The Rise of Home Cooking in Thailand, a Nation of Dining Out──What Kitchen Appliances Are Next in the Thai Market?

- Release date: Oct 17, 2025

- Update date: Oct 17, 2025

- 1951 Views

Thailand's dining-out culture is highly developed, with many people regularly eating out. The streets are lined with numerous food stalls and eateries, offering easy access to a variety of affordable dishes. In Bangkok especially, dining out has become an integral part of daily life, serving as a strong ally for locals.

Meanwhile, rising health consciousness has led to an increase in households cooking at home. Particularly noticeable are efforts to increase vegetable intake and reduce fat consumption to achieve a balanced diet.

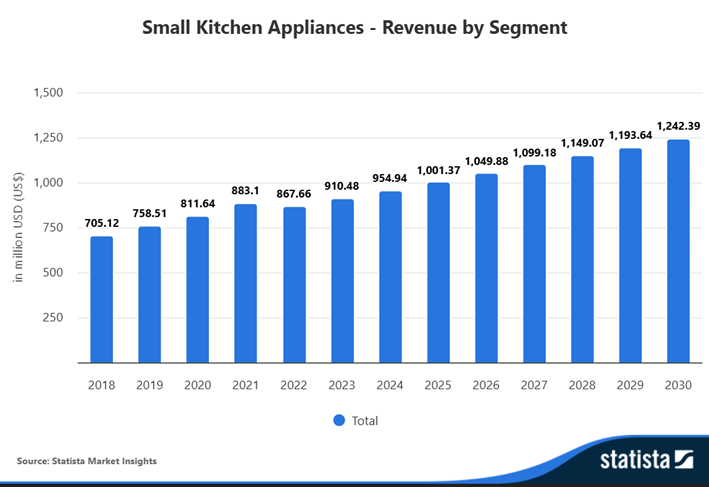

According to Statista data (2025), Thailand's small kitchen appliance market is valued at 1 billion USD (approximately 150 billion yen), and is projected to continue showing high growth rates.

Source: Statista Market Insights (cited from Statista)

Meanwhile, we analyzed the penetration of kitchen appliances in Thai households by compiling and analyzing Intage's overseas consumer data “Global Viewer”*.

*Data compilation basis: Targeting Bangkok households in socioeconomic class (SEC) C and above

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

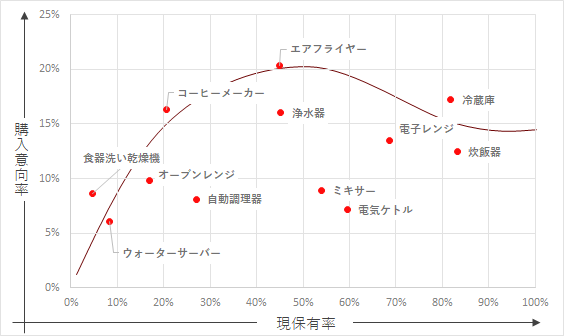

The following diagram shows the relationship between the cooking appliances currently owned and those being considered for future purchase.

Moving further to the right indicates greater penetration into households, while moving further upward indicates higher future demand.

Generally, as penetration increases for cooking appliances—which are part of durable goods—demand tends to stabilize, entering a steady-state phase like refrigerators, rice cookers, and microwave ovens.

Conversely, categories currently undergoing household penetration show high demand. This column will refer to the curve illustrating this relationship as the “penetration curve.”

Looking again at the chart, we can see that the air fryer sits at the peak of the penetration curve. As mentioned earlier, the desire to reduce fat intake for health reasons—one motivation for cooking at home—likely drives the high demand for air fryers.

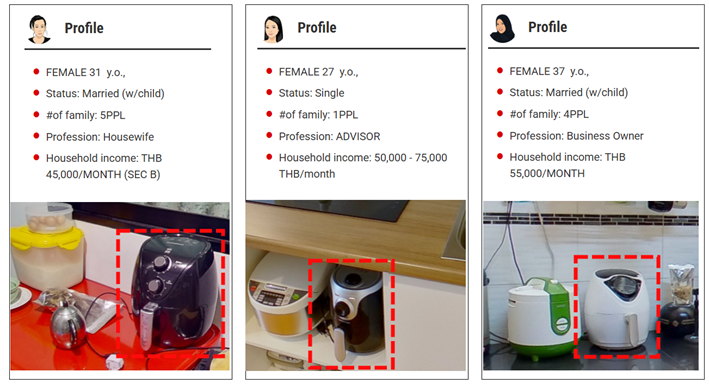

Observing actual households in Bangkok, it's evident that many kitchens feature an air fryer.

※Photos excerpted from Intage's overseas consumer visual database “Consumer Life Panorama” (commonly known as CLP)

Many air fryers were smaller than I had imagined. While a lack of sufficient kitchen space is a physical reason, it seems they are also used less for cooking large quantities of elaborate dishes and more for preparing relatively simple items in smaller portions.

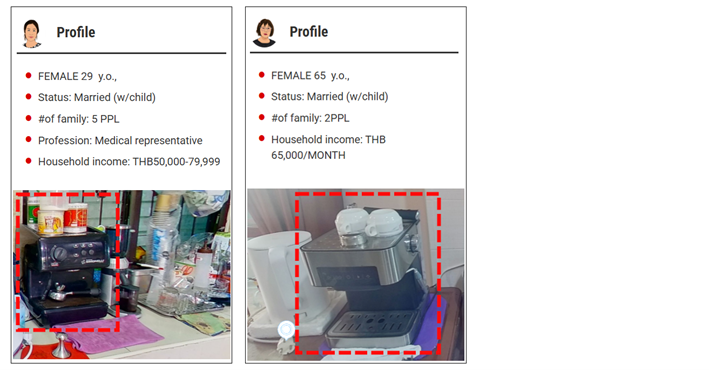

Also noteworthy is the presence of “coffee makers” just before the peak of the penetration curve, alongside air fryers.

While Thailand is famous for tea being its traditional, widely enjoyed beverage, a café culture centered around Bangkok is spreading, and coffee is gaining traction among the younger generation. Against this backdrop, it seems “coffee makers” are starting to find their way into households.

※Photos excerpted from Intage's overseas consumer visual database “Consumer Life Panorama” (commonly known as CLP)

Analysis results indicate a growing trend toward upgrading kitchen appliances, particularly among relatively affluent households in Bangkok. This shift suggests a departure from the traditional street food culture where home cooking was uncommon, toward a new trend of enjoying cooking at home and prioritizing healthier meals.

-

Author profile

Kenichiro Takahashi

INTAGE Inc. Global Business Division Overseas Business Promotion Department Business Planning Group

After extensive involvement in global research within the mobility industry, has been engaged in overseas business promotion, establishing global research services, and developing new solutions since 2023. -

Editor profile

Chew Fong-Tat

Malaysian researcher who has lived in Japan for 14 years and has handled many surveys on ASEAN countries.

Global Market Surfer

Global Market Surfer CLP

CLP