HUMAN AFTER ALL: Closing Asia’s Well-being Gaps

- 公開日:2025/08/25

- 更新日:2025/08/25

- 1918 Views

Growth today is achieved not through technology alone, but by addressing fundamental well-being needs. INTAGE’s study shows that leading brands are those that embed well-being into everyday life: they create repeatable rituals, tailor them to culture and generation, and deliver shared outcomes. These brands shape trends—they don’t just follow them.

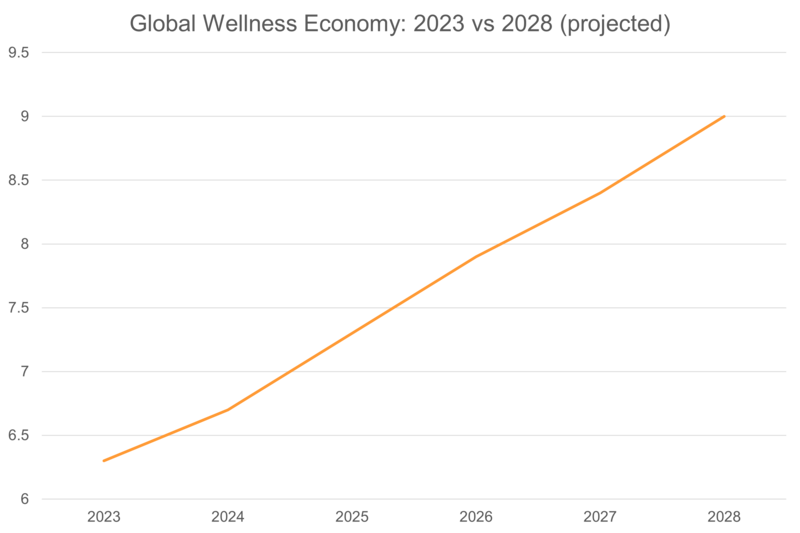

Well-being in Asia is not only a rapidly expanding market, but also a proven driver of productivity. Demand already outpaces supply, and the return on investment is increasingly quantifiable. The global wellness economy is projected to approach US$9 trillion by 2028 (GWI, 2024).

Mental illness at work is associated with an estimated 12 billion lost workdays annually, costing about US$1 trillion in productivity (WHO, 2024). Employer behavioral-health benefits have demonstrated US$190 in medical claims savings for every US$100 invested (JAMA Network Open, 2025), while improving social determinants of mental health can yield significant net benefits in regional models (Nature Mental Health, 2025).

