【アジア各国のZ世代】台湾編:家で楽しむグルメ志向の冷凍食品とクラフトビール

- 公開日:2025/08/14

- 更新日:2025/08/14

- 4014 Views

幼少期には既にインターネットが存在し、物心がつく頃にはSNSが日常のツールとなっていた台湾のZ世代。Z世代の間ではThreadsやInstagram、YouTubeでさまざまな情報が共有されており、特にグルメ情報は人気のカテゴリーだ。その中でも「自宅で楽しめる」冷凍食品や、クラフトビールをはじめとするアルコール飲料も人気のテーマである。

コロナ禍以降、台湾では冷凍食品の人気が高まっている。共働き家庭が多く、時間に追われる人が多いなか、電子レンジで加熱するだけで簡単に調理できる冷凍食品は生活に欠かせない存在となり、現在では年間450億食が消費されている。

世界の冷凍食品市場規模は2030年に468億ドルに達すると予測されているが、2023年の台湾市場は約14.2億ドル規模で、今後も拡大が見込まれている。

(参考:https://www.gvm.com.tw/article/115806)

この冷凍食品市場の拡大を牽引しているのがZ世代の存在である。外食文化が根強く、至るところに食堂や屋台が点在する台湾では、これまで手頃な価格で外食を済ませることが一般的だった。しかし近年は物価の高騰により、かつてワンコインで楽しめた夜市のグルメでさえ割高に感じられるようになっている。冷凍食品は輸入品に加えて台湾国内で製造された商品も多く、スーパーやコンビニエンスストアで幅広く展開されている。価格も100元(約500円)ほどと手頃で、日常使いしやすい点が受けている。

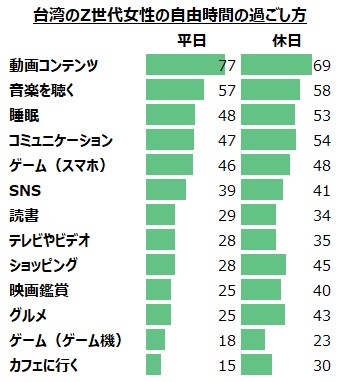

また台湾のZ世代は、スマートフォンの普及とともに、動画鑑賞や動画制作を日常の楽しみとしている世代だ。コロナ禍に定着した“自宅で楽しむ”習慣も相まって、自宅で食べたい時に温めるだけで食べられる冷凍食品は、彼らのライフスタイルにマッチしている。

インテージが保有する生活者データベース「Global Viewer」*のデータでも、Z世代の多くが自由時間を動画鑑賞や音楽鑑賞、ゲームといったインドアの趣味に費やしていることが分かる。こうした背景からも、自宅で気軽に楽しめる冷凍食品が、Z世代の支持を集めていることがうかがえる。

出典:Intage Global Viewer:V12S3. 自由時間の過ごし方 (MA)

*Global Viewerとは

インテージがストックする11カ国(アジア・US)の生活者の様々な実態・意識に関するアンケートデータを用いて、ご課題に応じたレポートをご提供するサービス。

カバーしている項目は、各種商品・サービスカテゴリーに関する行動実態・意識、価値観・情報接触など400項目に及ぶ。

台湾のコンビニエンスストア最大手であるセブン-イレブンは、冷凍食品の購入者の約50%が35歳以下の若者であると発表している。

(参考:https://www.knews.com.tw/news/356F61F3D984FE98CAD93D4A3A0AFB9E)

2025年2月には、日本のカレーチェーン「CoCo壱番屋」と共同開発した冷凍カレーライス「奶油咖哩雞肉飯(ナイヨウガーリージーロウファン)」が登場。CoCo壱番屋は台湾で40店舗以上を展開するほどの人気があり、冷凍でありながら本格的なココイチのカレーが食べられると注目された(価格は89元=約440円)。

セブン-イレブンは「Homeal家常美味(ジャーチャンメイウェイ)」と題した冷凍食品シリーズも展開しており、自宅で手軽に食べられることに加え、味にもこだわっているのが特徴だ。主なターゲットは学生層で、冷凍庫にストックして、夜食として食べられているという。

(参考:https://www.7-11.com.tw/company/csr/news_detail.aspx?id=418)

また、2023年に売上高が300億台湾ドル(1,440億円)を突破した台湾のファミリーマート(全家/チェンジャー)は、1億台湾ドル(4.8億円)を投資して自社の冷凍・生鮮食品生産ラインを再構築。「冰鮮計畫(ビンシェンジーファ/新鮮な味が楽しめる冷凍食品計画)」と題して、冷凍食品だからこそ実現できる“鮮度”を武器にした新たな商品開発に注力している。

