[Generation Z in Asian Countries] Taiwan Edition: Popular Instant Noodles and Cookies that Reflect the Values of Generation Z

- Release date: Aug 13, 2025

- Update date: Aug 13, 2025

- 7779 Views

Taiwan has continued to enjoy steady economic growth even after the COVID-19 pandemic. In recent years, Taiwanese semiconductor manufacturers have established factories in Kumamoto Prefecture, which has had a significant impact on the Japanese economy. In Taiwan, instant ramen has become a staple food for the busy Z generation.

According to a survey by the Tongyi Group, the instant ramen market in Taiwan is worth approximately 14 billion yuan (approximately 66 billion yen) annually, with approximately 900 million packs consumed each year. It is a popular food among all generations, with each Taiwanese person consuming an average of 40 packs per year.

(Reference: https://meet.bnext.com.tw/blog/view/18643?)

Instant ramen first appeared in Taiwan in 1967. It arrived about 10 years later than in Japan, and the first product was “Shenli Mian,” developed jointly by Nissin Foods of Japan and a Taiwanese company. Initially, the Japanese-style flavor was the mainstream, but it did not suit the tastes of Taiwanese people. However, as manufacturers gradually incorporated flavors familiar to Taiwanese people, such as “Dan Dan Mian” and “Rouzao Mian,” the product began to gain popularity.

Additionally, the spread of instant noodles in Taiwan is also related to the cultural practice of preparing for typhoons. When a major typhoon approaches, businesses and schools implement a closure policy known as “Ting Ban Ting Ke.” During such times, instant noodles, which can be easily prepared by simply adding hot water, are highly valued as emergency rations, contributing to increased sales.

Today, instant noodles have become deeply ingrained in Taiwanese life, appearing as snacks during overtime work, late-night meals, and even as offerings to deities.

This article explores the current state of Taiwan's instant noodle culture and introduces the latest trends spreading among Generation Z.

In Taiwan, just like in Japan, there are various types of instant ramen available, such as bagged and cup types. There is also a wide variety of flavors, including types that recreate Taiwanese dishes such as beef noodles, pork rib noodles, and minced pork noodles, as well as light seafood-flavored varieties that are popular. Among these, the “fresh shrimp flavor,” which emphasizes the taste of shrimp, is a staple that is widely enjoyed.

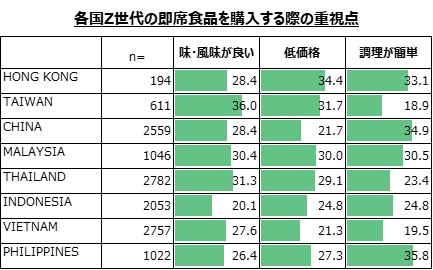

According to a survey conducted by Intage's consumer database “Global Viewer,” both men and women of Generation Z tend to prioritize “taste and flavor” when choosing instant noodles. This highlights the strong emphasis Taiwanese people place on taste when it comes to instant noodles.

Intage Global Viewer Banner:F9S2. Food Category-Specific Purchase Considerations (MA): Instant Foods

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

In addition, the growing health consciousness among Generation Z is also having an impact on instant ramen. In Japan, there is already a diverse lineup of products targeting health-conscious consumers, such as nutritionally balanced products and light-flavored instant ramen, but this has not been the case in Taiwan.

The new product “Reduced Sodium 25% Scallion-Braised Beef Noodles (Reduced Salt 25% Scallion-Braised Beef Noodles)” launched in November 2024 by “Manhan Dacuan” is gaining attention as the first reduced-salt type “health-conscious” product in Taiwan's instant noodle industry.

Since then, vegetarianism has been gaining popularity among Taiwan's Generation Z. However, unlike traditional religious reasons, it has spread as part of a healthy lifestyle influenced by models and celebrities, with a “flexitarian” style of eating vegetarian only on weekends or a few times a month becoming mainstream.

In response to this trend, Taiwanese supermarkets now offer a wide variety of vegetarian-friendly instant noodles known as “su shi,” which have caught the attention of Generation Z. Products that contain no meat at all are being released one after another, and the combination of the ease of being able to reduce animal protein intake according to one's mood and the convenience of simply adding hot water to prepare the meal aligns well with the lifestyles of today's young people.

