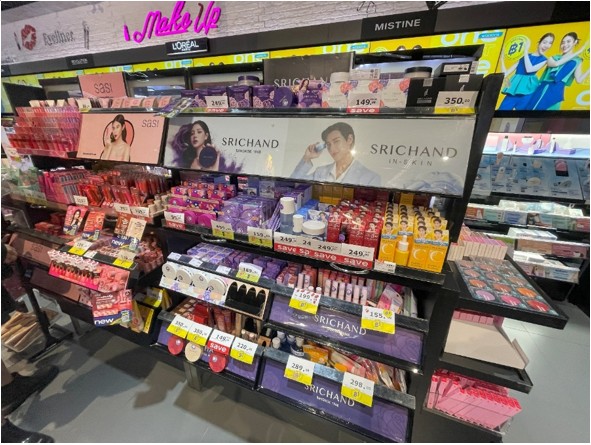

Hair Care Products

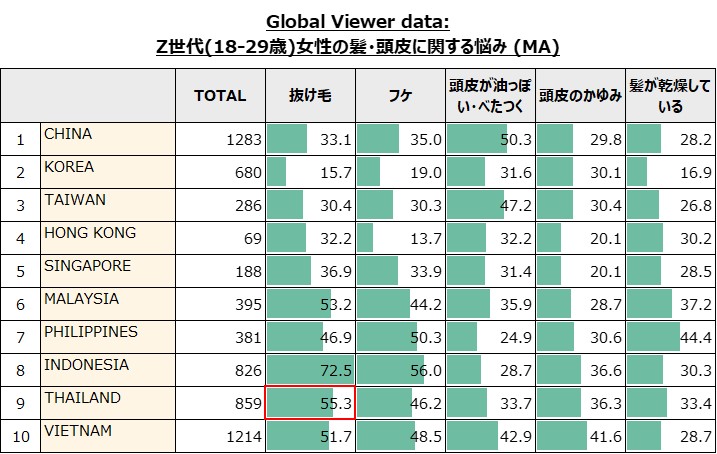

According to Intage's Global Viewer consumer database, 55% of Generation Z Thai women are concerned about “hair loss,” the second highest rate among the 10 East Asian and Southeast Asian countries. They tend to be concerned about hair loss from a young age.

(Source: Intage Global Viewer (2024))

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

When we spoke to a friend from a Thai family living in Bangkok, she told us that her second daughter, a high school student, suffers from dry, itchy scalp and dandruff because of her allergies and dry skin. Since common products make her head itch, she has been looking for and trying hair care products for sensitive skin, but products for sensitive skin are expensive and the fragrance is not to the liking of her eldest daughter, a college student. For this reason, she told us that the hair care products used by her family members are different brands.

In Thailand, several hair care brands using Thai herbs and natural ingredients have appeared on the market, responding to the hair and scalp concerns of Thai women that could not be solved by ordinary products.

Kaff & Co. (https://www.kaffandco.com/en) is a brand of hair and body care products using kabumikan extract oil, ginger, and aloe. Products are available according to scalp type (normal/oily), dandruff, hair loss, and other concerns. The brand was launched in 2014 after the brand owner, who herself suffered from hair loss due to allergies, came across kaffir lime extract oil.

The “Kaffir Lime Essential Oil Shampoo” (300 ml, 380 baht) is for those who suffer from dry, itchy scalp and dandruff.

Ginger Rhizome & Kaffir Lime Shampoo" (ginger and kaffir lime shampoo) is effective against hair loss and comes in a 300 ml bottle for 480 baht.

SKIN SYRUP (https://skinsyrup.co/) is a hair and body care brand that uses traditional Thai natural ingredients such as kobumikan and butterfly pea as well as rare ingredients imported from overseas. The products are formulated for people with sensitive skin by utilizing the knowledge and techniques of traditional Thai medicine.

