【ASEAN】Health Supplement Market: Insights from Rapid Growth

- Release date: Dec 03, 2025

- Update date: Dec 03, 2025

- 1893 Views

目次

1. Rising Health Awareness in ASEAN and the “Rapid Growth” of the Health Supplement Market

2. Health and Food Awareness in Three Countries: Is Thailand Less Concerned About Health and Food?

(1) Regarding “Health Awareness”

(2) Regarding dietary awareness for health

3. Examining the Reasons for Low Health Awareness in Thailand

4. Differences Revealed by Purchasing Behavior: Thailand Prioritizes Convenience

5. Summary

1. Rising Health Awareness in ASEAN and the “Rapid Growth” of the Health Supplement Market

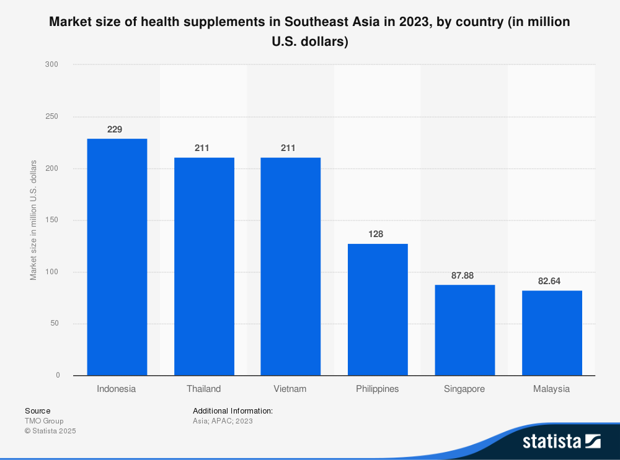

In recent years, the health supplement1 market in ASEAN has experienced rapid growth. By 2023, Indonesia will lead the health supplement market in terms of size, followed by Thailand and Vietnam.

1 Foods that supplement vitamins, minerals, protein, and other nutrients often lacking in daily meals.

Figure 1: Market Size of Health Supplements in Southeast Asia (2023, by Country) (Unit: Million USD)

Source:Market size of health supplements in Southeast Asia in 2023, by country(Source: Statista)

However, when market size is divided by population, Thailand stands at 3.19 USD (approximately 500 yen), with per capita spending reaching 3.9 times that of Indonesia.

Figure 2: Per capita expenditure on the health supplement market

Many people likely assume that the expansion of the health supplement market stems from heightened awareness of healthy eating in ASEAN countries. But what is the actual situation?

This article examines “health awareness,” “dietary awareness for health,” and “key considerations when purchasing food” in three major Southeast Asian countries (Indonesia, Thailand, Vietnam) using Intage's overseas consumer data “Global Viewer” (conducted in 2024). We explore the keys to the growth of the health supplement market.