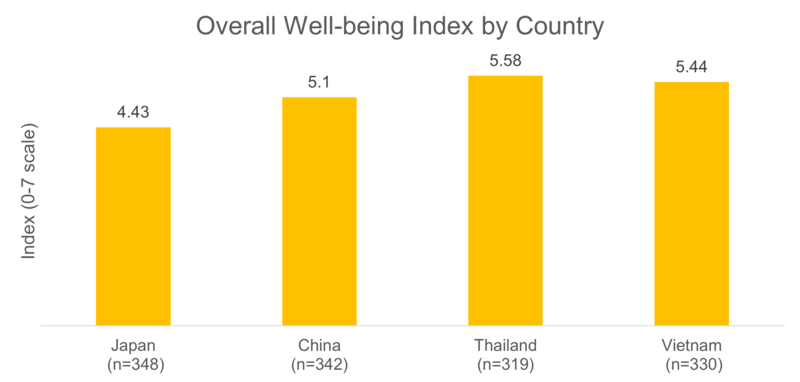

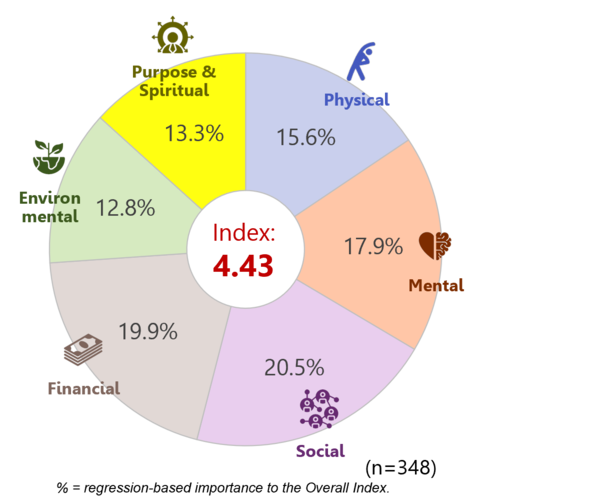

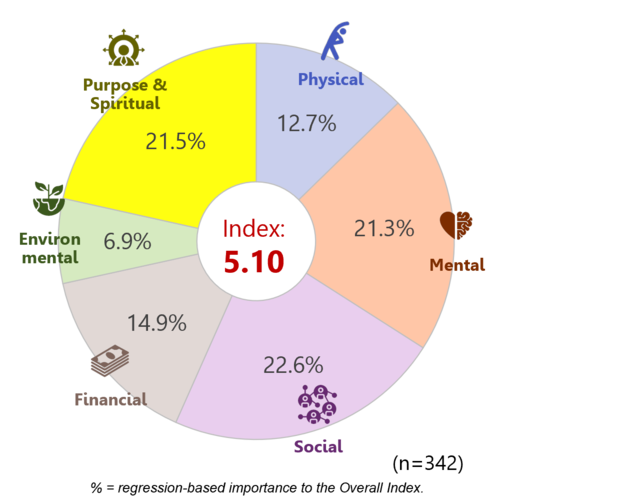

INTAGE’s recent Well-being study across Japan, China, Thailand, and Vietnam indicates that well-being is uneven. The biggest drivers of the total Well-being Index are also the most underserved. Social, Financial, and Mental well-being exert the greatest influence on the overall index, yet show meaningful satisfaction gaps.

INTAGE’s 4-step composite index blends behavior and perception: (1) dimension scoring in 6 dimensions (Physical, Mental, Social, Financial, Environmental, Purpose/ Spiritual), (2) factor analysis to remove multicollinearity, (3) regression to weight drivers, and (4) synthesis into a single Well-being Index. This enables apples-to-apples comparisons across six dimensions.

・The big picture

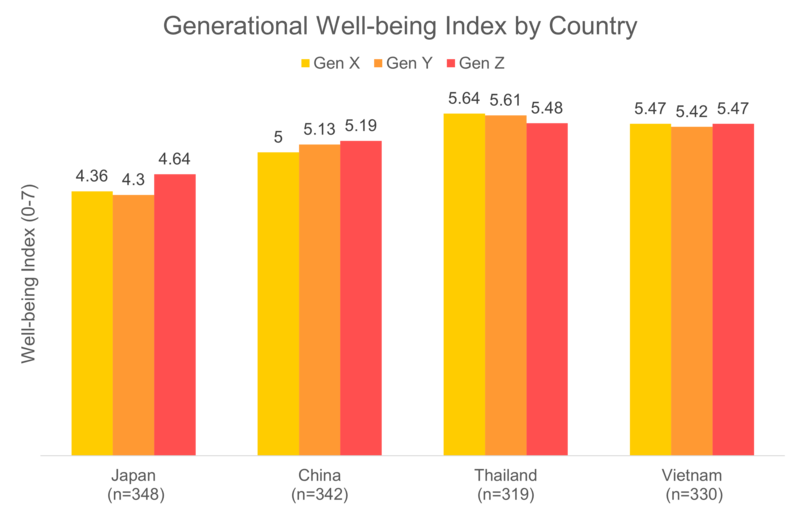

The Well-being Index varies by country, with tension highest in Japan. Thailand and Vietnam present relatively stronger results, yet still reveal weaknesses among younger generations.

・Mind the Gap: Generation-by-Generation Whitespace

Generally, while Gen Z shows aspiration but needs grounding, Gen Y desires connection and balance and Gen X values routine and stability.

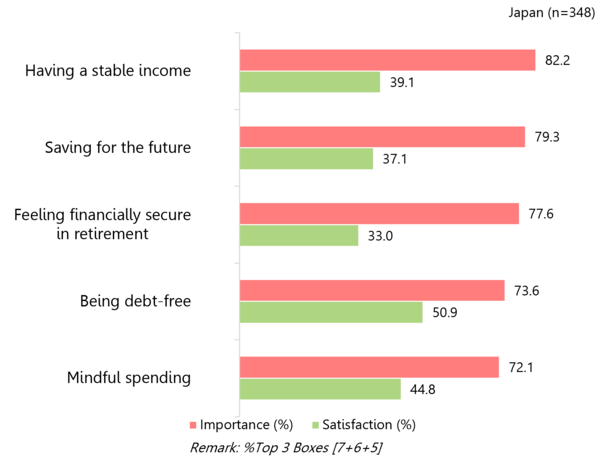

・Japan — “Structured, but strained.”

