Skin Concerns and Beauty Habits Among Men in ASEAN Countries: What Are Their Skin Issues and How Do They Address Them?

- Release date: Dec 16, 2025

- Update date: Dec 16, 2025

- 1827 Views

Skincare and makeup have traditionally been considered women's domains, but we are now evolving into an era where men are also actively caring for their skin and appearance. The global men's personal care market is expanding, projected to grow from approximately $90 billion (about ¥14 trillion) in 2024 to around $115 billion (about ¥17.9 trillion) by 2028. In recent years, men's awareness of beauty has increased, leading to the use of diverse products beyond just shampoo and shaving supplies, including facial cleansers, serums, and masks. This trend is also evident across ASEAN countries, with the male beauty market in ASEAN reaching $1.57 billion (approximately ¥240 billion) in 2024(※).

This article compares the grooming behaviors of men in Malaysia, Vietnam, and Thailand—countries within the ASEAN market where consumer characteristics differ—based on Intage's overseas consumer data “*Global Viewer” (2024).

※ Source:

South East Asia Mens Grooming Products Market Size, Share Report By 2033

目次

1. What do men in ASEAN countries prioritize in terms of appearance?

What do men in ASEAN countries think about appearance? To explore this, we examined the importance placed on looks using Intage's Global Viewer data (conducted in 2024) on overseas residents.

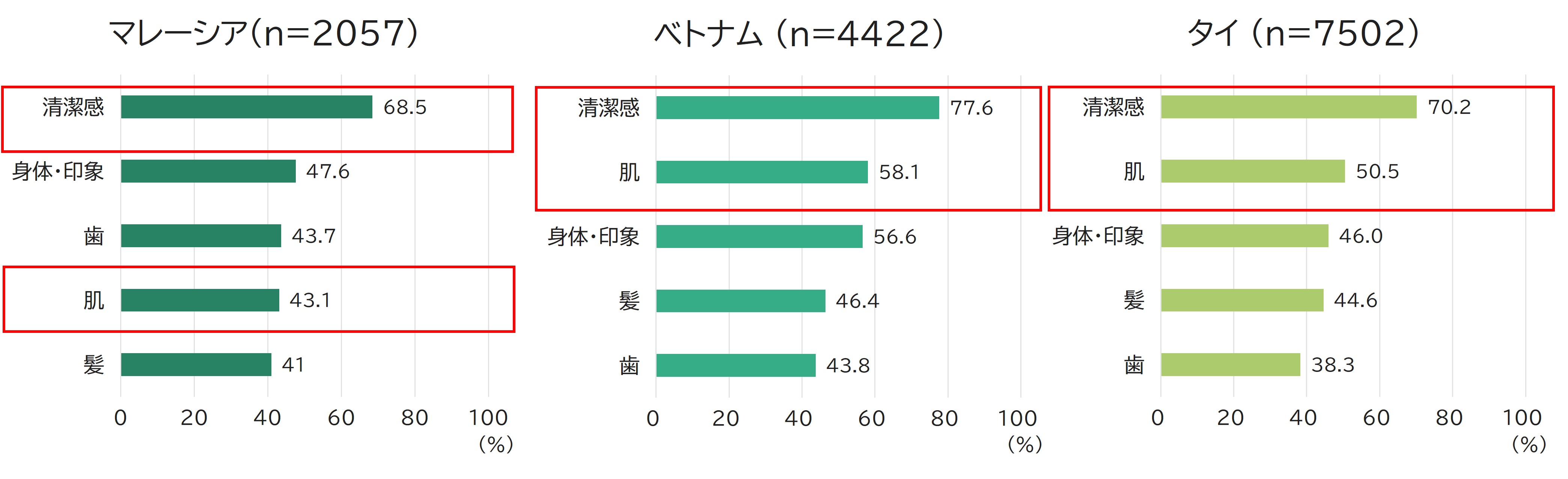

In all three countries, “cleanliness” ranked first, significantly outpacing other items. Vietnam (77.6%) showed a particularly high figure compared to Thailand (70.2%) and Malaysia (68.5%), indicating a very strong emphasis on cleanliness.