2. Health and Food Awareness in Three Countries: Is Thailand Less Concerned About Health and Food?

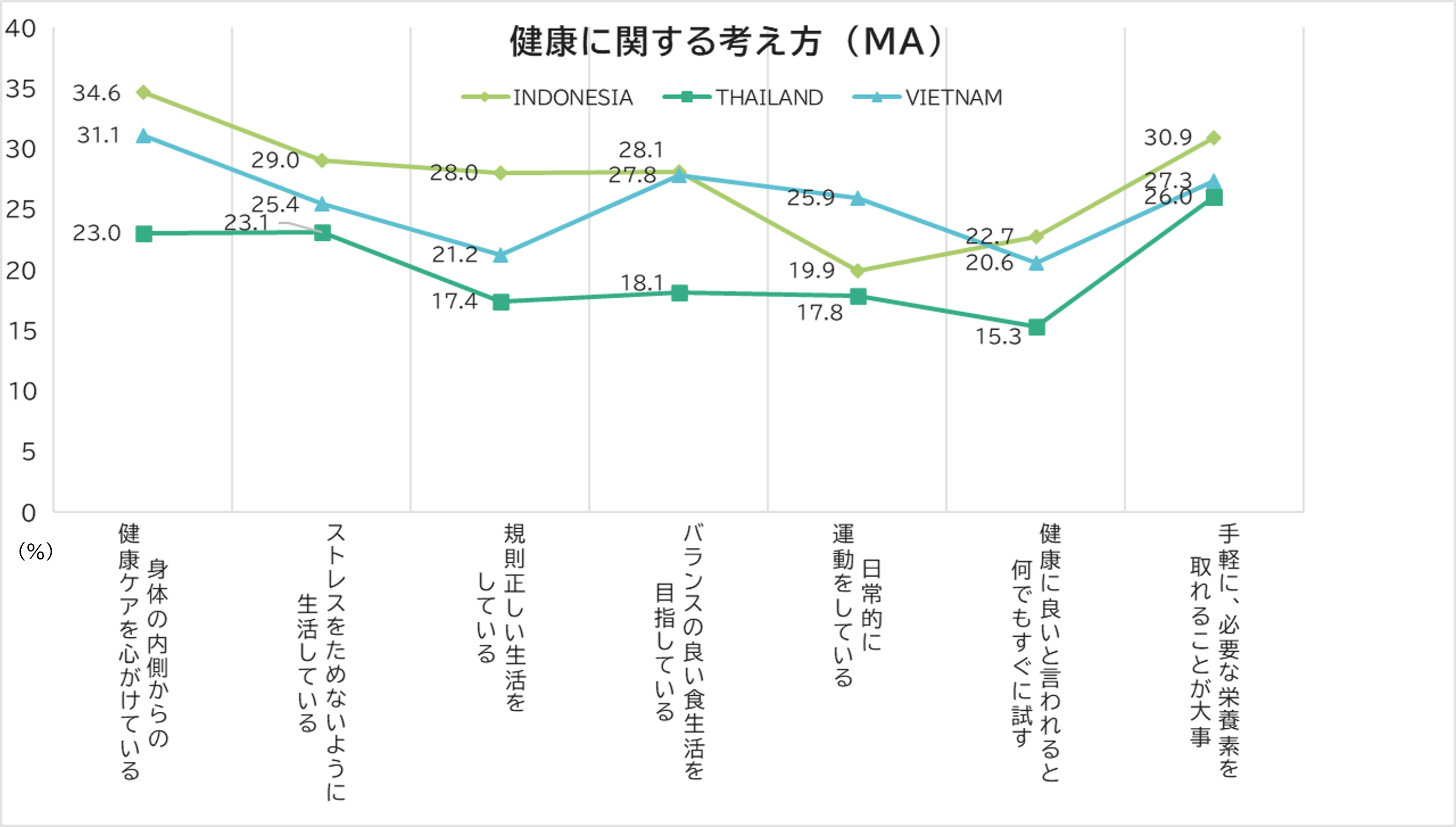

(1) Regarding “Health Awareness”

According to Intage's overseas consumer data “*Global Viewer” (2024 survey), Indonesia, which has the largest market size, scored higher than the other two countries on items such as “striving for health care from within the body,” “the importance of easily obtaining necessary nutrients,” and “aiming for a balanced diet,” indicating a strong emphasis on nutrition and healthy eating.

Conversely, Thailand, which has the highest per capita spending on health supplements, scored the lowest across all items. Indonesia shows the highest awareness of dietary balance and nutrition, while Thailand tends to be somewhat lower in comparison.

Figure 3: Attitudes Toward Health (5-Point Scale, Top 1)

