【China】Learning from Soy Milk Purchasing Behavior: The Future of China's Plant-Based Milk Market

- Release date: Dec 24, 2025

- Update date: Dec 24, 2025

- 1487 Views

目次

1. Expansion of the Global Plant-Based Milk Market

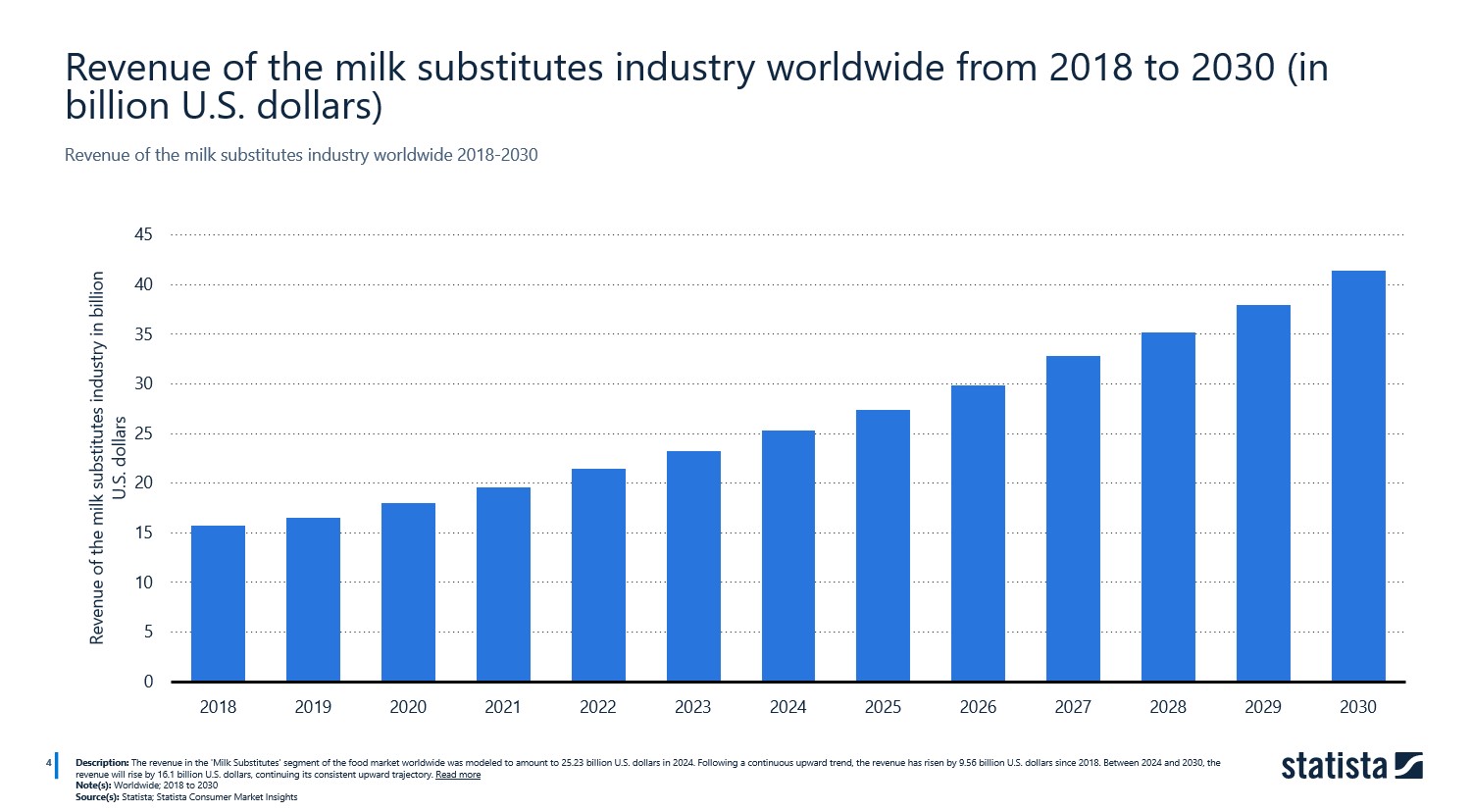

The global plant-based milk market has been expanding rapidly in recent years. Market size is projected to reach USD 25.33 billion (approximately 39 trillion yen) in 2024 and increase by 1.6 times by 2030.