Japan’s well-being landscape reflects a strong sense of structure and responsibility, yet also reveals a clear need for deeper emotional fulfillment. Gen Z scores highest among Japanese cohorts, but remains modest compared with peers in other countries.

Social, Financial, and Mental well-being are the top three drivers, yet mental well-being is consistently lower—highlighting opportunities for greater emotional connection.

・China — “Rooted in confidence, reaching towards wholeness.”

Chinese consumers show the highest aspiration in the Purpose & Spiritual dimension, especially among Gen Z. This signals a strong opportunity to connect through identity and meaning.

・Thailand — “High energy, hidden overwhelm.”

Thailand leads the overall index, yet Gen Z records the lowest scores—suggesting latent emotional stress.

Generational drivers differ: Financial for Gen X, Social for Gen Y, and Mental dimention for Gen Z. Despite lighter financial pressure, Thai Gen Z appears weighed down by emotional demands.

・Vietnam — “Balanced basics, ready to level up.”

Vietnam shows balanced well-being across generations, signaling stability but also a gap in inner purpose.

Among Gen Z, social ties drive well-being more strongly than inner dimensions. This creates opportunities for brands to inspire meaning and direction.

Dimension Insights

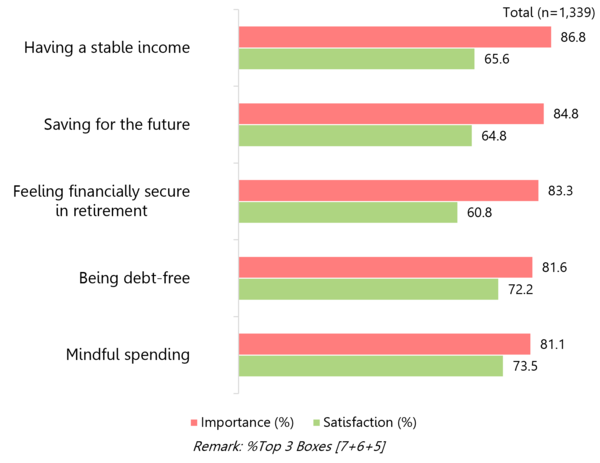

Financial well-being: the largest now–future gap

People value stability and retirement security, yet long-term planning is not yet habitual. China leads in financial discipline, drawing confidence from self-education and investing.

In contrast, Japan faces the most acute financial pressure, with sensitivity to income stability driving a large importance–satisfaction gap.

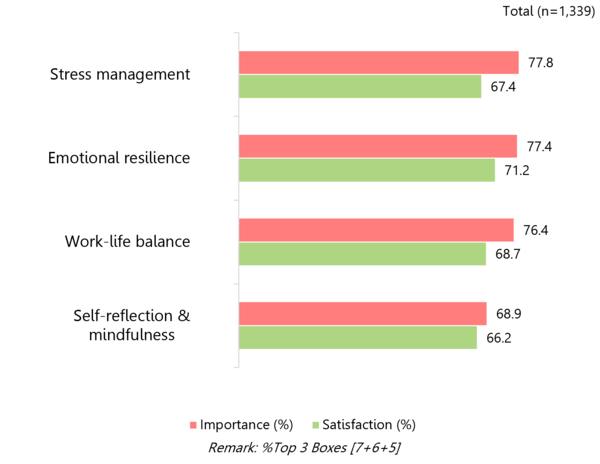

Mental well-being: an under-recognized but powerful driver

While often ranked below financial priorities, mental health has a latent impact across all markets. Stress management shows the largest gap, and activities with proven impact (e.g., mindfulness, yoga) remain underutilized.

Brands can treat mental well-being as a “hidden lever,” embedding stress-reduction, resilience, sleep, and social-support features into offerings.

