What's the Current State of the Music Streaming Market? The Spread of Music Streaming in Asian Countries

- Release date: Oct 27, 2025

- Update date: Oct 27, 2025

- 2469 Views

Music, movies, dramas, and other content are rapidly shifting to on-demand services. For example, looking at Japanese music services, various platforms like AWA, Line Music, Apple Music, and Spotify emerged between 2015 and 2016. Traditional formats like CDs are gradually being replaced by on-demand models. This trend isn't limited to Japan—how does it compare internationally? This article examines the penetration of music streaming, specifically focusing on music streaming services, in other countries.

Definition of Music Streaming: Digital distribution of audio content via the internet (specifically referring to subscription-based models hereafter).

目次

1. Market Size Trends for Music Streaming

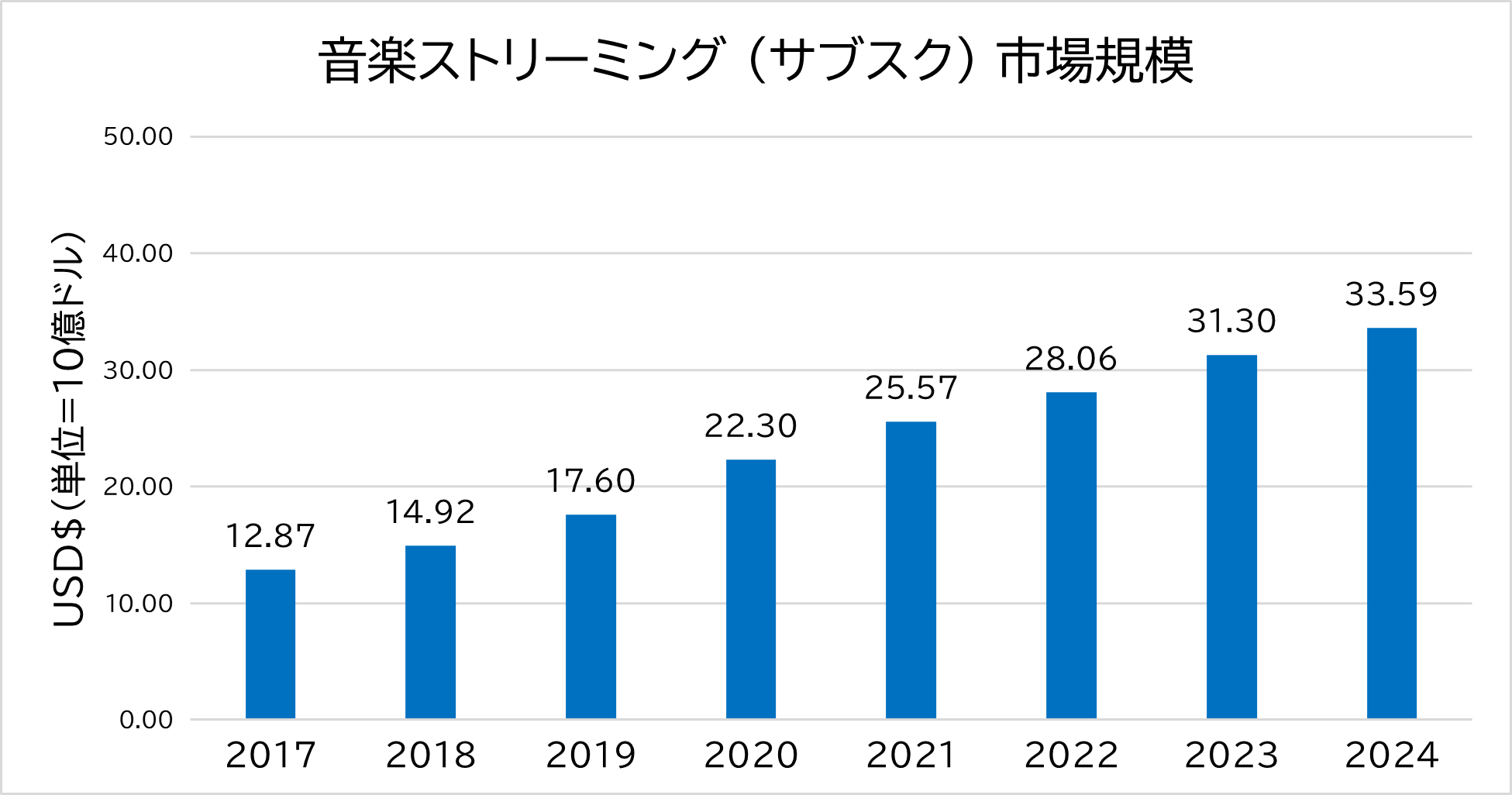

First, let's examine the global music streaming market trends. The Statista data below represents the estimated global market size for music streaming. The data shows that from 2017 to 2024, the market size expanded approximately threefold worldwide.

