[Indonesia] "OVO" e-money is rapidly gaining popularity / Expanding users by making it more accessible to daily life

- Release date: Aug 05, 2019

- 5851 Views

Partnering with supermarkets, department stores, and the ride-hailing app Grab, user numbers quadrupled in just two years

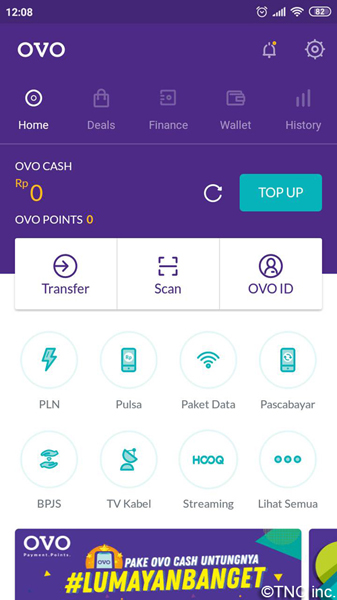

OVO, an e-money service provided by PT Visionet Internasional since 2016, partnered early on with major supermarket chain Hypermart and department store chain Matahari, growing its user base fourfold by 2018. In 2018, it further expanded usage scenarios through partnerships with Tokopedia, the largest online shopping mall in Indonesia, and the ride-hailing app Grab.

In addition to OVO Cash, which can be topped up via partnered credit cards or in-store, users earn OVO Points with each transaction. These points can be used for future payments at a rate of 1 point = 1 IDR (approximately ¥0.0076). In 2019, OVO launched a “Pay Later” service on Tokopedia, attracting attention by enabling installment payments without the need for a credit card.

Supermarkets and department stores collaborate with "Grab", a car-delivery app, to quadruple the number of users in two years.

The number of e-money users in Indonesia has been expanding due to the enhancement of car-dispatch apps and e-commerce, as well as the shift to cashless services on highways and public transportation, and the number of e-money users has rapidly increased by about 3.5 times from the end of 2017 to March 2018. On the other hand, the fact that e-money requires recharging in advance makes it difficult for middle-income and lower class people to accept it, and the belief in cash still remains strong. On the other hand, the fact that e-money requires recharging in advance makes it difficult to be accepted by the middle-income and lower class, and the belief in cash still remains strong. In this respect, OVO is easily accepted by those who have never been familiar with e-money payments, since points can be accumulated and used for payments even if the payment method is not e-money (OVO CASH). In addition, the high cash-back rate compared to other e-money, the ease of use of the application with QR code reader, and the fact that it can be used in everyday situations such as supermarkets and parking lots are all factors behind its popularity.

This article is co-authored by TNC Lifestyle Researcher (http://lifestyle.tenace.co.jp/) and Intage's Global Researcher.

Translated with AI Translator-

Author profile

TNC ASIA Trend Lab

TNC ASIA Trend Lab is an information organization run by TNC Inc. that researches and shares trends in Asia. It supports corporate marketing activities by finding insights from trends rooted in the lifestyles and habits of local consumers. http://lifestyle.tenace.co.jp/

-

Editor profile

Intage Inc.

***

Global Market Surfer

Global Market Surfer CLP

CLP