[China: World Residence Tour] Dental Care of Chinese Consumers

- Release date: Feb 01, 2023

- Update date: Sep 11, 2025

- 8078 Views

In China, the phrase “bright eyes and white teeth” is often used to describe beautiful people. However, looking at data for the Chinese population as a whole, it's also true that people aren't as concerned about dental care as this phrase suggests. So, what about those living in highly conscious urban areas? This time, we'll introduce the dental care products found on the bathroom counters of Shanghai residents registered with Consumer Life Panorama, while explaining their dental care awareness.

Related Articles

Part 1: [China: World Residence Tour] Why do the Chinese consumers prefer closed kitchens even though they love to talk?

Part 2: [China: World Residence Tour] Why bathroom and toilet are relatively small in Chinese households?

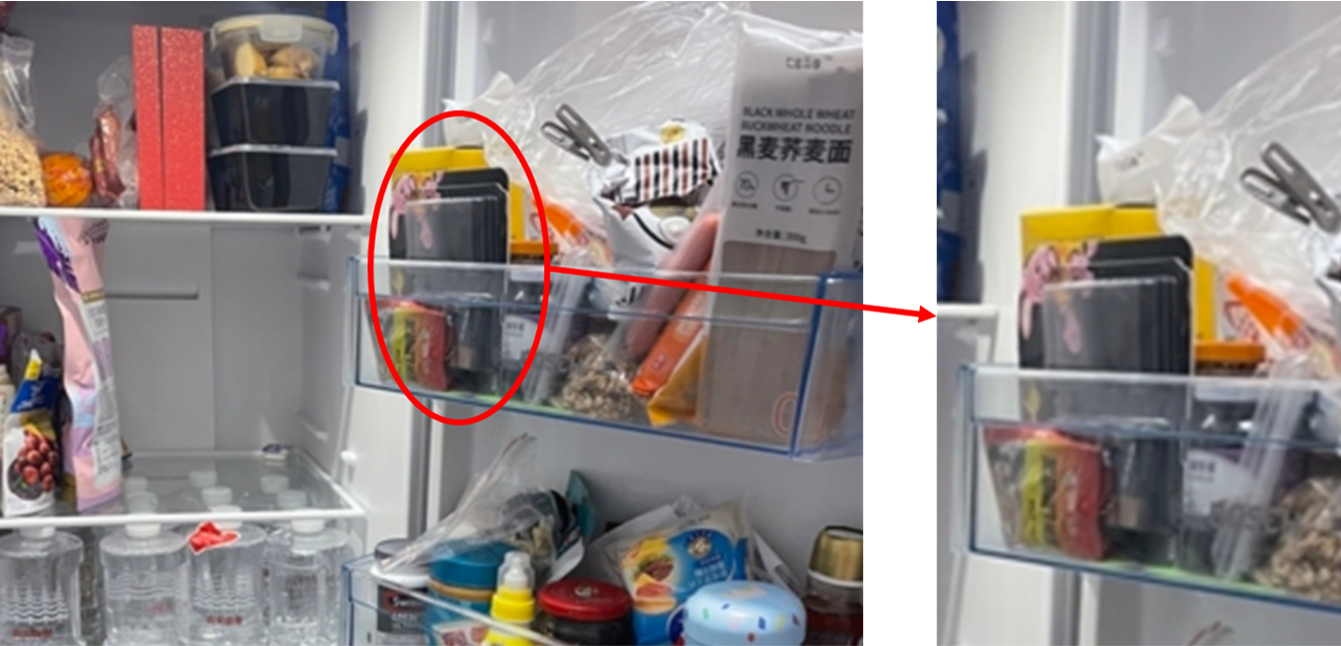

Part 3: [China: World Residence Tour] The entrance and refrigerator are the key to understand how do Chinese households use living room

Part 4: [China: World Residence Tour] How do Chinese households use their balcony?

Part 5: 【China】Chinese Homes Offer Greater Flexibility in Wiring

Part 6: [China: World Residence Tour] Chinese Lifestyle as Seen from Small Items in the Home

Part 7: [China: World Residence Tour] The Living Environment and Cleaning Conditions of Chinese Housing

Part 8: [China: World Residence Tour] Different air conditioner choices for different spaces and regions

Part 9: [China: World Residence Tour] Ideas about Privacy and Storage

Part 10: [China: World Residence Tour] Why do they install washing machines in the bathroom or laundry area?

Part 11: [China: World Residence Tour] Ancient wisdom on how to cope with the heat

Part 12: [China: World Residence Tour] Living environment with the same income level but with a large gap between areas

Part 13: [China: World Residence Tour] Explore the high-income consumers' electronics brands that can be found in their rooms.