Figure 1: Source: Statista Market Insights (cited from Statista)

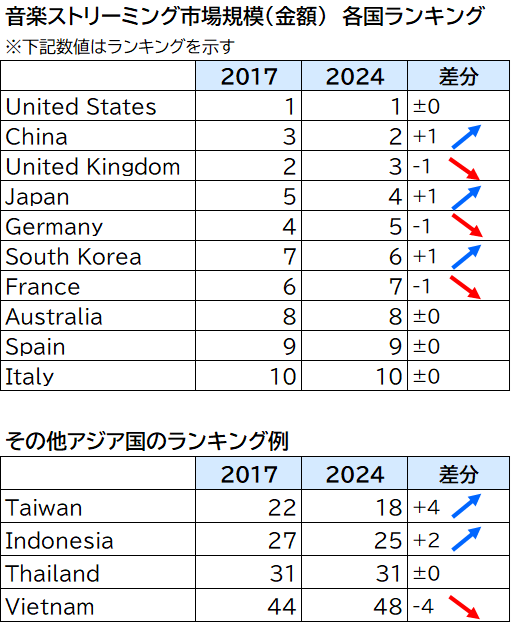

Next, we examine market trends across various countries worldwide. Growth is evident not only in the largest market, the United States, but also in other nations such as China, the United Kingdom, Japan, and Germany. Furthermore, among the top 10 countries, 7 are Western nations (including Australia), while 3 are Asian countries (China, Japan, and South Korea). Looking at the global market rankings, these three Asian countries have also improved their positions when comparing the 2017 and 2024 rankings, indicating they are driving the Music Streaming market.

So, what about the situation in other Asian countries? The rankings for Asian countries following China, Japan, and South Korea, which will be covered in the next section (2. Music Penetration in Other Asian Countries), are also presented.

Figure 2: Source: Statista Market Insights (cited from Statista)