Instant ramen for vegetarians

In Carrefour's “2025 Cup Noodle Sales Ranking,” Uni-President's “Lai Yi Ke Spicy Mushroom Flavor” ranked 9th with sales of 14.5 million yuan. Following that, Weili's “Su Piaoxiang Ma La Tang Flavor Noodles” reached 10th place with sales of 10 million yuan. Both are vegetarian-type products characterized by their spiciness, and the fact that such products have entered the top ranks of the rankings suggests that “spicy and healthy ramen” is becoming a trend, particularly among Generation Z.

(Reference: https://www.ettoday.net/news/20250610/2975968.htm)

In recent years, a trend that has become popular among Taiwan's Generation Z is the art of arranging instant ramen. In Japan,アレarranged recipes gained attention amid the COVID-19 pandemic and the resulting stay-at-home trend, but in Taiwan, thearrangement boom continues among young people as of June 2025, with a noticeable trend of sharing original recipe ideas on social media.

These posts have high viral potential, spreading rapidly among Gen Z and often being featured in online news. For example, a video of a modified recipe using Korean Shin Ramyun with added eggs and garlic has garnered 907,000 views and 13,000 shares, sparking significant buzz.

This trend of customization is not limited to instant ramen, but has also spread to tea drinks and juices sold at convenience stores. In Taiwan, there are specialty drink shops called “shouyao in” scattered throughout the city, and bubble milk tea, which has also become popular in Japan, is a representative example of this trend.

While hand-shaken drinks were once affordable for young people, recent inflation has caused prices to rise, with some cups now costing nearly 100 Taiwanese dollars (approximately 470 Japanese yen). While I mentioned earlier that the economy is developing smoothly, in reality, like Japan, income inequality is emerging as a social issue.

In this environment of rising prices, “arrangements” that can be enjoyed on a limited budget are one of the factors driving support among Generation Z. For example, combining a paper-packaged beverage purchased at a convenience store for 30 yuan (approximately 140 yen) with another drink to “recreate the taste of that famous store!” has become a popular topic, with low-cost recreations gaining traction.

When it comes to instant ramen in Taiwan, the popularity of Japanese products is also a key point to note. When instant ramen first appeared in Taiwan, Japanese-style flavors were not well received, and sales were sluggish. However, in today's Taiwan, where there are many Japanophiles, the majority of people prefer Japanese flavors.

According to a survey by Global Viewer, Japan ranked first by a wide margin in the “Countries/regions you want to visit within the next year” category. Online, information about Japan—such as food and leisure activities—is shared in large quantities every day, and the speed at which trends spread is almost on par with Japan.

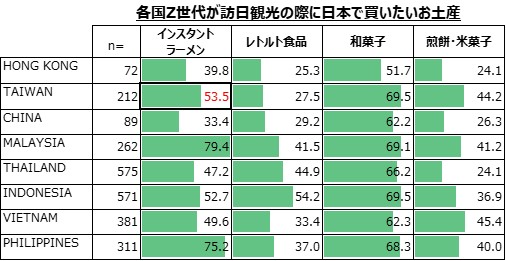

Amidst the continuing weak yen, many Taiwanese visit Japan to purchase newly released cup ramen and buy instant ramen at bargain prices at drugstores and mass retailers. In a survey on “food products I want to buy in Japan,” instant ramen received more than 50% support from both male and female members of Generation Z. At first glance, this figure may seem slightly lower than in other countries, but the background to this is that since the COVID-19 pandemic, the number of Japanese mass retailers and drugstores in Taiwan has increased significantly.

Intage Global Viewer Banner: T4S1. Food products that consumers wish to purchase in Japan (MA) [Base: Food purchasers]

Nowadays, instant ramen imported from Japan can be easily purchased at convenience stores throughout Taiwan, and Japanese foods that were once considered “luxury” items have now become part of everyday life. Popular Japanese stores such as Daiso, Uniqlo, and Don Quijote have opened branches in Taiwan, and it is no exaggeration to say that there are few Japanese products that cannot be found in Taiwan. The “Japanization” of Taiwan is accelerating.

