[China] Understanding the “silver generation”: The growing beauty market for seniors

- Release date: Aug 07, 2025

- Update date: Aug 07, 2025

- 2555 Views

With China's aging population and declining birthrate, the economic and consumer power of the silver generation is becoming a promising blue ocean market. Unlike the traditional image of the elderly, today's silver generation is young at heart and has high economic power. As a result, they have significant spending power in the beauty market, such as skincare and cosmetics, contributing to the formation of a huge market.

In this article, we will examine the latest consumer trends of the silver generation, which is positioned as the “new senior generation” (ages 50 to 69).

1. Profile of the silver generation: “Golden Consumers” with money and leisure time

First, we will use charts to introduce four points to help you understand the characteristics of the silver generation (new senior citizens aged 50 to 69) in China.

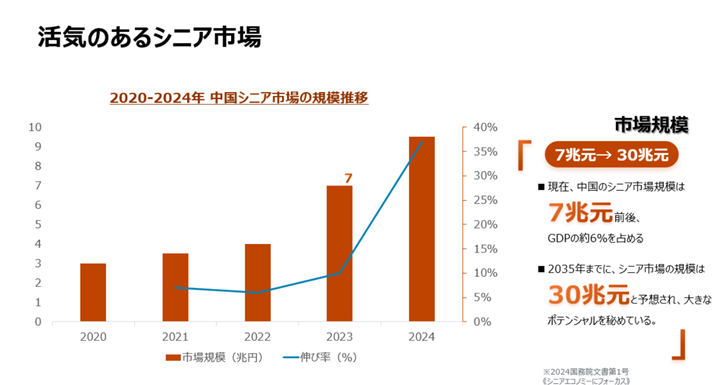

(1) Formation of a huge market: The silver economy is expected to reach 30 trillion yuan (approximately 510 trillion yen) in 2035.

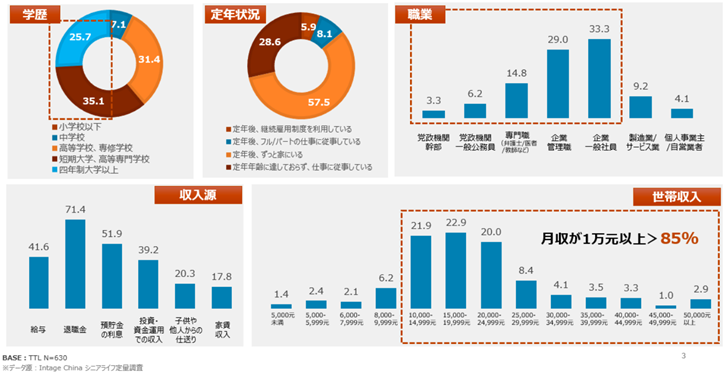

② Strong economic foundation: 85% have a monthly household income of over 10,000 yuan, with diversified sources of income (retirement benefits + investments + rent).

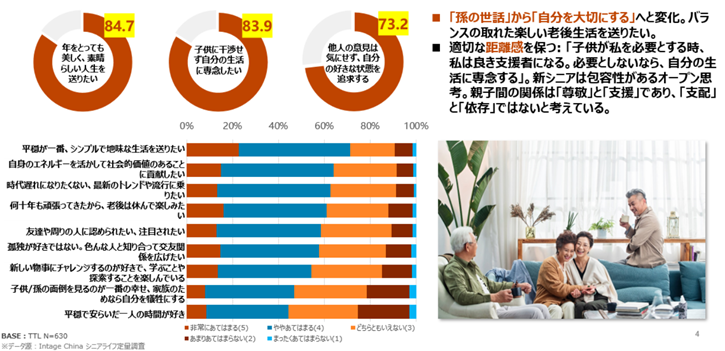

③ Change in consumer values: Shift from “consumption for daily life, family, and children” to “rewards for oneself.”

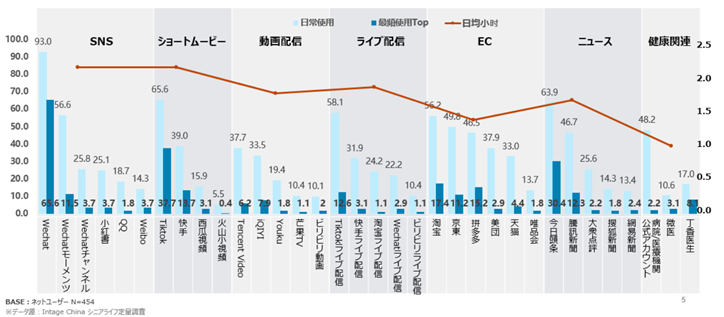

④Advancement of digital skills: Average daily video viewing time is 1.5 hours. The percentage of purchases made online through e-commerce is steadily increasing.

