<Resident Column>[India] Current Status and Future Potential of the Indian Game Market

- Release date: May 21, 2025

- 6584 Views

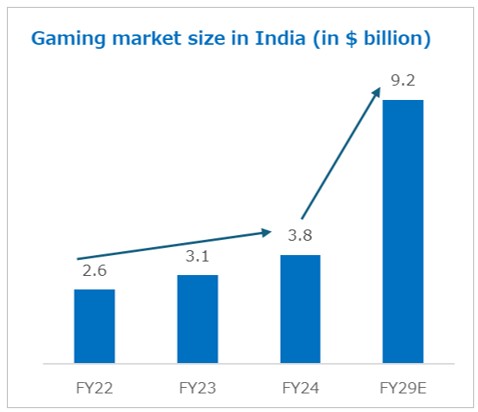

India's gaming market is expected to reach approximately $3.8 billion (approximately 550 billion yen) in 2024 and $9.2 billion (approximately 1.3 trillion yen) in 2029. Mobile games are driving the market, with more than 590 million users enjoying games on their smartphones. This popularity is due to the availability of affordable smartphones and the spread of the Internet.

Lumikai, “State of India Interactive Media & Gaming Research FY’24" created by the author.

On the other hand, the diffusion of home video game consoles is limited, and the main users are mainly young people with high incomes. One of the reasons for this may be that the value of games as “free” and “something to enjoy in one's spare time” is deeply rooted in the Indian market.

In this column, we discuss the current state of the Indian game market and its future possibilities, while also taking a look at the realities of the market from a local perspective.

Popularity of mobile games

Mobile gaming is highly popular due to its accessibility. The number of smartphone owners in India will reach approximately 883 million by 2024, and feature phones (so-called “rackets”) are rarely seen in urban areas. The average price of a smartphone is about $300 (about 42,900 yen), and many inexpensive handsets made in China or older models are in circulation. Communication costs are also very inexpensive, with a plan that allows 1 GB of usage per day being offered for about 200 rupees (about 350 yen) per month. This environment facilitates access to mobile games.

India ranks second in the world in terms of mobile game downloads, second only to China. Popular titles among people of all ages are casual games such as Coin Master and Candy Crush, while older users can be seen playing games such as chess and Tetris on the streets. Midcore” games such as BGMI and Free Fire are popular among younger players. (*1)

Compiled by the author from Google Play Ranking 2025

On the other hand, nurturing games such as RPGs are not very popular, and one rarely sees people actually playing them. Possible reasons for the popularity of casual games include the following.

1. short time for enjoyment

For many Indians, there is a sense that “games = killing time,” and games that can be enjoyed in a short time are preferred.

2. A wide variety of free games to enjoy

From classic games such as chess and Tetris to unique Indian board games, casual games offer a wide variety of free entertainment options.

3. Support for low-spec devices

Many users utilize low-end smartphones, and games with large file sizes may be a source of stress. Unstable network connections are also considered to be a hindrance to playing large games.

4. Simple rule design

English is a quasi-official language in India, but many people are non-native speakers, and complex content can be difficult to understand. Some casual games are available in multiple languages and are widely accepted by a broad range of users.

Created by the author based on each app.

Against this backdrop, free mobile games, especially casual games, have become central to the Indian gaming industry market.

Current status of PC games and home video game consoles

The PC game and home console game market is expected to remain at around 1% of the total market share by 2026, with mobile games continuing to dominate the market. This trend is driven by the convenience of mobile games, as mentioned earlier. The average monthly income in India is approximately 32,000 rupees (about 55,000 yen), making the purchase of home video game consoles, such as the PlayStation (approximately 50,000 rupees = 85,000 yen), unaffordable for many people. Additionally, home video game consoles require a television screen, which is not easily accessible for those living with family in India, where cohabitation is common.

Furthermore, many people did not own a game console during their childhood and first experienced games on smartphones, which is a significant difference from Japan. As a result, the belief that “games are something you can enjoy for free” is deeply ingrained, and there is resistance to paying for PC games or home game consoles.

Nevertheless, in recent years, both the PC game and home console game markets have shown signs of growth. The compound annual growth rate (CAGR) from 2025 to 2034 is projected to be approximately 7% for PC games and approximately 5% for home consoles. At the game booth of Comic Con (※2) held in Bangalore in January 2025, PC game-related content accounted for over 50% of the total, marking a notable shift from the previous year's VR-focused exhibits.