Part 14: [China: World Residence Tour] Preference for cosmetic brands influenced by "national tide"

Part 15: [China: World Residence Tour] Parenting of the Millennial Generation

Part 16: [China: World Residence Tour] Hygiene awareness of Chinese consumers

Part 17: [China: World Residence Tour] Men's use of cosmetics influenced by the "face value economy"

Part 18: [China: World Residence Tour] Pandemic Provides Opportunity for Reaffirmation of Traditional Medicine

Part 19: [China: World Residence Tour] Housing in southern China troubled by humidity

Part 20: [China&Vietnam: World Residence Tour] What is the secret of delicious acidity?

Part 21: [China: World Residence Tour] Creating rooms with consideration of children's growth

Part 22: [China: World Residence Tour] Area and Kitchen

Part 23: [China: World Residence Tour] Dental Care of Chinese Consumers

Part 24: [China: World Residence Tour] Rapidly developing EV market

Chinese Dental Care Awareness

In China, to promote dental health, the government has designated September 20th as “National Love Your Teeth Day” every year since 1989, focusing efforts on spreading knowledge about dental care. As a result, a 2017 Chinese government survey indicated that approximately 60% of people possess some level of oral health knowledge, and 85% reportedly hold a somewhat positive attitude toward dental care. However, the reality is that the path to making dental care a habitual practice remains a long one.

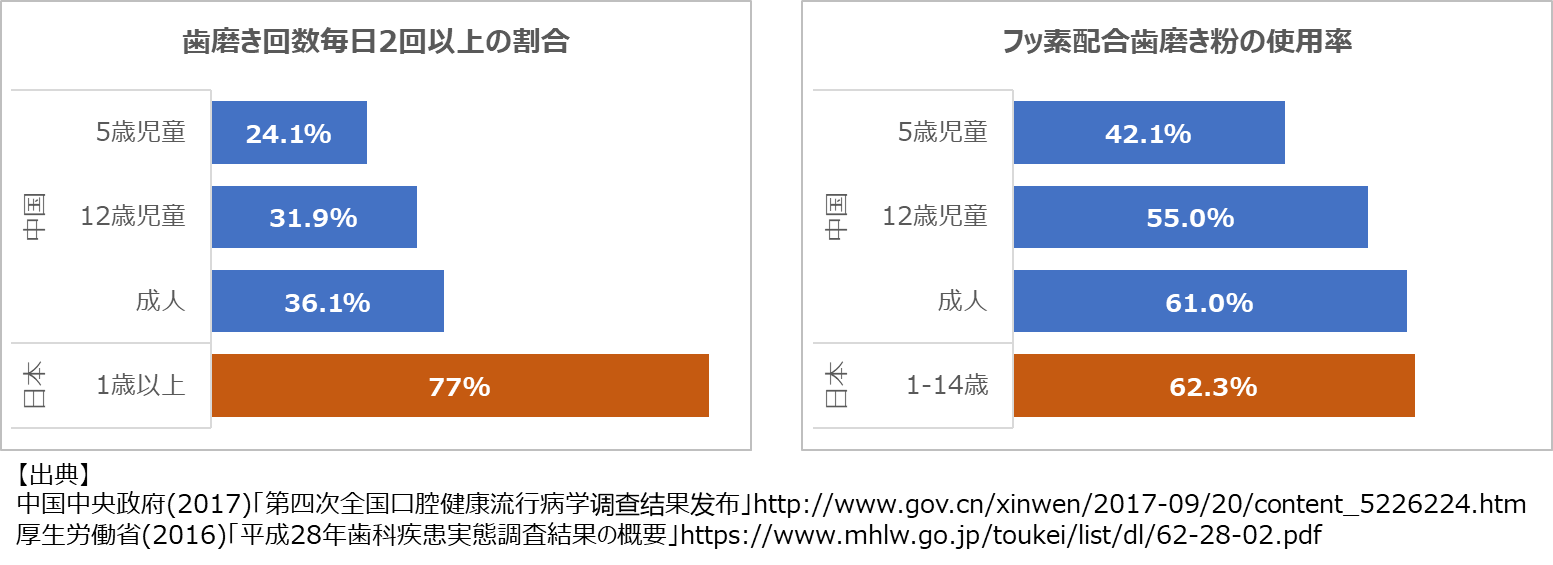

According to the results of the same survey conducted by the Chinese government in 2017, only 36% of adults brush their teeth twice or more daily. In contrast, data from Japan's Ministry of Health, Labour and Welfare for fiscal year 2016 shows that the same indicator is more than double that of China. Furthermore, looking at the usage rate of fluoride toothpaste in China, the percentage increases with age among adults. Even so, the rate among Chinese adults is only equivalent to that of Japanese children aged 1-14.

That said, it is also true that young households living in cities have a higher level of dental care awareness compared to the country as a whole. In particular, purchases of dental care products are reportedly growing, centered on young people (in their 30s and younger) in Tier-1 and Tier-2 cities. From here, we will explain the actual state of dental care among young urban dwellers, using data from Consumer Life Panorama on residents living in Shanghai.

