[Generation Z in Asian Countries] South Korea: Generation Z's Attitudes Toward Beverages and Related Trends

- Release date: Aug 12, 2025

- Update date: Aug 12, 2025

- 25 Views

South Korea has become known as a café superpower. Cafés are scattered throughout every part of daily life, not just in central Seoul and office districts, and have become an indispensable part of Korean life. How does this environment affect young people in particular? We will examine Generation Z's attitudes toward beverages and their relationship to beverage trends.

In South Korea, since around 2015, low-priced coffee franchises such as MEGA COFFEE have emerged, offering beverages at affordable prices, and have experienced rapid growth in the 2020s. A Venti-sized Americano (approximately 590ml) is sold for 1,500 to 2,000 won (approximately 160 to 210 yen), which is cheaper than the 500ml PET bottle drinks sold at convenience stores (averaging 2,000 to 2,500 won/approximately 210 to 260 yen). As a result, the convenience of being able to enjoy freshly brewed coffee has gained popularity, and the culture of drinking Americano as a substitute for tea has rapidly spread.

Korean Americano is made by diluting espresso with water, resulting in a crisp, refreshing taste. Its ease of consumption has led to many people drinking several cups a day. Additionally, cost-effective cafes typically offer an average of 30–40 menu items, providing a wide range of options beyond coffee, which aligns well with the needs of Generation Z.

As of 2025, there are over 100,000 cafés in South Korea, which is about twice the number of convenience stores. Unless you go to a very rural area, cafés are so common that you can find one without even looking for it. As a result, among South Korea's Z generation, it is more common to buy drinks at cafés than to buy bottled drinks. The fact that there are few vending machines in urban areas is also thought to be contributing to this trend.

Plastic cups may seem prone to spilling and unsuitable for carrying around, but in South Korea, it is common to see young people walking around with a cup of Americano in one hand. Plastic cups with straws are not merely seen as beverage containers but as part of fashion, and it is a common sight to see people boarding buses or subways with them.

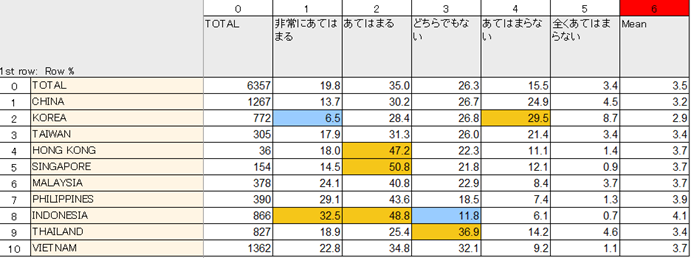

According to the “Global Viewer” consumer database owned by Intage, in the section on “Attitudes and Values Toward Beverages,” When asked, “I bring drinks from home to avoid buying them outside,” only 6.5% of respondents answered “very much so,” ranking last among the 10 surveyed countries. On the other hand, 29.5% answered “not at all,” indicating that for South Korea's Z generation, buying drinks outside has become a daily habit.

Intage Global Viewer Banner:D10S2. Attitudes and values regarding beverages (SA): I bring drinks from home so that I don't have to buy them outside.

As mentioned earlier, this trend is rooted in the fact that café culture is deeply ingrained in everyday life. People can easily purchase inexpensive, delicious drinks without having to bring their own beverages from home.

In addition, almost all Korean café franchises have introduced kiosks (touch-panel ordering and payment terminals) for ordering, which is another reason why they are popular among Generation Z, who are accustomed to non-face-to-face interactions and can use them stress-free without having to interact with staff. Furthermore, while drinks prepared at home are limited in variety, cafés offer a wide range of menus and the opportunity to try new drinks reflecting current trends. This flexibility and high level of convenience are believed to support the Z generation's habit of drinking out.

In South Korea, there are many coffee franchises offering good value for money, but among them, MEGA COFFEE, COMPOSE COFFEE, and the Venty are particularly popular among Generation Z. Among these, MEGA COFFEE has seen remarkable growth in recent years, recording sales of 466 billion won (approximately 50 billion yen) in 2024. This represents a substantial increase of 26.5% compared to the previous year, with operating profits also rising by 55% to 1.076 trillion won (approximately 11 billion yen), securing the company the second-place position in the industry behind Starbucks (*1).

*1

NEWSIS 2025/5/5 https://www.newsis.com/view/NISX20250502_0003162668

In addition to its standard café menu, MEGA COFFEE continues to keep consumers interested by offering seasonal limited-time menus and new products that reflect current trends. In recent years, there has been an increase in menus that allow customers to enjoy beverages as if they were desserts, and the following lineup of seasonal limited-time products will be available in the summer of 2025.

● “Honey Watermelon Flower Smoothie” (4,600 won/approximately 480 yen), a watermelon smoothie topped with a variety of fruits.

● “Low-Sugar POP POP Plum Iced Tea” (4,000 won/approximately 420 yen), a low-sugar plum iced tea topped with a round ice cream ball resembling a plum.

● “Mango Parfait” (4,400 won/approximately 460 yen) combines mango, coconut chips, whipped cream, and mixed cereal.

These menus are designed with the health-conscious preferences of Generation Z in mind, featuring seasonal fruits and “low-sugar” options. Additionally, the brand has further enhanced its appeal by featuring NCT WISH, an idol group popular among Generation Z women, as its advertising model.