Social well-being: family bonding matters most

Family consistently ranks highest among social relationships, with gaps generally narrow.

Appearance also contributes, especially in Japan where makeup boosts confidence for younger cohorts. Travel is a key driver in Thailand and China, while social media plays a stronger role in Vietnam.

Key Takeaway

Across Asia, consumers are redefining what it means to live well—extending from social connection to financial confidence, and beyond. Each dimension offers brands the chance to connect with human values and transform intention into habit. Leading brands don’t just market well-being; they operate it—strategically, culturally, and consistently.

1) Integrate across dimensions

Design platforms that link multiple aspects of well-being (e.g., mental × physical × environmental).

Alipay Ant Forest (China): A multi-dimension blueprint touching environmental, physical, social, and purpose—with spillovers into local livelihoods. Users earn “green energy” for low-carbon acts; virtual trees become real trees in arid regions (~600M by Earth Day 2025). The app rewards walking/cycling/transit, tracked via Alipay and partners, reinforcing daily movement. Social mechanics—friend energy sharing, leaderboards, co-watering, visible “real-world tree” milestones—keep engagement sticky. Planting with NGOs/government in desertification zones creates rural jobs and stewardship, anchoring the program in local culture and economics.

2) Create communities, not campaigns

Build always-on communities that enable contribution, learning, and emotional connection. (not the other way around).

VinFast (Vietnam): Treats infrastructure as a community system that maps to multi-well-being levers (environmental, social, mental, physical, financial). VinFast runs active owner forums (charging, maintenance, tips, troubleshooting) that turn users into mentors and reduce EV anxiety. Owner-led content and brand partnerships create continuous sharing and recruitment. Community-impact recognition reframes participation as civic contribution, not mere fandom.

3) Leverage generational triggers

Purchasing power is shifting. Gen Z’s spend ~US$12T by 2030 and Gen Z in APAC already leads on preventive, retail, and digital health pathways (Bain, 2023). Tailor to the shifting purchasing power of Gen Z, converting long-term goals into present-tense micro-wins.

Pokémon Sleep (Japan): Turns a health behavior into a low-friction game loop. Place your phone by the pillow (or pair a watch/GO Plus+); sleep is categorized (Dozing/Snoozing/Slumbering/Balanced) to unlock daily rewards. Mechanics map to cohort triggers: Gen Z rallies around monthly social events (“we do this together”), Gen Y enjoys cozy self-care and collectible unlocks, Gen X values automation and control via seamless device integrations.

When brands stop merely talking about well-being

and begin operating it with clear measures and

cultural care, they move from chasing trends to

setting them.

Asia is not a single market; it is a mosaic of rituals, relationships, and realities. INTAGE translates that mosaic into workable habits for your brand—locally tuned and generation-aware. Our role is to ensure that what you launch earns its place in everyday life and over time, in preference and pricing power.

Know today, power tomorrow. INTAGE knows Asia best.

References

Global Wellness Institute (2024). 2024 Global Wellness Economy Monitor.

Bain & Company (2023). Asia-Pacific consumers—willingness to pay more out of pocket for better outcomes/experience.

NIQ & World Data Lab (2024). ‘Spend Z’ report: Gen Z global spending to ~$12T by 2030.

WHO (2024). Mental health at work: Fact sheet (12B workdays lost; ~US$1T cost).

JAMA Network Open (2025). Return on Investment of Enhanced Behavioral Health Services: $190 savings per $100 invested.

McKinsey Health Institute (2025). Investing in the future—how better mental health benefits everyone.

-

執筆者プロフィール

ダンジャイタウィン・アナタチャイ(オーム)

オームは、タイで高い評価を受けるマーケティング分析と持続可能なマーケティングのコンサルタントの一人であり、25年以上の経験を有しています。彼女の専門知識は、消費者心理、データ駆動型戦略、人間中心のイノベーションを結びつけ、組織が変化する消費者価値観と一致させることを支援します。

文化の動向の変化と目的志向のマーケティングに対する深い洞察を活かし、オームは企業がいまや将来の世代にわたって真に重要なものに根ざしたレジリエンス、関連性、関係性の深みを育むため、短期的な成功を超えて持続可能な成長を促進します。

Global Market Surfer

Global Market Surfer CLP

CLP