[China: World Residence Tour] Preference for cosmetic brands influenced by "national tide"

- Release date: Dec 09, 2021

- Update date: Sep 09, 2025

- 5794 Views

In the previous article ([China] Exploring High-Income Household Appliance Brands Revealed by Room Types), we discussed how Chinese consumers' preferences for appliance brands are influenced by the “Guochao” trend. In fact, this influence is also evident in cosmetics brands. This time, we will focus on Chinese women's preferences for cosmetics brands, primarily based on consumers registered in Consumer Life Panorama.

Preferred cosmetic brands vary by city

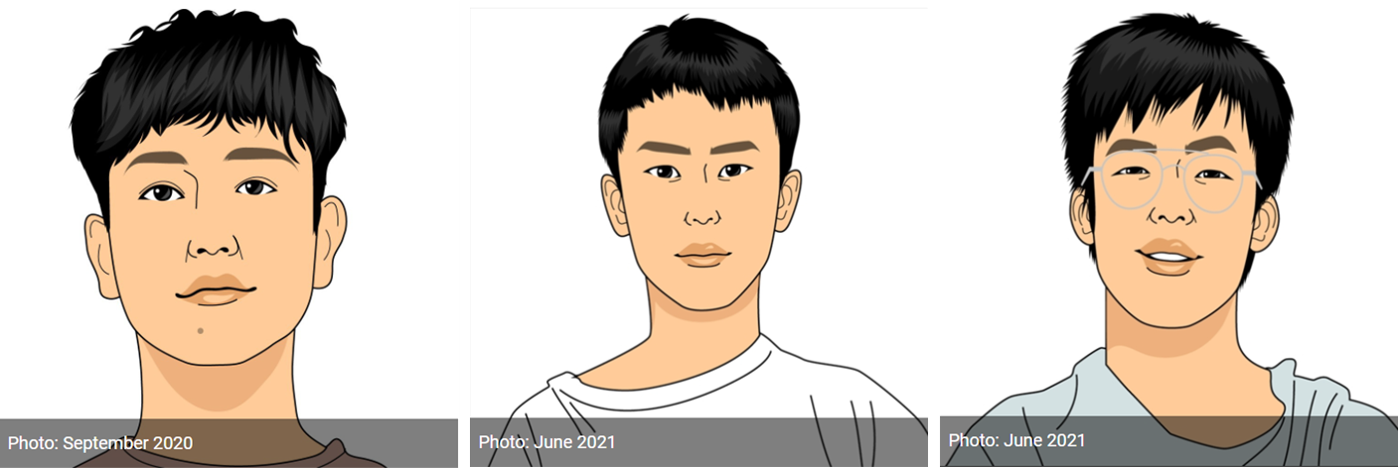

In China, besides the four first-tier cities—Beijing, Shanghai, Guangzhou, and Shenzhen—and 15 newly emerging first-tier cities like Hangzhou, Chongqing, and Chengdu that have developed rapidly in recent years, there are also numerous second-tier, third-tier, and other regional cities. Income levels, living costs, and lifestyle habits vary by city. Differences in brand awareness also arise. This time, let's compare the cosmetic brands used by Ms. A, who lives in the relatively high-income tier-one city of Shanghai, and Ms. B, who lives in Harbin.