全台湾の2,000店舗以上に4ドア式冷凍棚を導入し、知名度の高いレストランチェーンとの共同開発商品や、インフルエンサーとのコラボ商品なども展開。Z世代をターゲットに売上を伸ばしている。

(参考:https://www.foodnext.net/news/industry/paper/5234937108)

人気グルメ系YouTuber「千千(チェンチェン)」とのコラボで開発された冷凍食品「麻辣豬皮(マーラージューピー)」は、ピリ辛でご飯やお酒に合う味付けと、柔らかく仕上げた豚皮が好評。コラーゲンが手軽に摂取できることもあり、Z世代の女性を中心に支持を集め、2023年9月から翌年5月までに30万袋を売り上げた(価格は49元=約240円)。

千千のYouTubeチャンネル「千千進食中」で告知されたコラボ動画は、2025年7月現在で55万回以上再生されている。

こうした施策の成果もあり、2023年のファミリーマートの冷凍食品売上高は約20億台湾ドル(96億円)に達した。

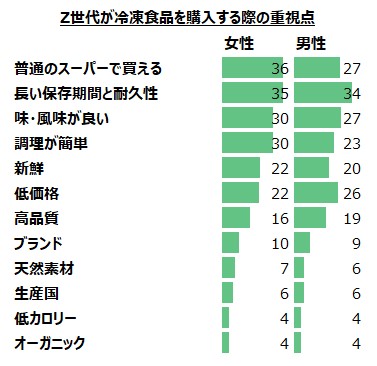

Global Viewerによると「冷凍食品の購入時の重視点」では、「普通のスーパーで買えること」が男性で26.6%、女性で35.5%と回答。24時間営業のコンビニエンスストアは、気軽に買えるというニーズに合致しており、Z世代の冷凍食品需要を的確に捉えていると言える。

Intage Global Viewer:F9S2. 食品カテゴリー別 購入時重視点 (MA) : 冷凍食品

Z世代に人気のクラフトビール

物価高の影響もあり居酒屋に足を運ばず、自宅で“家飲み”を楽しむZ世代が増加傾向にある。その流れを受けて、コンビニエンスストアやスーパーで購入できるビールやアルコール飲料の需要が高まり、各店での売り場も拡大している。

台湾を代表するビールブランド「台灣啤酒(タイワンピージョウ)」をはじめ、日本のキリンやアサヒなどのビールも、現地では定番の人気商品として親しまれている。

近年では、台湾の地元メーカーによるクラフトビールがZ世代を中心に注目を集めている。Global Viewerによると、ビール購入時重視点で「味・風味が良い」と回答した割合が、男性で60.1%、女性で70.9%にのぼり、味へのこだわりが重視されていることがうかがえる。

台湾のビールメーカー「臺虎(タイフー)」が展開するアルコール度数9.99%のクラフトビールが、Z世代から圧倒的な支持を得ている。彼らの間では「臺虎9.99(タイフージョウディエンジョウジョウ)」という愛称で親しまれており、99元(約490円)という手頃な価格も魅力だ。

「臺虎」は現在までに30種類以上のクラフトビールを販売しており、特に「百香風暴(バイシャンフォンバオ)」は、2021年のAsia Beer Championshipで金賞を受賞した実績がある。パッションフルーツにジャスミンティーをブレンドした爽やかな味わいで、Z世代にとっても馴染みのある「手搖飲(ショウヤオイン)」スタイルの味に近いため、クラフトビール初心者でも抵抗感なく受け入れられている。

カクテルからインスピレーションを得たフレーバーや、台湾茶やフルーツなどを使った豊富なバリエーション、そしてカラフルで斬新なラベルデザインもSNS映えするとあって、Z世代の心をしっかりつかんでいる。

日本では健康リスクが懸念され、販売が縮小されつつあるストロング系アルコール飲料だが、台湾では依然として根強い人気を誇っており、アルコール度数9.99%のビールの人気からもその傾向が見てとれる。コンビニエンスストアやスーパーマーケットでは、こうしたストロング系が定番商品として並び続けている。

その背景には、日本と同様に「1缶で手軽に酔える」という点がある。もちろん、台湾でも若者のアルコール摂取に関する注意喚起はメディアを通じて行われているが、メーカー側が製造を抑制する動きは今のところ見られない。