Comic-Con 2025 in Bangalore

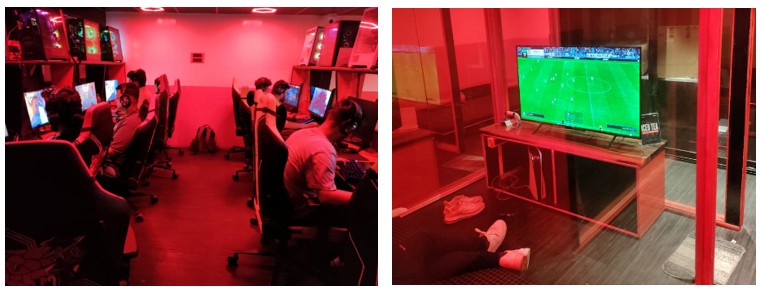

In urban areas, there are online game cafes where you can enjoy PC games, PlayStation, Xbox, VR devices, and more at reasonable prices. For PC games, you can play for 100 rupees (about 180 yen) per hour, and even on weekday evenings, many young people visit these cafes.

Online game cafe in Mumbai (left: PC games, right: PlayStation)

future potential

The Indian gaming market is expected to grow even more in the future. I would like to share my thoughts on the factors that will promote this growth and the possibilities for the future.

1. Large youth population

As of 2024, the population aged 35 and under will exceed 600 million, accounting for 45% of the total population. The median age in 2025 will be 28.8, with tech-savvy generations driving the market. The trend of young people driving the Indian gaming market is expected to continue.

2. Proliferation of high-spec smartphones

The number of smartphone owners is approaching 900 million, and with the availability of affordable data plans, everyone has easy access to games. In 2023, Apple opened its first retail store in India, indicating growing demand for high-performance devices. This may lead to a future where people can enjoy a variety of games without stress.

3. Rising popularity of anime

Since the COVID-19 pandemic, the popularity of anime has skyrocketed due to the spread of streaming services. In January 2025, there was a collaboration between “Free Fire” and “NARUTO” (*3). “Free Fire” was the most downloaded mobile app in the world in January 2025, with 37 million downloads, of which India accounted for 34.8%, the largest share in the world. This may be due to the increased interest in games among anime fans.

4. Government investment in digital technology

Under the “Digital India” initiative, the government is focusing on developing digital infrastructure. Internet access is becoming more widespread in rural areas, and 5G is being rolled out rapidly in urban areas. This is expected to lead to the spread of advanced gaming experiences such as VR and AR. Investment is also being made in digital-related industries such as fintech, e-commerce, and mobile games.

5. Increase in paying users

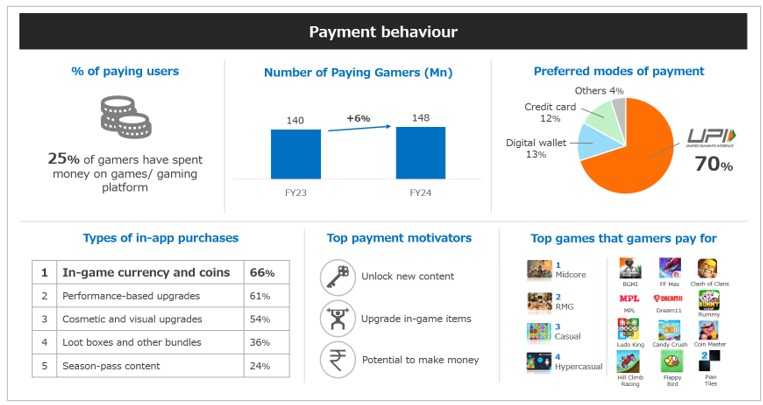

Although there is a perception that “games are free to play,” in recent years, the number of paying users for mobile games has increased, not just for free games. According to a 2024 report by Lumikai, 25% of all game users make in-game purchases or pay for games, with the number of paying users increasing by 6% year-on-year. “Midcore” games such as ‘BGMI,’ ‘Free Fire Max,’ and ‘Clash of Clans’ are at the center of paid games, and overseas publishers are now able to generate revenue solely through in-app purchases in India. Users are making payments for new content and game updates, and it appears that ‘Midcore’ gamers are seeking to enjoy games more deeply.

Lumikai, “Levelling up: State of India Interactive Media & Gaming Research FY’24” created by the author.