Source: INTAGE Global Viewer (2024) V6S2_MA1

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

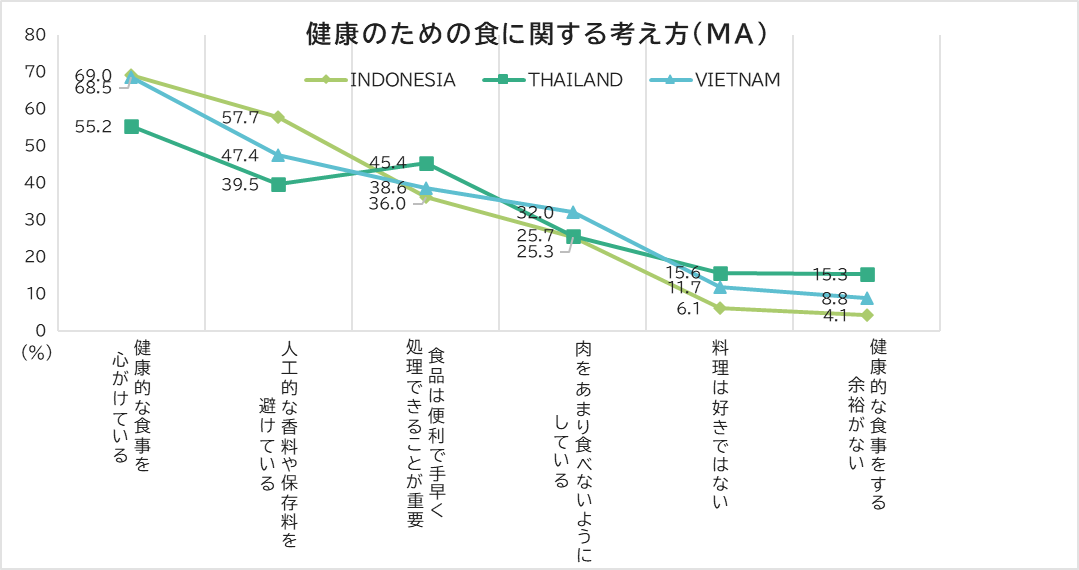

(2) Regarding dietary awareness for health

Looking at health-conscious eating habits, “I try to eat healthy meals” and “I avoid artificial flavors and preservatives” scored higher than other items in all three countries. However, Indonesia again scored highest here, while Thailand scored lowest.

However, regarding “Food should be convenient and quick to prepare,” Thailand scored over 5 points higher than the other two countries. Additionally, Thailand had higher percentages for “I don't like cooking” and “I can't afford to eat healthily,” indicating a lower awareness of home cooking.

Figure 4: Attitudes Toward Food for Health (MA)

Source: INTAGE Global Viewer (2024) V0221

3. Examining the Reasons for Low Health Awareness in Thailand

By now, it has become clear that health awareness in Thailand is lower than in other countries. So, let's examine why this difference in awareness exists.

This difference in awareness is thought to stem from changes in the economy and lifestyle. Thailand has the highest per capita GDP among the three countries2. Rising incomes and urbanization have led to the development of eating out and street food culture, reducing the frequency of home cooking. These lifestyle changes have fostered eating habits prioritizing “convenience” and “taste,” relatively weakening the emphasis on healthy food.

In contrast, Indonesia and Vietnam retain a strong culture of preparing meals at home and sharing them as a family3. It is thought that cooking for family members emphasizes natural ingredients and nutrition.

2 ASEAN Countries GDP per Capita 2020-2030 | Statista

3 Home cooking in Asian countries: How Cooking Frequency Reveals Differences in National Eating Habits| Column | Global Market Surfer

Furthermore, the healthcare infrastructure of each country may also be indirectly influencing these trends. As of 2024, Thailand's per capita healthcare expenditure stands at $423.62 (approximately ¥66,000)4, higher than Indonesia's $168.09 (approximately ¥26,000) and Vietnam's $218.96 (approximately ¥34,000). This indicates a well-developed healthcare infrastructure. It is speculated that the sense of security provided by the ability to receive medical care even when ill reduces the individual need to seek “health” in food. Instead, there is a growing tendency to prioritize ‘convenience’ and “taste.”