Cookies popular with Generation Z

In addition to instant ramen, “biscuits and cookies” are also ranked high among “food items people want to buy in Japan.” In my experience, until about 20 years ago, Chinese-style cookies made with plenty of vegetable oil were the mainstream in Taiwan. Therefore, when I brought Japanese cookies made with plenty of butter as souvenirs, they were very well received.

Additionally, there is a strong fascination with Hokkaido among Taiwanese people. At Japanese product exhibitions held in Taipei, Hokkaido-produced butter sandwiches would often sell out in no time.

Against this backdrop, the image of “Japanese Western-style confectionery being delicious” has firmly taken root among Taiwanese people. In recent years, specialty cookie shops focusing on high-quality butter and flour have been opening one after another across Taiwan, and it is believed that the high evaluation of Japanese Western-style confectionery is also influencing domestic brands.

Since Starbucks arrived in Taiwan, café culture has become firmly established, and with it, the genre of “pastries that go well with coffee” has also evolved. For example, the Western-style pastry specialty store “but. we love butter” in Taipei features cookies made with French Échiré butter and Taiwan's famous Jin Zhan pineapple as its signature product. These cookies are popular not only among local Taiwanese but also among Japanese and international tourists.

Stylish packaging is also appearing one after another, and many consumers purchase these products as souvenirs or gifts. In addition, Taiwan has a custom called “Xi Bing,” in which the bride distributes gifts such as cookies to friends, colleagues, and others who have helped her in the past when she gets married. The cookies from “but. we love butter,” which are both visually appealing and highly rated for their taste, are extremely popular as Xi Bing gifts.

Amidst this trend, this cookie brand, which enjoys immense popularity in Taiwan, opened a hotel-style concept store named “Naiyou Fandian” in Taichung last October. Inside the store, customers can not only purchase gift sets but also enjoy photo-worthy interior designs and limited-edition products. The store has been bustling with crowds, with lines forming daily and tickets being distributed to manage the crowds.

A cookie specialty store with a hotel-like atmosphere, created by renovating an office building.

At first glance, it looks like a hotel, but it does not offer any accommodation services. Instead, it mainly sells cookies, and visitors are treated to samples. The four-story building features a laundry room and a floor inspired by Roman baths, making the entire building a spot perfect for social media posts. In Taiwan, renovating old buildings from the Japanese colonial era into stylish shops has become a recent trend, and Creamy Hotel is one of them. The former office building has been transformed into a space with excellent design by a famous designer.

Each floor features spots perfect for posting on social media, inspired by the Roman baths.

Fortunately, many Taiwanese people in their 30s and 40s and older admire Japan as a “country of aspiration,” and I have often encountered such sentiments. However, now that Japanese food products are readily available locally, it seems that imported goods from Japan are no longer considered special by Taiwan's Z generation.

Furthermore, high-quality products are being developed domestically in Taiwan, and there is a growing tendency to think, “There's no need to buy Japanese products; local ones are sufficient.”

As Japan faces a declining birthrate, it will become increasingly important to develop and expand products not only for Japan's Z generation but also for the Z generation in Taiwan and other Asian countries.

Related Article: Understanding Overseas Gen Z Characteristics: Country-Specific Trends in Values and Lifestyle (Singapore, Hong Kong, South Korea, Taiwan, China, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

Using a large consumer database, we identify characteristics and trends among Gen Z in each country and present them in a summary article.

You can also view information on Gen Z in other countries.

Countries Covered: Singapore, Hong Kong, South Korea, Taiwan, China, Malaysia, Thailand, Indonesia, Vietnam, Philippines

-

Author profile

TNC Lifestyle Researcher

I have lived in Taiwan for over 20 years. I majored in ethnology at a Japanese university and conducted research on Japanese food culture. Currently, I am writing a column on the origins and cultural background of Japanese food for a Japanese language learning magazine published in Taiwan.

-

Editor profile

Chew Fong-Tat

Malaysian researcher who has lived in Japan for 14 years and has handled many surveys on ASEAN countries.

Global Market Surfer

Global Market Surfer CLP

CLP