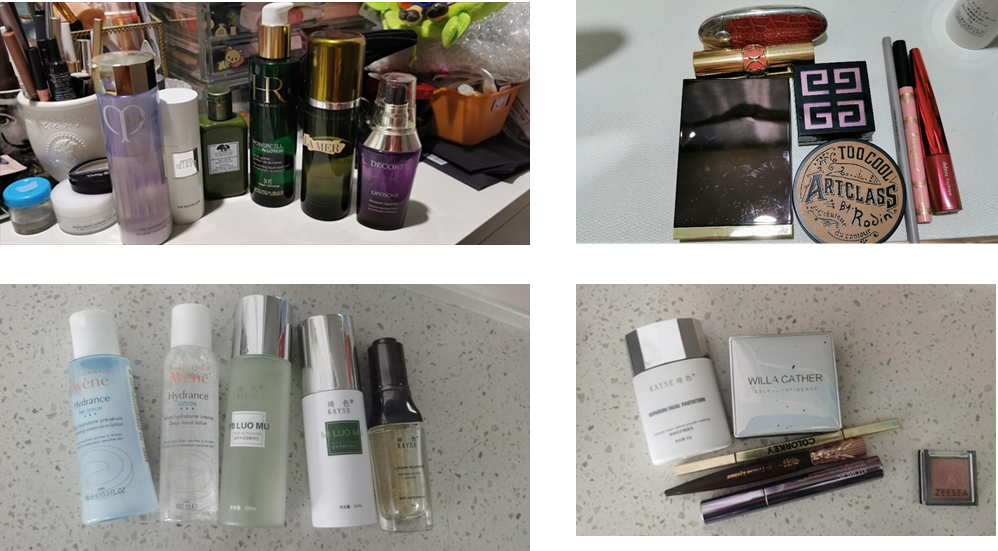

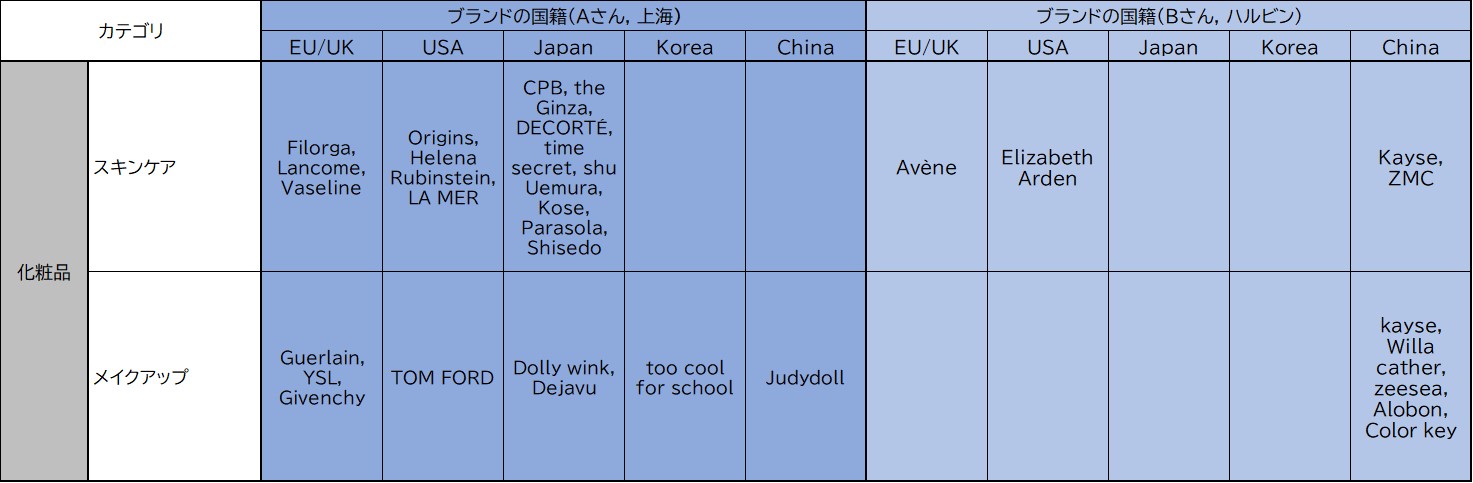

Ms. A's skincare products (top left) and makeup products (top right) in Shanghai

Ms. B's skincare products (bottom left) and makeup products (bottom right) in Harbin

(Source: Consumer Life Panorama)