また近年では、居酒屋などでアルコールを飲むよりも、自宅で動画配信やSNSを楽しみながら、コンビニエンスストアやスーパーマーケットで購入した50〜100元(約250〜500円)のビールや缶酎ハイを飲むスタイルが、Z世代の間に浸透している。

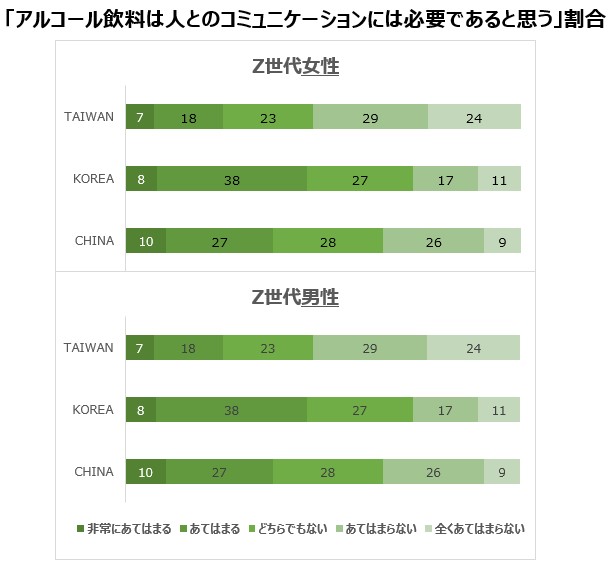

Global Viewerによれば、「アルコール飲料は人とのコミュニケーションに必要である」という設問に対し、「あてはまらない」「まったくあてはまらない」と回答した割合は、男性で37.3%、女性では52.5%と高い水準を示している。Z世代にとって、同僚や友人と飲みに出かけるよりも、自分の部屋でリラックスして“ひとり飲み”を楽しむスタイルが好まれているようだ。コロナ禍をきっかけに広がった“家飲み文化”は、現在もなお根強く支持されている。

Intage Global Viewer:D10S2. 飲料に関する考え方・価値観 (SA) :

アルコール飲料は人とのコミュニケーションには必要である

大手スーパー「家樂福(ジャールーフー)」の統計によれば、2023年の缶入りフレーバーカクテルおよびビールの販売量は、前年比で約50万缶増加し、成長率は15%を記録した。5%以下の低アルコール商品が依然として主流だが、アルコール度数9.99%のような高アルコール飲料も売り上げを伸ばしており、Z世代を中心に多様なニーズを取り込んでいる。

(参考:https://tw.news.yahoo.com/)

時短・低価格で手軽に楽しめる冷凍食品と、居酒屋に行かずとも高品質なアルコール飲料を自宅で気軽に味わえる環境は、現代のZ世代にとって、もはや日常の一部となっている。加えて、若者の感性に響くパッケージデザインや、フルーティーな風味、意外性のある素材使いなどもヒットの重要な要素だ。今後も、Z世代のライフスタイルや価値観に寄り添った新商品が次々と登場し、日々の“おうちグルメ”を彩っていくことだろう。

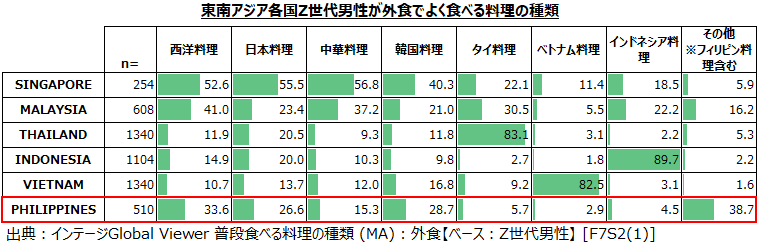

関連記事:海外Z世代の特徴を把握:価値観と衣食住から見る国別トレンド(シンガポール、香港、韓国、台湾、中国、マレーシア、タイ、インドネシア、ベトナム、フィリピン)

大型生活者データベースを用いて各国Z世代の特徴やトレンドを把握し、まとめ記事として紹介しています。

他国のZ世代についてもご覧になれます。

対象国:シンガポール、香港、韓国、台湾、中国、マレーシア、タイ、インドネシア、ベトナム、フィリピン

-

執筆者プロフィール

TNCライフスタイル・リサーチャー

台湾在住20年以上。日本の大学では民俗学を専攻し、日本の食文化をテーマに研究。台湾のクラフトビールの豊富さに惹かれ、コンビニとスーパーを日々観察している。

-

編集者プロフィール

チュウ フォンタット

日本在住14年目マレーシア人リサーチャー。ASEAN各国の調査を多く担当しています。

Global Market Surfer

Global Market Surfer CLP

CLP