Reasons why eco-friendly practices related to beverages are not progressing

In recent years, the keyword “valuable consumption” has become popular in South Korea, and “ethical consumption,” in which people, mainly Gen Z, choose environmentally friendly products and foods, is spreading. In the cosmetics field, vegan products have become mainstream, and plant-based foods such as alternative meats are also appearing one after another. The use of earth-friendly packaging has also become commonplace.

For Generation Z, choosing sustainable products is not only fashionable but also a way to demonstrate their environmental awareness to others. However, when it comes to eco-consciousness regarding beverages, South Korea lags behind other countries in some areas.

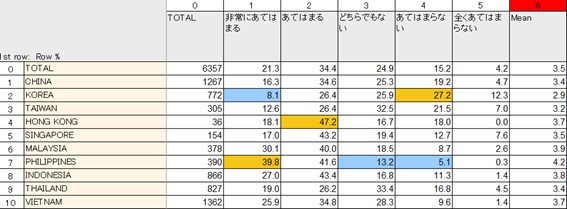

Intage Global Viewer Banner:D10S2. Attitudes and values regarding beverages (SA): When going out, always bring a water bottle or tumbler.

When asked, “Do you always bring your own water bottle or tumbler when you go out?”, only 8.1% of South Korean Gen Z respondents answered “very much so,” ranking lowest among the 10 countries surveyed. On the other hand, 27.2% answered “not at all,” ranking highest, clearly showing how South Korean Gen Z does not carry their own water bottles.

So, why aren't Gen Z, who are supposed to be leading ethical consumption in the country, more proactive about using reusable bottles?

This is likely due to the “parli-parli (빨리빨리 = quickly, quickly) culture” deeply rooted in Korean society. This mindset has been passed down to Gen Z, who strongly prioritize avoiding hassle and unnecessary effort. They likely find it more efficient and convenient to choose disposable plastic cups or bottled drinks rather than using reusable water bottles that require washing at home.

Another reason is the fashion trends among the younger generation.

In recent years, “mini bags” have become a major trend among Korean Z-generation women. Celebrities and fashion influencers frequently feature them on social media, with over 750,000 posts related to “mini bags” on Instagram.

IVE's Jang Won-young, who is extremely popular among Gen Z, often uses high-end mini bags, and her style is frequently featured on social media and online media, generating a lot of buzz.

South Korea, known as a cashless advanced country, had already reached a cashless ratio of 93.6% in 2020 (*2), and among Generation Z, almost no one carries large wallets such as long wallets or bi-fold wallets. It is generally considered that a smartphone, a small card-sized wallet, and a mini bag that can hold minimal cosmetics such as lipstick and foundation are sufficient for everyday outings.

*2

Electronic newspaper, 2023/5/15 https://www.etnews.com/20230515000262

Recently, keyring-type cosmetics have appeared on the market, allowing users to carry lipstick and eyeshadow that don't fit in their mini bags as keyrings. Their cute appearance and photogenic qualities are also factors in their popularity among Generation Z.

The vegan beauty brand AMUSE is known for its pop, colorful, and transparent designs, and is popular not only for being environmentally and skin-friendly, but also for its cute appearance. As one of the first brands to adopt keyring-shaped cosmetics, it offers products like the “Tint Balm Keyring (15,000 KRW / approximately 1,600 JPY)” and “Powder Lip & Cheek (19,000 KRW / approximately 2,000 JPY).” It also features unique items such as the “Ring Lip Balm (13,000 KRW / approximately 1,400 JPY).”

In this way, the miniaturization of bags and the minimization of portable items are not simply a matter of convenience for Generation Z, but are considered part of their “style.” As a result, bulky water bottles are difficult to carry around in terms of fashion, and carrying an additional tote bag is often avoided as it “upsets the balance of the outfit.”

In conclusion

While the frequency of café use is high, the low rate of reusable bottle usage indicates an increase in plastic cup consumption. The government is taking this issue seriously and has implemented several measures to address plastic waste, but in reality, these measures are not yet fully effective.

For many members of Generation Z, “valuable consumption” is seen merely as part of a trend. Even if they understand that it is good for the environment, they are unlikely to take action if it does not align with their lifestyle or fashion preferences. At present, ‘individuality’ and “convenience” tend to take precedence over ethical choices.

It will likely take some time for eco-consciousness regarding beverages to take root among young people in South Korea.

What is Global Viewer?

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories (*).

Examples of categories:

Food and beverages, personal care/cosmetics, house hold care, childcare/nursing care, mobility, home appliances, smart home, housing, entertainment content (games, music, etc.), finance, insurance, travel (to Japan), online services, etc.

In addition to country-by-country comparative analysis as described in this article, analysis by attributes (sex, age, income, etc.) within a single country is also possible.

For details, click here.

-

Author profile

TNC Lifestyle Researcher

I have been living in South Korea for 14 years. I live with my Korean husband on Yeongjong Island, surrounded by the sea. My hobbies are visiting cafes and traveling to Japan.

-

Editor profile

Chew Fong-Tat

Malaysian researcher who has lived in Japan for 14 years and has handled many surveys on ASEAN countries.

Global Market Surfer

Global Market Surfer CLP

CLP