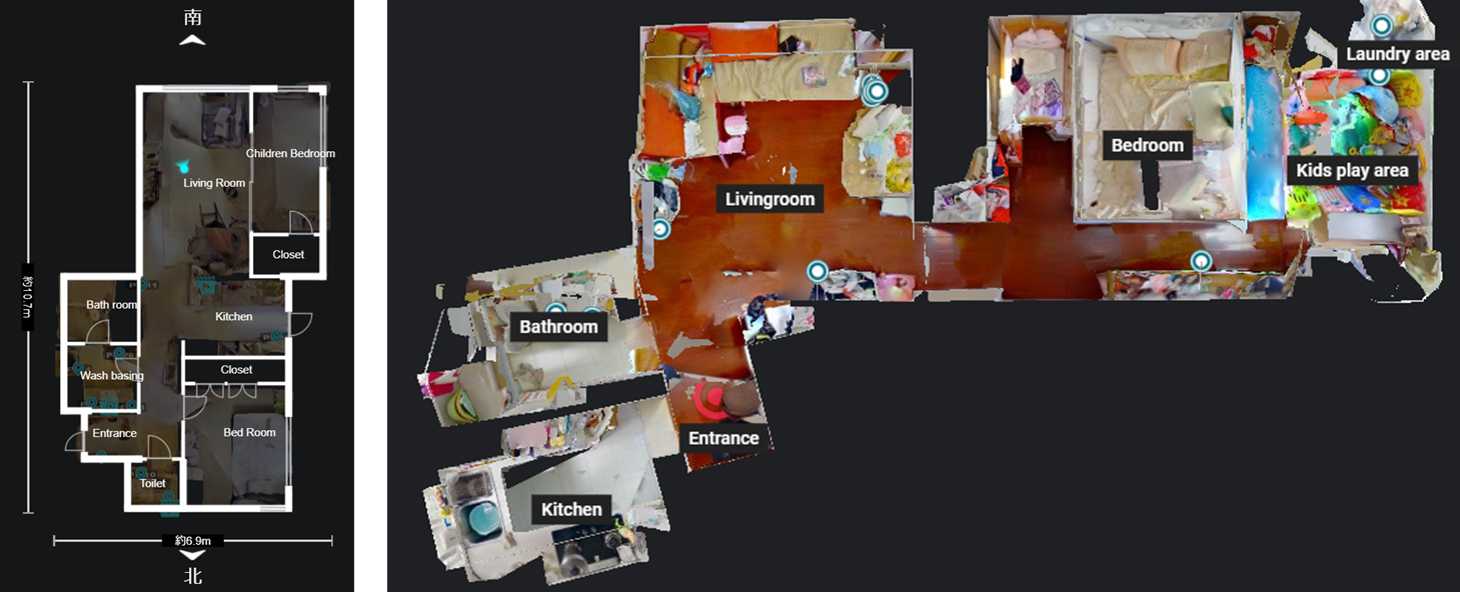

What is Consumer Life Panorama?

This is a website-type database that has accumulated visual data on more than 1,000 sei-katsu-sha from 18 countries around the world. The database includes many 3D models of living environments and 2D data of items owned by each sei-katsu-sha, and is useful for understanding overseas sei-katsu-sha, which is difficult to grasp using only letters and numbers.

Using visual data such as those cited in this column,

Compare the differences in the attributes of overseas consumers

To get a realistic understanding of the actual usage of each category

To understand the overall lifestyle of target consumers

etc., can be utilized as a “no-go” home visit survey.

List of Brands Owned by Person A and Person B (Source: Consumer Life Panorama)

First, skincare products. Ms. A primarily uses prestige brands, focusing especially on Japanese brands like CPB and the Ginza. On the other hand, Ms. B uses cost-effective domestic brands and overseas brands rather than Japanese ones. Next, looking at makeup products, Ms. A uses overseas brands like YSL, Tom Ford, and Dolly Wink, as well as Chinese brands like Judydoll. In contrast, Ms. B uses only Chinese brands.

Actually, when selecting products, Ms. A prioritizes uniqueness and practicality above all else. With her extensive brand knowledge, she can choose distinctive items or those that suit her from various brands. For example, she selects makeup cosmetics based on their distinctive features for specific makeup areas or usage scenarios, regardless of the brand's country of origin. However, for skincare cosmetics, she primarily uses high-quality Japanese brands that suit Asian skin.

On the other hand, Ms. B isn't as knowledgeable about brands as Ms. A, so she gathers information from various sources, studies, and experiments. Ms. B particularly values word-of-mouth reviews and always checks online reviews before making a purchase. Another key source is online KOLs and KOCs. She purchases and tries products recommended by KOLs and KOCs while checking user reviews. Consequently, while she currently doesn't use Japanese brands, it's not that she absolutely refuses to buy them. If Japanese brands increase their presence on Chinese social media, consumers like Ms. B in regional cities are highly likely to purchase Japanese brands in the future.