Milk with protein

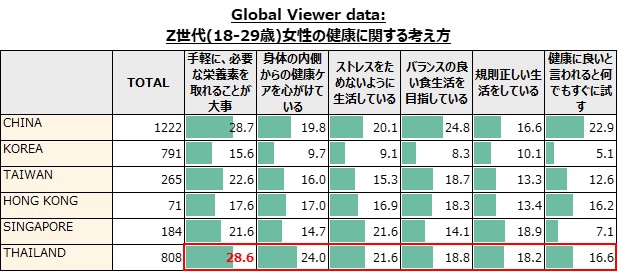

(Source: Intage Global Viewer (2024))

Among these, many Thai Zs think it is “important to be able to take in the nutrients they need easily” (28.6%). Urban youth living in Bangkok are busy every day, and it is difficult for them to get well-balanced nutrition in their daily meals. In recent years, convenience stores and supermarkets have begun to carry RTD products that provide a variety of nutrients. In particular, as more people become health-conscious and take proper diet and exercise, protein-packed milk products are gaining popularity, and many types of products can be found on the refrigerated drink shelves of convenience stores and food shops.

In 2015, the protein drink brand Hooray! launched its RTD protein milk, which was still a rarity at the time. It now accounts for 40% of the protein-packed milk market, with annual sales expected to reach THB 800 million.

According to an interview with Jane, founder of CROSSMAX RETAIL, the company that markets Hooray!(https://www.drinkhooray.com/proteinshakelactosefree)(*) Before launching the brand, CROSSMAX RETAIL started a fitness studio business in response to the growing health consciousness. Many young women who went to fitness clubs understood that protein was good for their bodies, but at the time, there was no good-tasting, easy-to-drink protein available in Japan. They saw a commercial opportunity and created a brand as a start-up.

In developing the product, we took into consideration the fact that Thai people like sweet foods and find “sweet = delicious,” but they also want to cut back on sugar for their health, so we used artificial sweeteners to achieve the sweet taste that Thai people prefer. Furthermore, based on research showing that 98% of Thais are lactose intolerant, we developed a lactose-free product. Thus, a product that is easy for Thai people to drink and absorb was born.

Protein Shake Lactose Free" is available in four varieties, including plain, chocolate, and strawberry, and costs 49 baht for a 340 ml bottle. It is available in a wide range of sales channels, including convenience stores, shopping malls, and supermarkets. The company also offers plant-based protein and almond milk products.

In addition to Hooray, the RTD protein milk market in Thailand includes products from major food manufacturers such as Meiji and Dutch Mill, as well as Tofusan, a domestic soy milk brand. Generation Z health-conscious people are said to consume protein as a meal replacement to get in shape or lose weight, or as a pre-workout snack.

The author's teenage son also buys RTD protein drinks at convenience stores when he wants to take in protein as soon as possible after muscle training. The brand he drinks most often is Meiji, and the package design of Hooray! RTD protein products such as Hooray! are likely to be in high demand in the future, as they allow consumers to easily consume nutrients and stay in shape at the same time.

The three brands featured in this report all have sophisticated designs reminiscent of foreign brands, which make them attractive and tempting to pick up. The protein milk brand is promoting a healthy and cheerful impression. These stylish product images seem to match the sensibilities of young Thais, and are the reason why these products are gaining popularity.

Related Articles

[Generation Z in Asian Countries] Thailand : The Work Style Generation Z is Seeking - Focus on Young Women Starting Their Own Businesses

[Generation Z in Asian Countries] Vietnam: Vegan cosmetics are attracting the attention of young Vietnamese people

[Generation Z in Asian countries] Vietnam: Trends and behaviors of young women when choosing drinks

[Generation Z in Asian countries] Philippines: Generation Z values “good smells”

[Generation Z in Asian Countries] The food preferences of Generation Z in the Philippines reflect the national character - Western food vs. Japanese food

Related Article: Understanding Overseas Gen Z Characteristics: Country-Specific Trends in Values and Lifestyle (Singapore, Hong Kong, South Korea, Taiwan, China, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

Using a large consumer database, we identify characteristics and trends among Gen Z in each country and present them in a summary article.

You can also view information on Gen Z in other countries.

Countries Covered: Singapore, Hong Kong, South Korea, Taiwan, China, Malaysia, Thailand, Indonesia, Vietnam, Philippines

-

Author profile

TNC Lifestyle Researcher

I have lived in Bangkok for 18 years with my Thai husband and three children. When I first came to Thailand, I used to buy Japanese hair and body care products from Japan, but now I mainly use Thai brand products!

-

Editor profile

チュウ フォンタット

Malaysian researcher living in Japan. Since he is in Malaysia, he has been using major Western brands of shampoo, and still continues to use them because the same products can be procured in Japan.

Global Market Surfer

Global Market Surfer CLP

CLP