2. The Spread of Music in Other Asian Countries

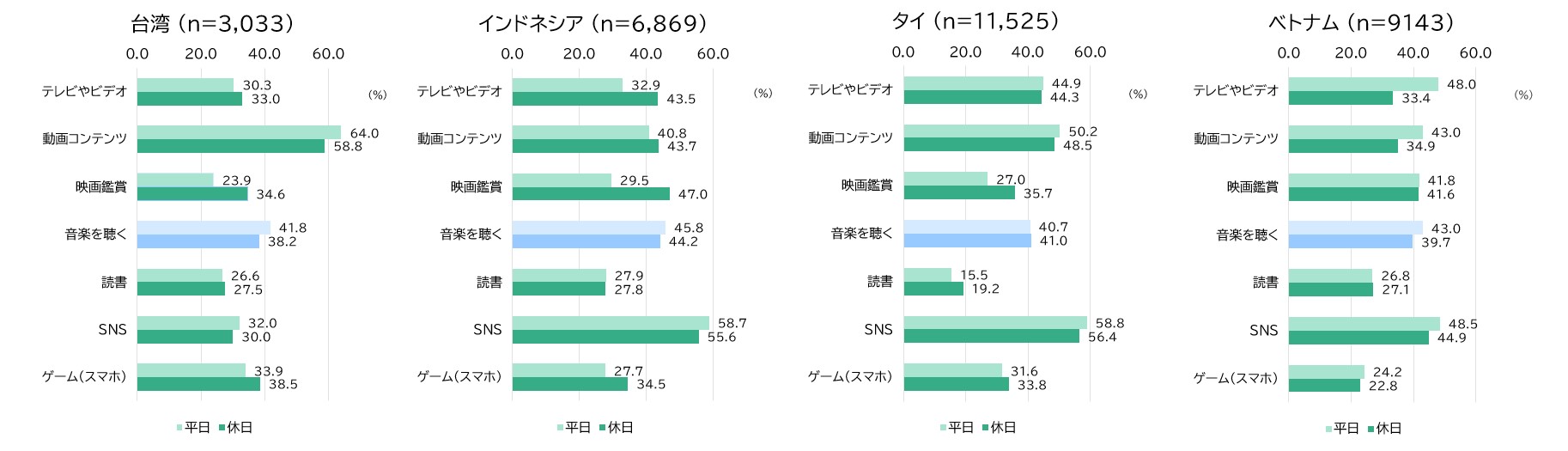

Before examining the penetration of music streaming, we first want to look at how deeply listening to music is integrated into daily life across Asian countries. Intage's overseas resident data “Global Viewer (2024 survey)”* includes data on how respondents spend their free time. Here, we focus on Taiwan, Indonesia, Thailand, and Vietnam. The data shows the primary ways respondents spend their free time on weekdays and holidays.

On weekdays, “listening to music” ranks within the top three main activities in Taiwan, Indonesia, and Vietnam (fourth in Thailand). Furthermore, “listening to music” also ranks within the top five activities on weekends in all countries. This indicates that “listening to music” is deeply integrated into daily life in these countries.

Figure 3: How People Spend Their Free Time (MA): Excerpt from Weekdays / Weekends

Source: INTAGE Global Viewer (2024)