6. The spread of digital payments

UPI and digital wallets (*4) are making in-game purchases easier. UPI is widely used, and there are almost no opportunities to use cash in everyday life. Mobile game payments can be completed in a matter of seconds. According to the above Lumika report, 70% of users used UPI for payments, with the next highest method accounting for only about 10%, indicating that UPI dominates as a payment method. The author also had an experience where they accidentally tapped the UPI payment screen in a game, and the ease of only needing to enter a password led them to make an in-app purchase. With the increase in disposable income, it is expected that the number of users making in-app purchases will continue to grow.

Issues and prospects

While there are bright spots for the growth of the gaming market, challenges also exist. Regulations, cyber countermeasures, and privacy issues are common to all countries and are therefore omitted. However, “(1) difficulty in monetization,” “(2) cultural background,” and “(3) unstable infrastructure” can be cited as challenges.

1. difficulty in monetization

Many mobile game users do not pay for their games, and casual games in particular must rely on advertising revenue.

2. cultural background

The value system of “games = something to play for free,” lack of experience playing games on game consoles, and a language environment that differs from that of Japan may be barriers to market entry. In order to succeed in the Indian game market, language localization should be considered.

3. unstable infrastructure

The telecommunications environment and power supply can be unstable even in urban areas, and in many cases this hinders the gaming experience. Infrastructure problems will not necessarily be resolved dramatically in the next few years, and it is necessary to assume that these conditions will continue to exist.

The Indian gaming market is a growing market with great potential for Japanese companies. We hope that the day will come when Japanese games will have a strong presence in India.

Translated with AI Translator

Notes

*1: BGMI stands for Battlegrounds Mobile India and is an India-exclusive version of the popular battle royale game PUBG Mobile (PlayerUnknown's Battlegrounds Mobile) In 2020, the Indian government banned Chinese-made apps including “PUBG Mobile Free Fire is a mobile battle royale game developed and distributed by Garena. It has been optimized to be “playable on mid-range and lower smartphones” since the early stages of development. These games, which fall between casual and hardcore games, are called “midcore” games.

*2: Comic Con India is one of the country's largest pop culture events, celebrating a wide variety of pop culture, including comics, animation, movies, games, and cosplay. Held in Delhi, Mumbai, Bangalore and other major Indian cities. (https://www.comicconindia.com/)

*3:The game in collaboration with Naruto is free to play. However, limited and premium items require payment (Garena Free Fire, https://ff.garena.com/en/article/1438/ )

*4:“UPI” stands for “Unified Payments Interface,” a digital payment system that is very widely used in India. It is directly linked to a bank account, and allows users to instantly send money to any individual or store via QR code or phone number for the balance in their bank account. The main applications include Google Pay, Paytm, PhonePe, etc. Since UPI is operated by the Government of India and the Reserve Bank of India, it is a national infrastructure. On the other hand, “digital wallets” are. Amazon Pay, Paytm Wallet, etc. are examples.

Reference

・Lumikai, Indian Gaming Market: https://www.lumikai.com/post/indian-gaming-market-to-reach-9-2-bn-by-fy29

・Google Play Ranking, The Top Grossing Games in India: https://www.appbrain.com/stats/google-play-rankings/top_grossing/game/in

・Desk log Io, Average Salary In India 2025: https://desklog.io/newsletters/average-salary-in-india/

・Market Research Future, Gaming Pc Market Overview: https://www.marketresearchfuture.com/reports/gaming-pc-market-26477

・EMR, India Gaming Console Market Size and Share Outlook - Forecast Trends and Growth Analysis Report: https://www.expertmarketresearch.com/reports/india-gaming-console-market

・ASO World, Top 10 Global Mobile Game Downloads in January 2025: https://marketingtrending.asoworld.com/en/news/top-10-global-mobile-game-downloads-in-january-2025/

・Games Industry. biz, Why India's games spending is expected to reach $9.2bn in five years: https://www.gamesindustry.biz/why-indias-games-spending-is-expected-to-reach-92bn-in-five-years

-

Author profile

Kenta Akashio

A Japanese researcher based in Bangalore, India, she started her career in the research industry after teaching elementary school for 7 years. She is mainly in charge of FMCG projects in the food and beverage industry. In order to deepen his understanding of entertainment-related projects, which have been on the rise in recent years, he visits anime and game events in Bangalore as much as possible and aims to participate in all of them.

-

Editor profile

Chew Fong-Tat

A Malaysian who has lived in Japan for 14 years. He is in charge of creating the Global Market Surfer website.

Global Market Surfer

Global Market Surfer CLP

CLP