[China] New trends in the pet market in 2025

- Release date: Aug 20, 2025

- Update date: Aug 20, 2025

- 6720 Views

In recent years, the pet market in China has been growing rapidly. It is expected to become an even larger consumer market in the future.

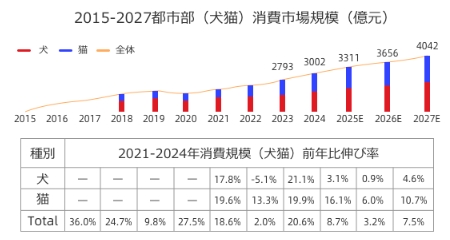

The growth and scale of the dog and cat market show enormous potential.

From 2015 to 2024, the dog and cat consumption market in urban areas of China will grow steadily at an annual rate of 13.3%, maintaining its position as the second largest pet market in the world.

Dog market growth rate: 4.6%

Cat market growth rate: 10.7%

This shows the growth characteristics of “strong cats and stable dogs.”

Data source: “2025 China Pet Industry White Paper” https://xueqiu.com/8788721445/314819825

The new face of pet owners: led by young people. Double increase in education and income

Trends toward younger consumers and higher education levels. Consumption by those born in 2000 and later is becoming a new engine of growth. People are seeking greater enjoyment in life through pet ownership.

The percentage of people born between 1990 and 2000 is 66.8%.

* 15.5%↑ for those born in 2000 or later

The percentage of college graduates is 73.6%.

* Graduate degree or higher: 2.0% increase * Bachelor's degree: 7.1% increase

The percentage of those earning more than 10,000 yuan per month is 45.3%.

* 6.6% increase

Data source: “2025 China Pet Industry White Paper” https://xueqiu.com/8788721445/314819825

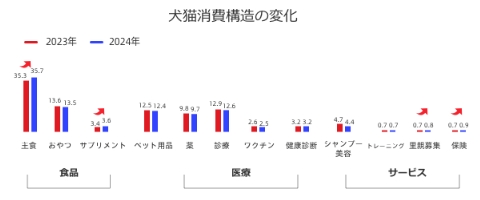

Average annual spending on dogs and cats is on the rise. Strong demand for food remains stable. Services are expected to expand.

Pet owners are becoming increasingly demanding about food quality and nutrition. The proportion of high-end categories of staple foods (baked foods, fresh foods) and nutritional products is increasing. Although the proportion of services is low, pet boarding and insurance services are on the rise. There may be significant room for growth in the future.

Data source: “2025 China Pet Industry White Paper” https://zhuanlan.zhihu.com/p/21720323620

New pet trends driven by emotion and technology

New trends brought about by the emotional economy

●Pet interaction venues are becoming a new gateway to consumption. For example, during the Qingming Festival holiday, consumers flocked to many pet interaction venues in Shanghai, and pet interaction shops became extremely popular spots.

●Pate Fresh has emerged as a new type of pet business (pet green tea, spicy hot pot buffet, etc.).

●The 4th Shanghai Pet Fashion Week expanded in scale, attracting a large number of global brands and pet-loving audiences, establishing itself as an event with significant international influence.

Products and services are becoming smarter through integrated technology

●Pet stores are upgrading their strategies. By connecting to Tencent Cloud's big data model and AI model DeepSeek, they achieve a synergistic effect where 1+1>3. *Source: Global Times

●AI pet doctor “VetMew” has launched services. It accurately identifies pet symptoms in detail, enabling health consultations and diagnoses. It establishes personalized health management plans, sets up an emergency notification line, and optimizes recommended labels. The online information center and customer service make it easier for users to receive feedback on information and advice.

●Innovative products such as smart feeders, health-monitoring necklaces, and environmental interaction robots are accelerating the reconstruction of industry edges, driving pet consumption toward smartification, refinement, and emotionalization. *Source: China Research and Consulting Institute

The Chinese pet industry is undergoing a transition from expansion to quality improvement. Generation Z and high-income groups are leading the way in this shift toward higher-end consumption.

Opportunities and potential coexist in every area. There is ample room for exploration in product innovation, service development, and technology application.

This article is a translation of an article by Intage China using an AI translation tool.

-

Author profile

Intage China

***

-

Editor profile

Chew Fong-Tat

***

Global Market Surfer

Global Market Surfer CLP

CLP