2. New Beauty Trends Among the Silver Generation: From Basic Needs to a More Refined Lifestyle

The silver generation is challenging conventional wisdom.

In the past, it was sufficient to provide the silver generation with products that met their needs for “cleanliness: maintaining health” and “anti-aging: slowing down the aging process.”

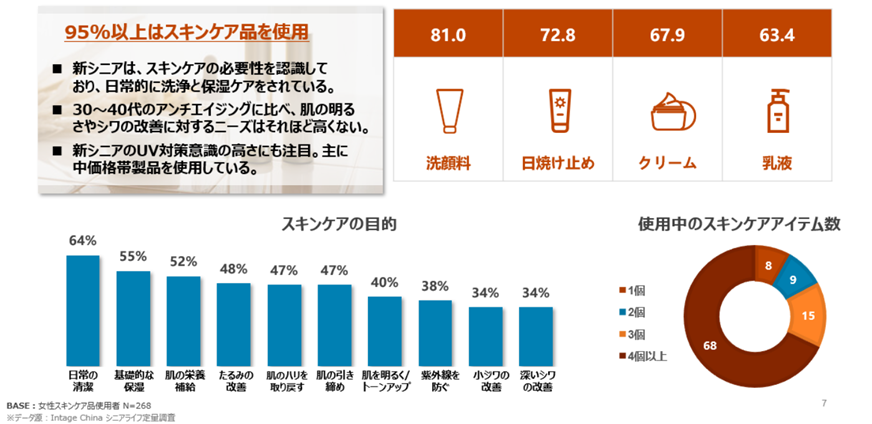

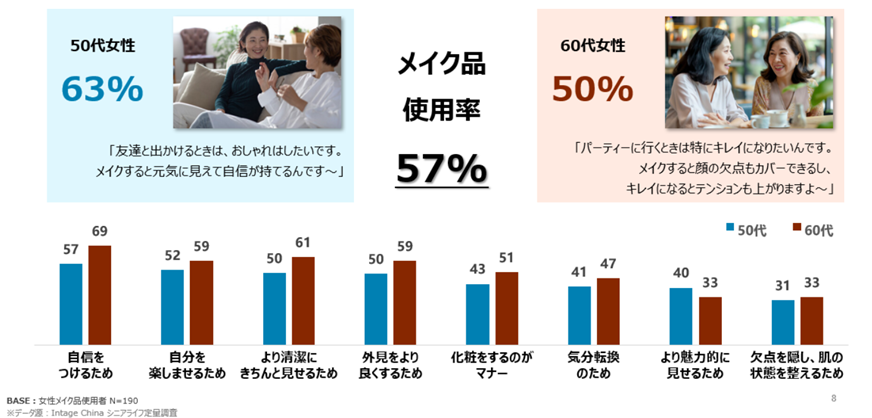

However, recent surveys show that 95% use skincare products and 57% use makeup cosmetics, with many expressing positive opinions such as “boosting confidence” and “enjoying oneself.”

These survey results reflect their confident and self-affirming lifestyle attitudes. They are no longer satisfied with generic “senior-oriented products” and are beginning to seek “product proposals that fulfill positive and forward-thinking values.”

3. New Opportunities in the Silver Economy

The silver economy is ushering in a new era of consumption unlike anything we have seen before. The “new senior demographic” possesses strong economic power and a positive consumer mindset that has never been seen before, and is poised to reshape the commercial landscape of the beauty market for skincare and cosmetics. The “new senior demographic” is no longer simply “elderly,” but rather a “new consumer” seeking a refined lifestyle.

To capture the “new senior demographic,” which possesses strong purchasing power and a youthful mindset, it is essential to approach them from both functional and emotional perspectives. Functionally, it is necessary to address their basic needs for “elderly-friendly (healthy and safe)” products, while emotionally, it is crucial to appeal to their sense of self-worth by avoiding the stigma of aging and instead reconstructing an image of vitality.

Products and services that combine these two points will lead the way in the trillion-dollar market of the future.

Related articles:

中国の新たな購買層 の生活・消費トレンドを先読み!~中国の銀髪族(シルバー市場)はブルーオーシャンになるのか?~(前編)

中国の新たな購買層 の生活・消費トレンドを先読み!~中国の銀髪族(シルバー市場)はブルーオーシャンになるのか?~(後編)

-

Author profile

Qian ni Lu

Qian ni Lu 卢茜妮, joined INTAGE CHINA in 2003.

With more than 20 years of research experience and extensive knowledge of FMCG products in particular, she has extensive experience as a moderator, and she is well informed about the latest methods and industry conditions.

-

Editor profile

Stacy sun

Stacy sun孙珊珊, joined INTAGE CHINA in 2016.

She worked as project manager in HC team, she is now responsible for supplying content to the GMS platform for Intage China.

Global Market Surfer

Global Market Surfer CLP

CLP