Additionally, “skin” ranked second in Vietnam and Thailand, and fourth in Malaysia, indicating that “skin” is also perceived as an important element of appearance.

Figure 1: Appearance Priority (Multiple Choices) - Top 5 Countries

(Base: Men Aged 18-64 in Each Country)

Source: INTAGE Global Viewer (2024)

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

2. Skin Concerns and Makeup Items Among Men in ASEAN Countries

So, what skin concerns do men in different countries have regarding their appearance, a crucial element of their look? As a solution to these skin issues, while still a minority, some men have recently started using makeup items. Let's also look at what kinds of products these men are using to cover their skin concerns.

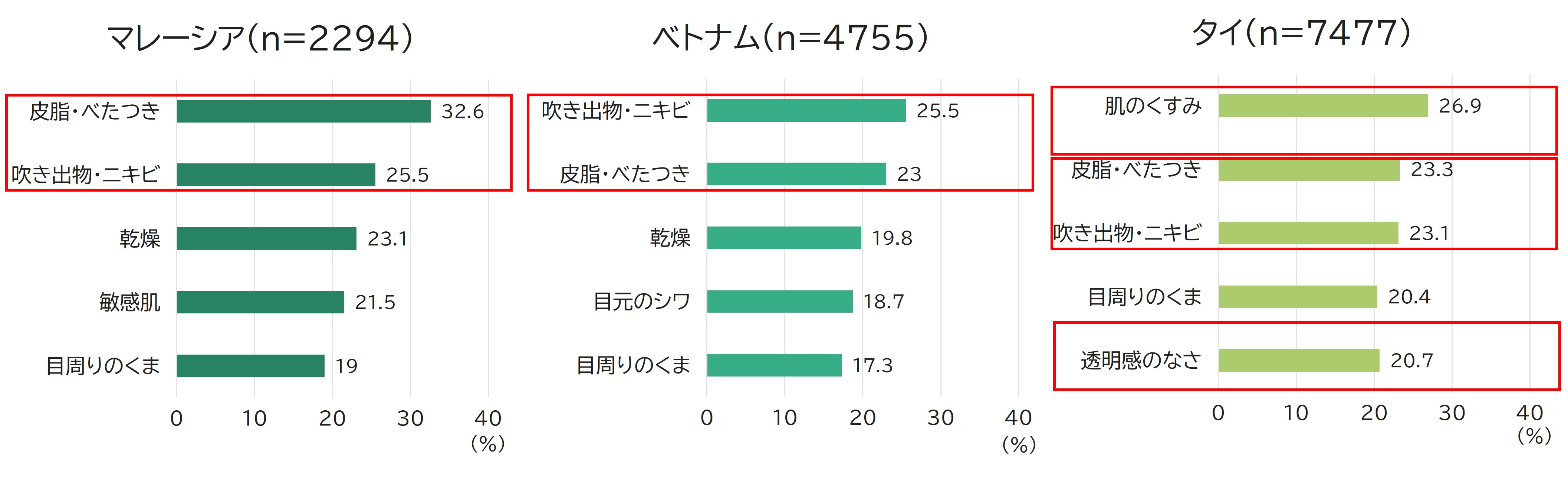

First, “oiliness/stickiness” and “pimples/acne” rank in the top three concerns across all countries. Combined with hot, humid climates, oily skin and acne are common major concerns.