Preference for cosmetic brands varies by income

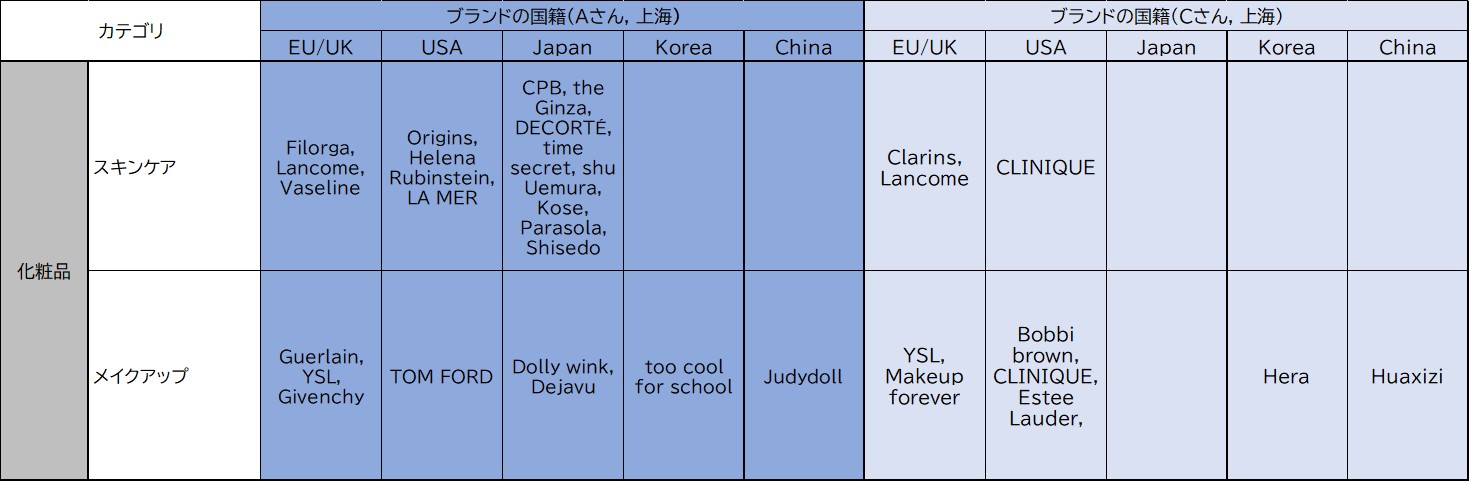

Ms. C's skincare products (left) and makeup products (right) in Shanghai

(Source: Consumer Life Panorama)

List of Brands Owned by Person A and Person C

(Source: Consumer Life Panorama Database)

Brand preferences also differ based on income, even within the same city. Ms. A and Ms. C both live in Shanghai. Ms. A's household monthly income is approximately ¥450,000, while Ms. C's household monthly income is approximately ¥240,000. Ms. C uses prestige makeup brands like YSL, but also uses Korean brands like Hera and Chinese brands like Huaxizi (花西子) for their good cost performance. For skincare products, she mainly uses Western brands but does not choose high-end brands to the same extent as Ms. A.

Skincare products are often chosen for Japanese brands, as they are expected to suit Asian skin and offer high quality. On the other hand, for makeup products, emerging Chinese brands are increasingly being selected alongside overseas brands. In fact, in China today, emerging domestic brands like Huaxizi (花西子) and Perfect Diary (完美日記) primarily focus their product lines on makeup cosmetics.

In fact, such products, alongside Chai-borg (Chinese makeup), are gaining acceptance not only within China but also among young women in Japan. As “Guochao” has the potential to expand its influence beyond Chinese consumers to overseas markets, we should keep an eye on the future development of Chinese brands.

-

Author profile

Yang Yan

A Chinese researcher based in Japan shares insights on overseas consumer lifestyles, primarily focusing on China. Recently, when visiting drugstores and cosmetics shops, I noticed that Chinese cosmetic brands have also made their way to Japan.

-

Editor profile

Yusuke Tatsuda

Responsible for building the Global Market Surfer website. When I studied abroad as a teenager, I was deeply impressed by the high level of skin care awareness among Korean male students my age.

Global Market Surfer

Global Market Surfer CLP

CLP