The Actual State of Dental Care Among Urban Youth: A Case Study of Shanghai

First, let's start with toothpaste. In the Chinese market, when it comes to toothpaste, there are primarily two major players. Foreign brands mainly focus on “whitening” as their key selling point, while domestic brands primarily emphasize ‘herbal’ and “traditional Chinese medicine” (TCM) ingredients as their main selling points.

Since China's reform and opening-up, foreign companies entering the Chinese market leveraged their global marketing experience, particularly in developed countries. Unlike local manufacturers, they adopted a strategy clearly focused on the appeal point of “whitening,” achieving massive success in China. Brands like Colgate and Darlie have practically become national brands. The image below shows an example from Colgate's official Douyin account, where the brand still creates advertising content primarily centered on whitening effects.

Furthermore, observing the dental care products used by consumers registered in Consumer Life Panorama reveals the prevalence of foreign brands emphasizing whitening effects.

Whitening toothpaste used by young households in Shanghai.

Brands shown are Darlie (left: CN_113; center: CN_114) and Sunstar (right: CN_66).

(Source: Consumer Life Panorama)

What is Consumer Life Panorama?

This is a website-type database that has accumulated visual data on more than 1,000 sei-katsu-sha from 18 countries around the world. The database includes many 3D models of living environments and 2D data of items owned by each sei-katsu-sha, and is useful for understanding overseas sei-katsu-sha, which is difficult to grasp using only letters and numbers.

Using visual data such as those cited in this column,

Compare the differences in the attributes of overseas consumers

To get a realistic understanding of the actual usage of each category

To understand the overall lifestyle of target consumers

etc., can be utilized as a “no-go” home visit survey.

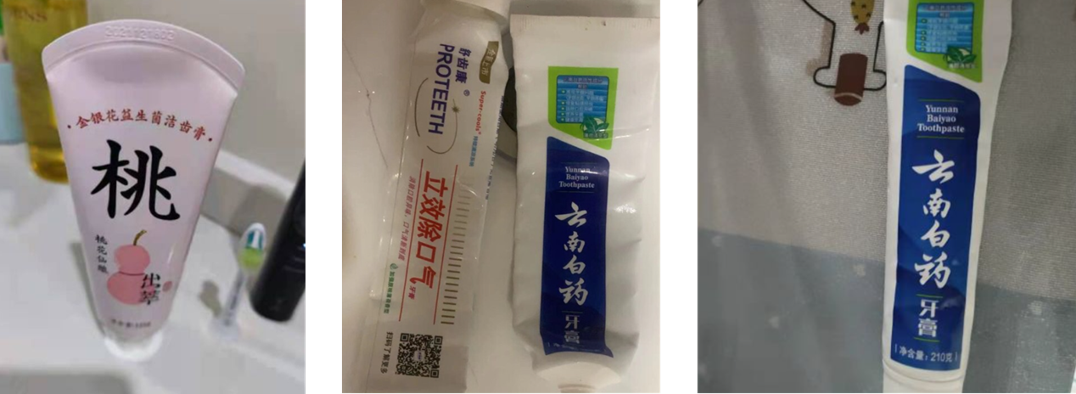

On the other hand, domestic brands weaponized traditional Chinese medicine ingredients to compete with foreign companies. Among these, Yunnan Baiyao is particularly famous. While its exact composition remains a trade secret, it is known as a hemostatic medicine originally made from traditional medicinal plants of the Yunnan region. Consequently, beyond toothpaste, it offers a variety of products including bandages.

Looking at the domestic brands with Chinese herbal ingredients held by consumers registered in Consumer Life Panorama, most are Yunnan Baiyao. Domestic brands leveraging Chinese herbal ingredients have now grown into a force capable of competing head-to-head with foreign brands. Furthermore, foreign brands are also developing Chinese herbal products within their product lineups to counter these domestic brands.

Domestic brands leveraging traditional Chinese medicine (left: CN_106, center and right: CN_100, 109)

(Source: Consumer Life Panorama)

Japan is said to have one of the lowest adoption rates for electric toothbrushes among developed nations. Meanwhile, in China, adoption is still in its early stages, so it's natural that the rate is lower than Japan's. However, in Shanghai's higher-income households with greater awareness, they have already begun using them. Furthermore, in these conscious households, beyond electric toothbrushes, it's also common to see manual toothbrushes hung on wall hooks and covered with dust-proof covers for hygiene reasons.

Electric toothbrushes in Shanghai households (left: CN_113) and dust covers (right: CN_58)

(Source: Consumer Life Panorama)

-

Author profile

Yang Yan

A Chinese researcher based in Japan shares insights on overseas consumer lifestyles, primarily focusing on China. Using an electric toothbrush provides a refreshing sensation in less time than manual brushing.

-

Editor profile

Yusuke Tatsuda

I was in charge of building the Global Market Surfer website. I feel like it looks much cleaner now, so I prefer flossing over electric toothbrushes.

Global Market Surfer

Global Market Surfer CLP

CLP