Figure 1: Global Dairy Alternative Industry Revenue (2018 to 2030, in billions of US dollars)

Source:

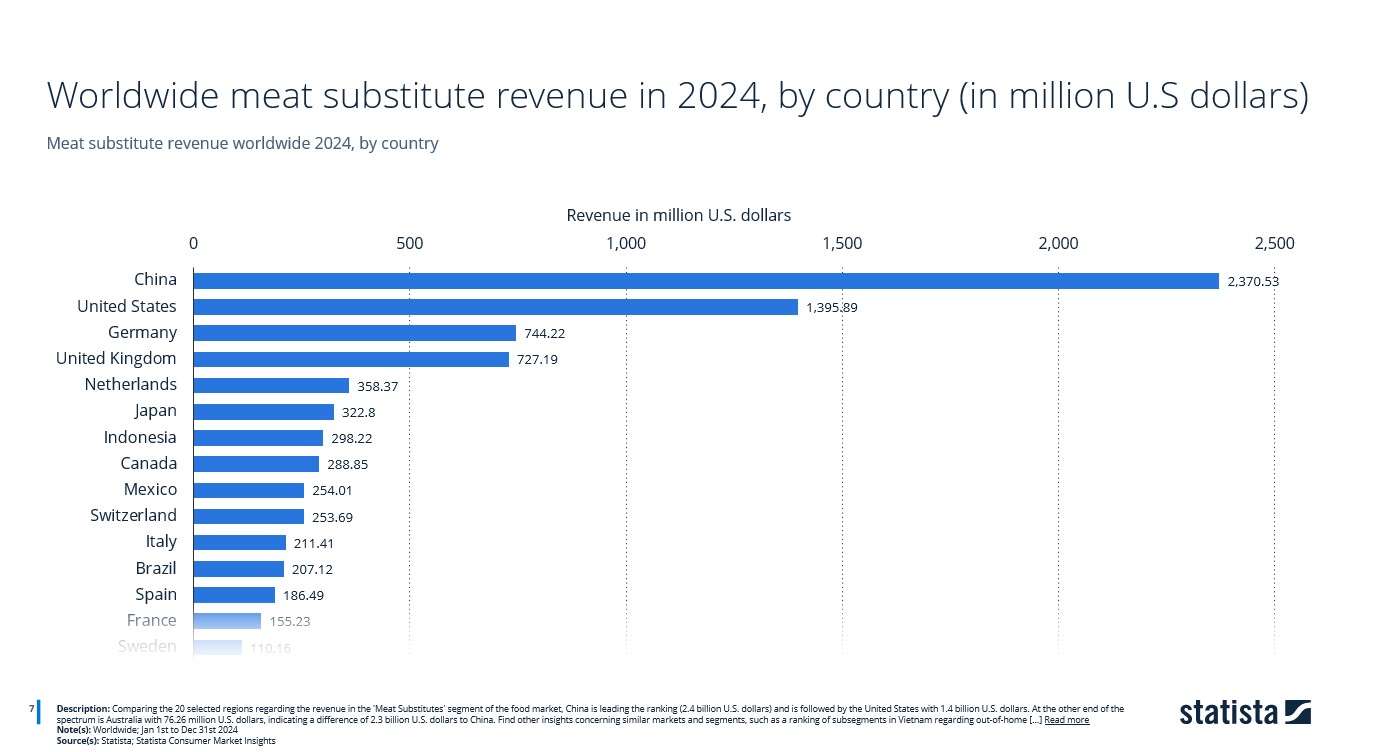

Among these, the Chinese market stands out as particularly significant, with China leading the way in 2024 with country-specific market revenue of USD 9.9 billion (approximately ¥1.5 trillion). Within this global growth, the Chinese market represents a noteworthy target.