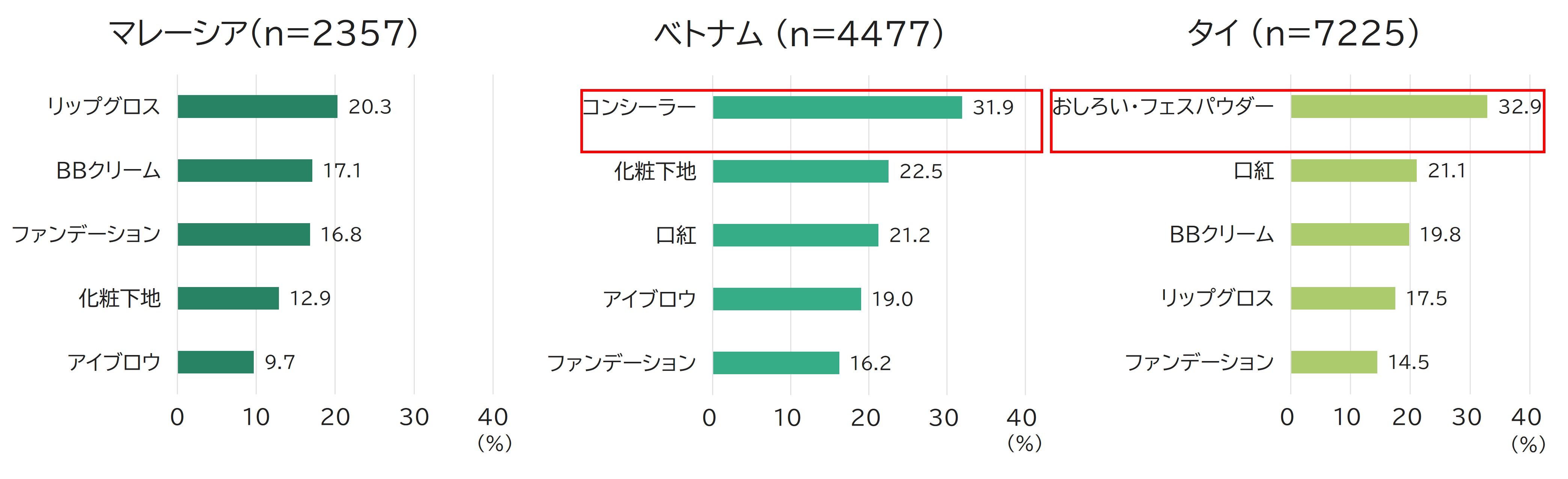

On the other hand, the makeup items currently in use showed distinct characteristics by country. For example, in Vietnam, “concealer” ranks as the top currently used item. This is likely driven by the desire to conceal “pimples and acne,” which is the number one skin concern in Vietnam.

Thailand is particularly interesting. In Thailand, the most common concern is “dull skin” (26.9%), and “lack of translucency” (20.7%) also ranks fifth. Unlike the other two countries, this indicates a very high level of interest in skin tone and brightness. Perhaps influenced by this, examining current product usage reveals a clear demand for base makeup items like “face powder” and “BB cream” to create a flawless appearance.

Figure 2: Top 5 Skin Concerns for the Face (Multiple Choices) by Country

(Base: Men Aged 18-64 in Each Country)

Source: INTAGE Global Viewer (2024)

Figure 3: Top 5 Makeup Items Currently Used by Country (Base: Men Aged 18-64 in Each Country)

Source: INTAGE Global Viewer (2024)