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

3. The Penetration of Music Streaming

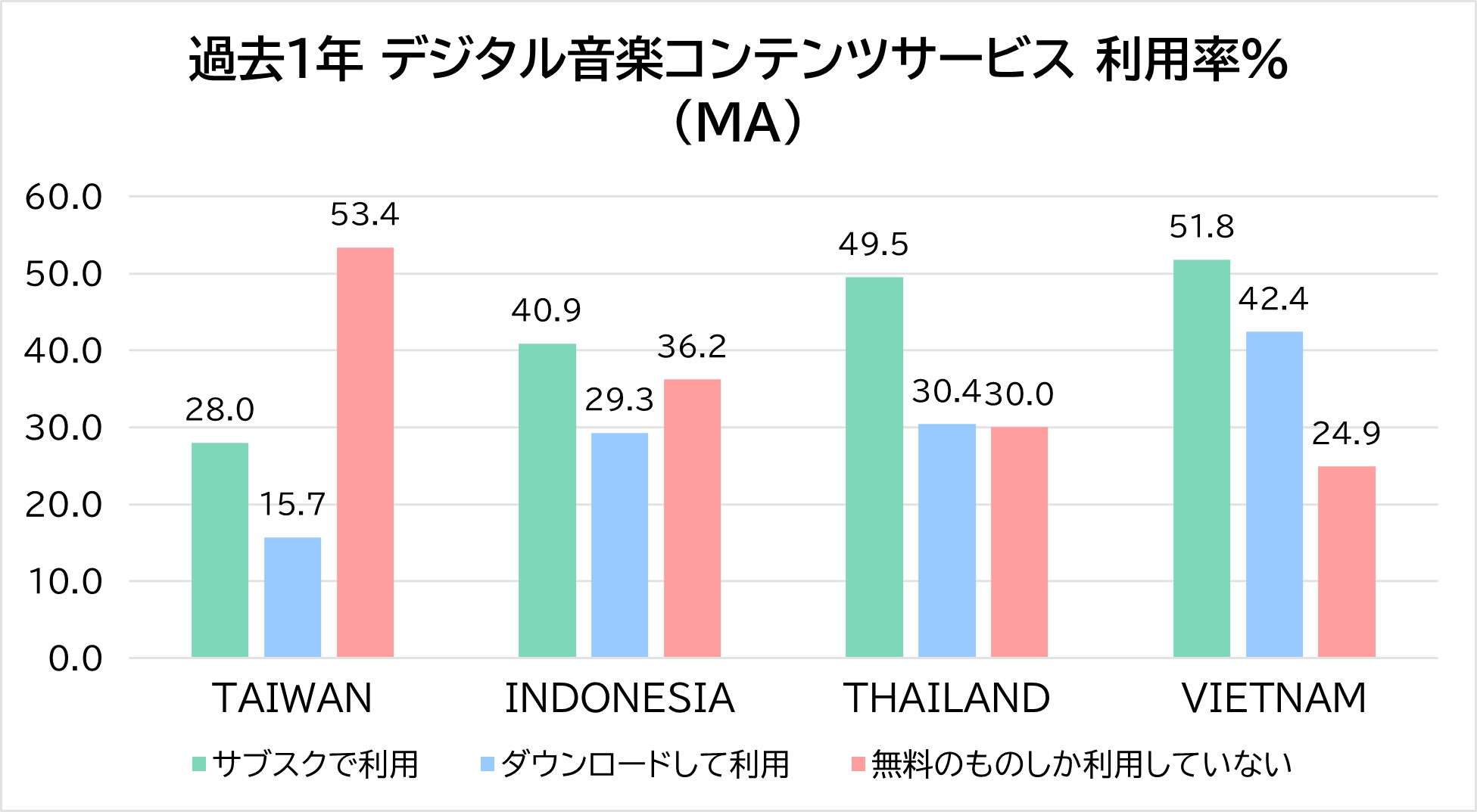

Beyond subscription services, there are other ways to enjoy music. We also examined which listening methods have gained traction in the four target countries.

Digital music usage rates over the past year were as follows.

Figure 4: Digital Music Content Services Used in the Past Year (MA)

Source: INTAGE Global Viewer (2024)

The penetration of subscription-based music streaming varies across countries. In Indonesia, while “listening to music” as a leisure activity was as common as in Thailand and Vietnam, the subscription service usage rate remained at only 40%, indicating significant potential for further growth.

In Taiwan, however, usage of free digital music content is high. To expand the subscription market going forward, it will likely be necessary to promote benefits unique to subscription services that free services lack.

Finally, regarding Vietnam, the usage rate of download-based digital music content is also high.

In the initial market ranking (Figure 2), Vietnam's 2024 ranking had declined compared to 2017. From the perspective of expanding subscription-based music streaming in Vietnam going forward, it may be necessary to consider strategies that specifically address the challenge posed by download-based music content.

4. Summary

As described above, music streaming holds significant potential for further growth across the four Asian countries examined here, despite differing market positions. The adoption of music streaming in these emerging markets appears poised to be a major key to the further expansion of the music streaming market.

-

Author profile

Yujiro Muroi

Since 2020, he has been responsible for supporting and assisting with marketing activities for manufacturers of daily food, beverages, and sundries in his current position.

His hobby is discovering favorite music. Whenever he goes out, watch TV at home, or encounter a song he likes in daily life, he immediately searches for it using music apps. His go-to app is Shazam. -

Editor profile

Kenichiro Takahashi

INTAGE Inc. Global Business Division Overseas Business Promotion Department Business Planning Group

After extensive involvement in global research within the mobility industry, has been engaged in overseas business promotion, establishing global research services, and developing new solutions since 2023.

Global Market Surfer

Global Market Surfer CLP

CLP