Figure 2: Global Meat Substitute Sales in 2024 (by Country, in millions of US dollars)

Source:

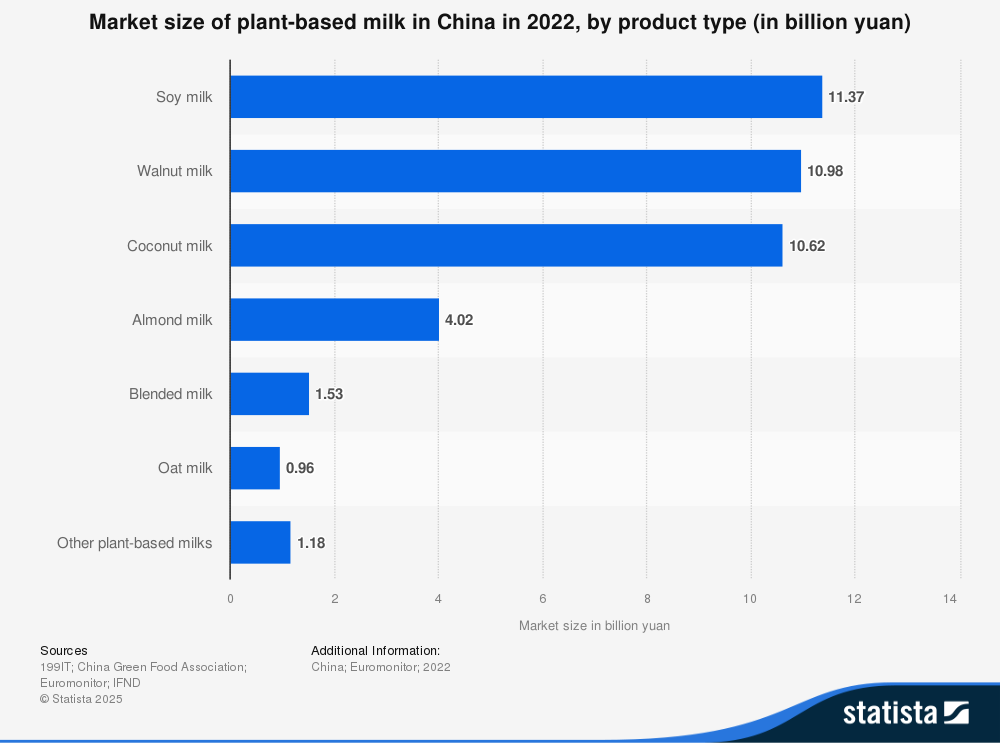

Soy milk, with its long history of consumption and overwhelming market share, remains the core product in China's market. Meanwhile, new plant-based milks have been gaining a stronger presence in the market recently. This article focuses on Chinese consumers' “key considerations when purchasing soy milk” and “information sources during purchase,” examining what insights can be drawn for other plant-based milk products.

2. China's Plant-Based Milk Market

By 2025, 81% of Chinese consumers had tried plant-based alternative foods1, with plant-based milk (soy milk, rice milk, almond milk, oat milk, etc.) being the most popular at 81%2. Soy milk, in particular, enjoys widespread acceptance due to its long tradition and high health value3. Meanwhile, newer categories like oat milk and almond milk are gradually gaining recognition.

1 China: share of plant-based alternative food consumers 2025| Statista

2 China: most popular plant-based alternative food products 2025| Statista

3 Same 1

Figure 3: Market Size of Alternative Milk Products in China (2022) – By Product Type

(Unit: 10 billion yuan)

Source: Market size of plant-based milk in China in 2022, by product type (in billion yuan)

(Source: Statista)

3. Chinese Consumers' Key Considerations and Information Sources When Purchasing Soy Milk

What do consumers prioritize when purchasing soy milk in China? The answer comes from Intage's overseas consumer data, “*Global Viewer (2024 survey).” The top priorities are “Nutritional Content” (47.4%) and “Taste/Flavor” (45.7%). This indicates soy milk is a category where both health benefits and deliciousness are demanded. Next in importance are “natural ingredients” (34.4%) and “price” (34.1%). Clean label preferences and cost consciousness are in balance, making reassurance and affordability key decision factors for this everyday beverage. Furthermore, “national safety certification” (33.5%) and “brand image” (26.5%) also exert significant influence, with assurance of reliability driving purchases.

Figure 4: Key Considerations When Purchasing Soy Milk - China Total (Ages 18-64, Both Genders)

Source: INTAGE Global Viewer (2024)

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

Regarding purchase information sources, “product packaging at the store” (47.9%) ranked highest, with “in-store advertisements/POP displays” (27.0%) also placing high. Soy milk is an everyday beverage, and when consumers glance at the label in front of the shelf, the decisive factor is whether nutritional claims and flavor are instantly clear.

