Free Time in ASEAN: What do Indonesians do in their free time?

- Release date: May 02, 2025

- 1703 Views

The working-age Japanese (20s-50s) often feel that they do not have enough free time due to various reasons such as work, childcare, and nursing care. How do they spend their free time?

In this article, we focus on Indonesia, which tends to have the most free time among the ASEAN countries, and explain how they spend their free time using INTAGE's Global Viewer (conducted in 2024) of overseas sei-katsu-sha data.

Which countries have the most free time among the current generation in ASEAN?

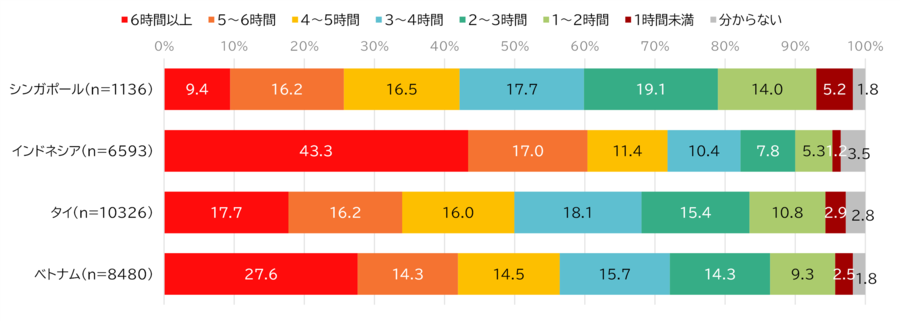

When asked how much free time they have on weekdays in their 20s to 50s in the four ASEAN countries (Singapore, Indonesia, Thailand, and Vietnam), more than 40% of Indonesians answered “6 hours or more,” with the percentage here more than 10 ppt higher than in Vietnam and the Philippines, which come in second and higher, indicating more free time This is more than 10 ppt higher than in Vietnam and the Philippines, which come in second and higher.

Figure 1: Free time on weekdays (base: men and women aged 20-59 in each country)

(Source: Intage Global Viewer (2024))

How do Indonesians use their free time on weekdays?

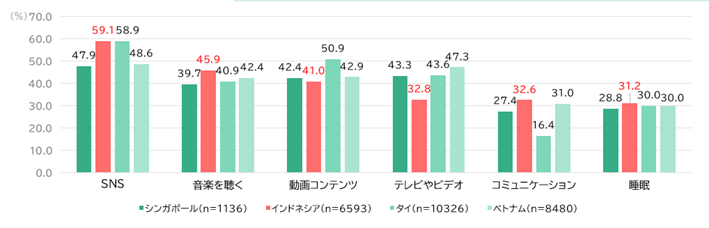

Compared to other ASEAN countries, relatively more Indonesians spend on “SNS” and “listening to music,” while “TV/video” is lower than in other countries. It is believed that these are at the top of the list because Indonesia is said to have a social culture that values connections with family and friends, and music is also deeply rooted in daily life, with religious and cultural events always present and being an indispensable part of life.

Figure 2: How people use their free time on weekdays

(base: men and women aged 20-59 in each country)(selected top 5 items for Indonesia)

(Source: Intage Global Viewer (2024))

How much time do Indonesians spend on what social networking sites?

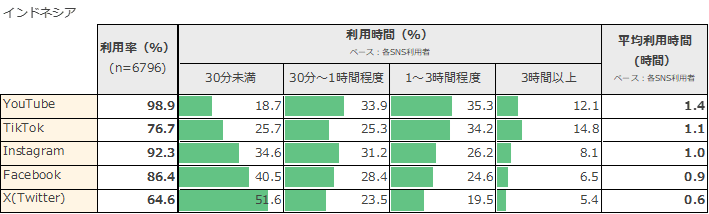

SNS" was the top use of free time on weekdays, but what kind of SNS do they use? In Indonesia, “WhatsApp” is the most popular SNS, but it is not included in this survey because of its strong messaging aspect. TikTok, which is the second most popular SNS with an average daily usage time of 1.1 hours, has a certain number of respondents who do not use it, but among those who do, it is the most popular SNS with a longer usage time than the other SNSs. Although TikTok's content is often shorter than that of YouTube, it can be inferred that users spend a relatively long time watching a large amount of content.

*Sort in descending order by average usage time

Figure 3: Time spent per day by social networking site (base: Indonesian men and women aged 20-59)

The sample size for each social networking site user is as follows:

YouTube n=6,724, TikTok n=5,209, Instagram n=6,275, Facebook n=5,871, X(Twitter) n=4,387

(Source: Intage Global Viewer (2024))

As can be seen, trends in disposable time differ from country to country, as do the ways in which that time is used.

When considering touch points with consumers in each country for overseas marketing activities, it is advisable to optimize them by referring to this kind of information.

What is Global Viewer?

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories (*).

Examples of categories:

Food and beverages, personal care/cosmetics, house hold care, childcare/nursing care, mobility, home appliances, smart home, housing, entertainment content (games, music, etc.), finance, insurance, travel (to Japan), online services, etc.

In addition to country-by-country comparative analysis as described in this article, analysis by attributes (sex, age, income, etc.) within a single country is also possible.

For details, click here.

-

Author profile

Takahashi Hidemasa

After working extensively in overseas marketing and research support for Japanese FMCG and DCG manufacturers, he has been engaged in overseas business promotion and planning and maintenance of global research services in his current position since 2021.

-

Editor profile

Risa Takahama

After working in marketing research support for Japanese FMCG manufacturers (cosmetics, baby products, food and beverages, etc.) in Asia, Europe, and the United States, from 2019, in her current position, she develops solutions for overseas marketing research for Japanese companies and conducts seminars and other outward communications.

Since the birth of her child, her greatest concern is how to maintain the physical and mental health of her family and herself, and she has been experimenting with various goods and services.

Global Market Surfer

Global Market Surfer CLP

CLP