3. Current Skincare Products Used by Men in ASEAN Countries

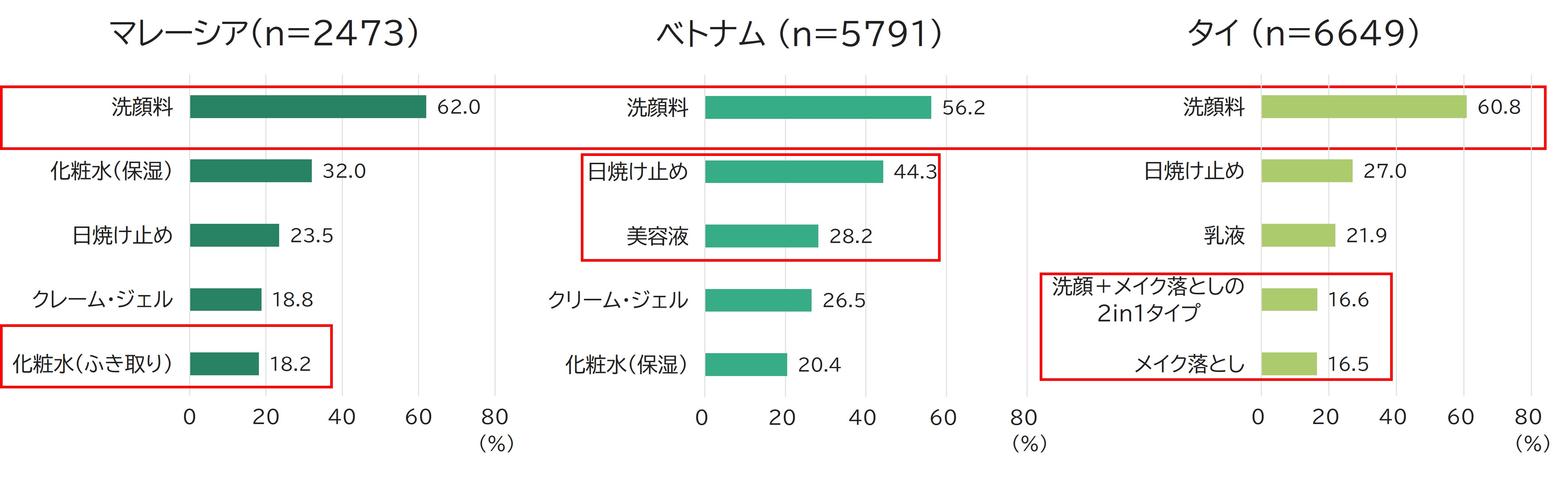

Country-specific skin concerns have been highlighted. So, what skincare products do they actually use daily to address these specific issues?

First, “cleansing products” are a staple in men's skincare routines, ranking overwhelmingly top in all three countries with usage rates around 60%. This indicates that ‘cleansing’ to keep skin clean is widely established as the first step in men's skincare, regardless of country.

Malaysian men feature “toner (moisturizer)” in second place, highlighting their faithful execution of the basic skincare step of “moisturizing” after cleansing.

Meanwhile, Vietnamese men show significantly higher sunscreen usage than the other two countries, with “serum” also ranking third, revealing their strong focus on UV protection and specialized care.

In Thailand, makeup remover-related items rank highly. This suggests many men regularly use base makeup like face powder or BB cream and recognize the necessity of “removing” it.

Figure 4: Top 5 Skincare Items Currently Used by Country (Base: Men Aged 18-64 in Each Country)

Source: INTAGE Global Viewer (2024)

4. Summary

This time, we compared the grooming behaviors of men in three countries—Malaysia, Vietnam, and Thailand—each with distinct consumer characteristics. The data revealed both commonalities and differences among the three nations.

A shared commonality is skin concerns like oily skin and acne, stemming from their hot and humid climates. Consequently, basic needs prioritize addressing sebum and acne issues while maintaining a “clean look.” For instance, cleanser usage exceeds 50% across all age groups.

However, distinct national characteristics also emerged. In Thailand, for instance, beyond the basic needs of oil and acne control, the demand for tone-up and skin-enhancing effects is high even in the male cosmetics market. This is reflected in the use of base makeup items like “face powder” and related “makeup remover” products to remove them.

This analysis reveals both common skin concerns stemming from the hot and humid environment and distinct trends across different countries. Identifying the balance between these “commonalities” and “differences” is crucial for capturing the ASEAN men's cosmetics market.

※ Source:

South East Asia Mens Grooming Products Market Size, Share Report By 2033

-

Author profile

Zining Ji

Born in China. Joined the company in 2024, responsible for marketing research in the cosmetics team.

Enjoys fashion and skincare, with a strong sense of curiosity.

Aims to share the appeal of Japanese cosmetics with the world. -

Editor profile

Risa Takahama

After working in marketing research support for Japanese FMCG manufacturers (cosmetics, baby products, food and beverages, etc.) in Asia, Europe, and the U.S., from 2019, in his current position, he develops solutions for overseas marketing research for Japanese companies and conducts seminars and other outward communications.

Global Market Surfer

Global Market Surfer CLP

CLP