Vitasoy, one of the leading soy milk brands in Chinese market, features packaging highlighting nutritional claims

such as “low sugar,” “zero cholesterol,” and “high-quality plant-based protein.

”The design clearly indicates the peach flavor and emphasizes the use of “real fruit juice.”

(Image sourced from the brand's social media account for the Hong Kong market)

Additionally, “word-of-mouth from family, friends, and acquaintances” ranked high at 39.8%, followed by “online shopping site reviews” (27.6%) and “social media, videos, or live streams by ordinary people” (18.4%). Meanwhile, “social media, videos, or live streams by celebrities or influencers” accounted for only 14.2%, highlighting the influence of relatable, everyday people.

Furthermore, the power of mass media remains strong, with “TV (programs/commercials)” ranking third at 35.4%. “Magazines (articles/advertisements)” (15.5%) and “Newspapers (articles/advertisements)” (13.8%) also hold significant influence. Mass media like television remains effective for broad awareness building and likely functions well in driving traffic to physical stores and digital initiatives.

Figure 5: Information Sources When Purchasing Soy Milk - China Total (Men and Women Aged 18-64)

Source: INTAGE Global Viewer (2024)

4. Lessons from Soy Milk: How Other Plant-Based Milks Can Win

Insights into the purchasing behavior of soy milk, which holds an overwhelming presence in the Chinese market, can provide clues for the growth of other plant-based milks like oat milk and almond milk.

①Balancing Health Benefits and Taste

The most important factors when purchasing soy milk are “nutritional content” (47.4%) and “taste/flavor” (45.7%). This is a key point common to all plant-based milks. For oat milk, it's crucial to clearly communicate nutritional benefits like dietary fiber and beta-glucan; for almond milk, it's vitamin E and low calories. Simultaneously, emphasizing drinkability and versatility is important.

②Gain Trust Through Clean Labels and Safety Certifications

Since “natural ingredients” (34.4%) and “national safety certifications” (33.5%) are key factors in soy milk purchases, other plant-based milks must also demonstrate transparency regarding ingredient origins and production methods. Imported brands, in particular, can enhance credibility by obtaining certifications compliant with Chinese safety standards and clearly displaying them on packaging and official websites.

③Price Strategy Focused on Everyday Use

“Price” (34.1%) ranks high for soy milk, indicating strong cost awareness. Setting price points that allow other plant-based milks to be purchased routinely is crucial. For example, establishing a two-tier structure—a low-price line for standard sizes and a premium line with enhanced functionality—can cater to a broad range of consumers.

④Three Pillars of Information Outreach

The top source of purchase information is “product packaging at the store” (47.9%), followed by “word-of-mouth from family and friends” (39.8%) and “online reviews on e-commerce sites” (27.6%). Furthermore, “television” (35.4%) also holds significant influence.

This suggests that other plant-based milk brands could effectively increase consumer reviews by focusing on appealing packaging on store shelves. Combining this with television and digital advertising could strengthen the path from awareness to purchase.

5. Summary

The global plant-based milk market is experiencing rapid growth, with China being the largest market where soy milk dominates with an overwhelming share. Understanding the structure of soy milk purchasing behavior could provide insights for other plant-based milks to grow within the Chinese market.

For those interested in learning more about daily life in China, please also check out this article.

2025 Edition|What is Real Life in China? Daily Habits and Current Trends Marketers Should Know

・Urban Housing Conditions: Surprisingly Not That Spacious? Floor Plans and Features

・Ways to Maximize Space Utilization

・Refrigerators in the Living Room? And Entranceways: Different Approaches Compared to Japan

・Chinese Households Focusing on Indoor Air Quality

etc.

-

Author profile

Jiayi Xu

Originally from China. Since 2024, has been responsible for supporting and assisting marketing activities for FMCG manufacturers at INTAGE.

-

Editor profile

Risa Takahama

After working in marketing research support for Japanese FMCG manufacturers (cosmetics, baby products, food and beverages, etc.) in Asia, Europe, and the U.S., from 2019, in his current position, he develops solutions for overseas marketing research for Japanese companies and conducts seminars and other outward communications.

Global Market Surfer

Global Market Surfer CLP

CLP