[Generation Z in Asian countries] South Korea: Generation Z enjoys managing their health easily and happily

- Release date: Apr 18, 2025

- 6684 Views

Since the pandemic, the younger generation in Korea has become increasingly health-conscious. Healthy leisure,” in which people manage their health while having fun, has become a trend, and products that remove ingredients and elements harmful to health, such as zero-sugar products, are gaining popularity. Demand is also growing for dietary supplements that provide necessary ingredients in an easy-to-use manner.

More recently, a new group of people have emerged, known as the “health-digging tribe,” who are deeply immersed in a particular health regimen or wellness activity. More and more Gen Zers are searching for ways to manage their health in a way that suits them, while practicing it easily and without strain.

① “OLIVE YOUNG”, which created an opportunity for Generation Z to get in touch with wellness

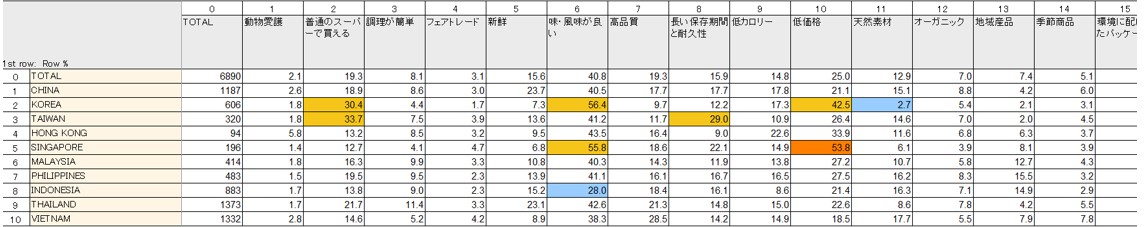

Looking at the “categories of interest” in Intage's Global Viewer sei-katsu-sha database, there is no category that shows particularly high numbers in South Korea, but as in other countries, “food/beverage,” “beauty,” and “health” occupy the first three positions.

In order to manage health easily, demand for functional health foods such as vitamins and probiotics is increasing. However, since there are no drugstores in South Korea like in Japan, it has been necessary to purchase supplements directly from pharmacies, supplement departments of large supermarkets, or stores specializing in health supplements. In these stores, the sales staff themselves often strongly recommended supplements, making it difficult for customers to carefully select the right product.

OLIVE YOUNG” changed this situation and created an opportunity for Generation Z to easily purchase supplements.

OLIVE YOUNG is Korea's No. 1 health and beauty store, with more than 1,300 stores nationwide (*1). With popular cosmetic brands such as CLIO, rom&nd, and 3CE, the store enjoys overwhelming support from young women and foreign tourists.

It used to have a strong impression of being a select cosmetics store, but since the Corona Disaster, it has expanded its product lineup to include W Care (women's health products), supplements, inner beauty, and health foods, and has developed a strategy to push wellness to the forefront.

*1 2024/12/4 Herald Economics

https://biz.heraldcorp.com/article/10008379?ref=naver

The store has a section dedicated to supplements & inner beauty products, with a wide variety of products.

Since the middle of 2023, dual-formulation multivitamins, consisting of a liquid and a tablet (supplement) in one bottle, have become common and are still in vogue today. Among them are “I'm vita Immune Shot” (34,900 won (approx. 3,600 yen)/pack of 16), which provides a total of 18 nutrients at once, including 10 vitamins, 7 minerals, and beta-carotene, and the German premium health food brand “orthomol immune Multivitamin & Mineral” (34,900 won (approx. 3,600 yen)/pack of 7 bottles), a premium German health food brand, are gaining popularity.

The dual-formulation products are suitable for the busy lifestyles of modern people because they are highly portable, can be taken without water, and are expected to be effective when taken once a day. The fact that the product is tasty and easy to manage one's health overlaps with the concept of “healthy leisure” and has led to its huge popularity.

In addition to the offline sales floor, OLIVE YOUNG has opened a specialized wellness store “Health + (Plus)” in the mobile app to enhance convenience for customers to purchase wellness products anytime and anywhere. Health+” also offers a variety of useful content, including health-related information and recommended items.

It also has a “Find the Right Supplement” function that allows users to search by various aspects such as gender, age, health status (pregnancy), target area (eyes, skin, intestines, muscles, etc.), and product efficacy (antioxidant, immune management, body fat management, etc.) to find products optimized to the consumer's characteristics.

Another attraction of the site is its daily sales of popular products. By opening the “Today's Specials” section on the main screen, customers can check products at a glance, and if they register as members of the application, various coupons are distributed each month to help them save even more money.

As a result of expanding the wellness segment, OLIVE YOUNG's sales of functional health foods in 2023 increased by more than 45% compared to the previous year. (*2)

Recently, convenience stores and Daiso have been focusing on the sale of health functional foods. Products that require purchase by the box online can be purchased from a single unit at convenience stores. At Daiso, the price is 3,000-5,000 won, about one-sixth of the over-the-counter price.

*2 11/27/2024 Seoul Economy

https://www.sedaily.com/NewsView/2DH0B63SRK

② Evolving Healthy Pleasure Marketing

After the Corona disaster, healthy convenience foods with reduced calories and sugar-free products appeared one after another, and zero-sugar/zero-calorie carbonated beverages became widely established after a huge boom.

In Japan, sugar-free RTD products (ready-to-drink) such as Coca-Cola Zero have been popular for quite some time, but in Korea, zero-calorie products were not common until around 2020 due to the persistent image of “zero-calorie is bad”.

However, with the emergence of trends such as “healthy leisure” and “slow aging,” demand for zero-sugar/zero-calorie products sweetened with alulose, stevia, etc. has expanded: in addition to RTD beverages, confections, and alcoholic beverages, ice cream, nutritional drinks, canned foods, and even ZERO SUGAR (zero sugar) instant ramen noodles.

Popular girl groups and idols such as NewJeans and LE SSERAFIM are often used in commercials for these zero-sugar products, suggesting that Generation Z is the primary target.

The development of alternative sweetener technology was also a major factor behind the boom. As it became possible to reproduce the taste of existing products without the use of sugar, resistance to zero-sugar products began to wane.

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

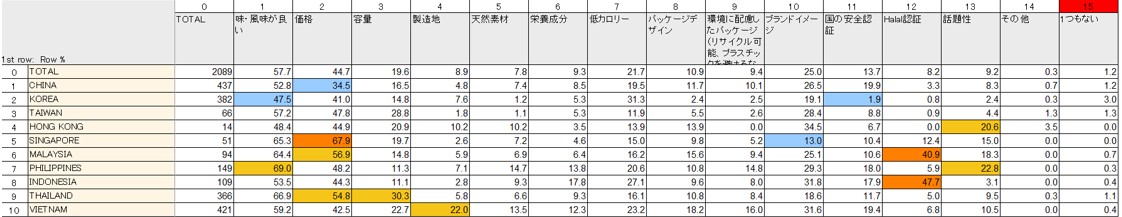

The percentage of respondents who selected “low calorie” for carbonated beverages was the highest among the 10 countries, at 31.3%. Although the percentage for “good taste/flavor” was not particularly high compared to the other countries, about half (47.5%) of the respondents considered it important. In the category of “sweets/jams,” “good taste/flavor” was ranked first among the 10 countries at 56.4%, and “low calorie” was ranked third at 17.3%, suggesting that the taste is important in addition to low calorie content when purchasing carbonated drinks and confections, many of which have zero-sugar products on the market. This suggests that the zero-sugar boom is a trend among Generation Z drinkers.

The zero-sugar boom has also brought about changes in the drinking culture of Generation Z. The zero-sugar shochu “Cero” (1,800 won/360 ml), which does not contain fructose, is characterized by its refreshingly soft taste.

It is a diluted shochu (Japanese Kou-type shochu) made mainly from barley and rice, and the addition of distilled shochu (Japanese B-type shochu) to bring out the original flavor of the shochu has made it a big hit. In the two years since its launch, cumulative sales have exceeded 500 million bottles*3, and zero-sugar shochu has become a “common sense” drink for young people.

*3 2025/3/12 News 1

https://www.news1.kr/industry/distribution/5716925

https://www.instagram.com/p/DGweDDMSbgF/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA

The “ZERO” series, Lotte Well Food's sugar and sugar-free brand, has so far launched 21 different products in various categories, including confectionery, ice cream, and dairy processed products. The company has spent a long time developing these products to achieve products that are not inferior in taste and quality compared to conventional products, and by 2024, sales will reach over 50 billion won, achieving a growth rate of approximately 214% compared to the first year of launch (2022) (*4). The company has helped zero-sugar food products to take root in the domestic market.

*4 2025/3/10 Hans Economics

https://www.hansbiz.co.kr/news/articleView.html?idxno=737655

In June 2024, Harim, a major food manufacturer, launched “zero flour” “oh! Today's Protein Protein Cookie” (3,000 won/40g). This gluten-free product uses 100% domestic rice flour instead of wheat flour. While enjoying the deep flavor of chocolate and butter and the crispy texture of the cookies as they are, customers can also consume high-quality protein and dietary fiber.

In addition to cookies, other companies have released dried noodles and roll cakes as zero flour products, and the number of products is expected to increase in the future.

In addition, many other products such as “zero caffeine” and “zero alcohol” have been introduced, and the zero food boom that began with zero sugar is being upgraded to the next level.

Conclusion

In Korea, many people maintain their style and enjoy fashion even as they age, and I feel that they have a higher sense of beauty than in Japan. The country is famous for cosmetic surgery, probably because so many women want to be beautiful.

The growing interest in health and wellness has strengthened the health needs associated with beauty, such as skin health, intestinal health, and weight management. This “health = beauty” trend will continue to accelerate. Accordingly, the health trend among Generation Z is expected to become even more pervasive and entrenched.

Translated with AI Translator

Related Article: Understanding Overseas Gen Z Characteristics: Country-Specific Trends in Values and Lifestyle (Singapore, Hong Kong, South Korea, Taiwan, China, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

Using a large consumer database, we identify characteristics and trends among Gen Z in each country and present them in a summary article.

You can also view information on Gen Z in other countries.

Countries Covered: Singapore, Hong Kong, South Korea, Taiwan, China, Malaysia, Thailand, Indonesia, Vietnam, Philippines

-

Author profile

TNC Lifestyle Researcher

A housewife who has lived in South Korea for 14 years. She lives with her Korean husband on Yeongjong Island, surrounded by the sea. Her hobbies include visiting cafes and traveling to Japan.

-

Editor profile

Chew Fong-Tat

A Malaysian who has lived in Japan for 14 years. He is in charge of creating the Global Market Surfer website.

Global Market Surfer

Global Market Surfer CLP

CLP