4 Thailand: current healthcare spending per capita 2014-2029| Statista

4. Differences Revealed by Purchasing Behavior: Thailand Prioritizes Convenience

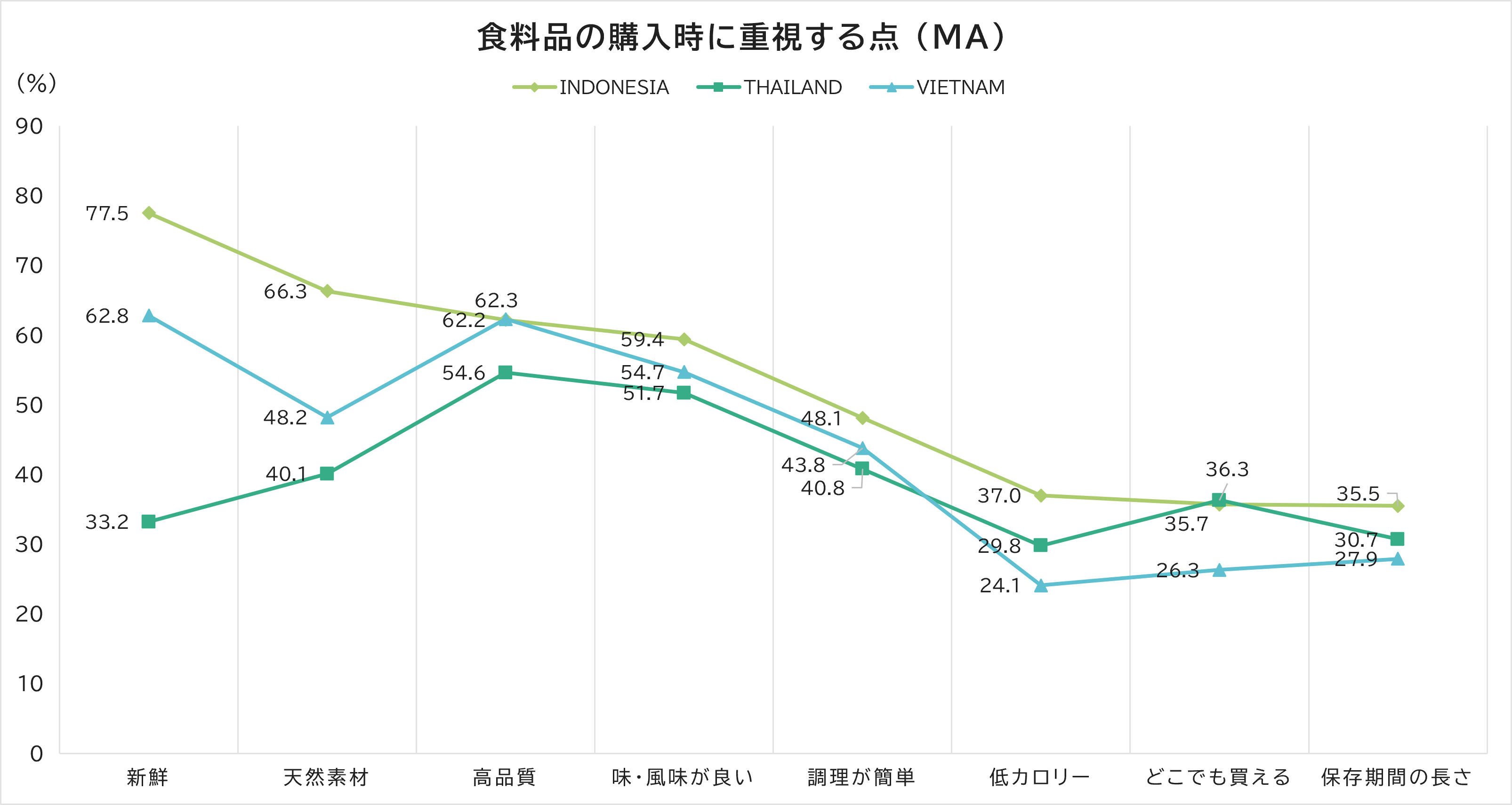

Now, let's verify whether the above analysis is correct using the “Key Considerations When Purchasing Groceries” data.

Comparing priorities when purchasing food, Indonesia and Vietnam place high importance on “freshness,” “natural ingredients,” and “high quality,” emphasizing health-related factors. In contrast, Thailand prioritizes “availability anywhere,” placing greater emphasis on convenience than the other two countries.

This suggests that “ease of access” may be the decisive factor in food purchases in Thailand. Furthermore, while Indonesia and Vietnam show a clear trend of prioritizing health in food purchasing, Thailand appears to be choosing “convenience” over that.

Figure 5: Key Considerations When Purchasing Groceries (MA)

Source: INTAGE Global Viewer (2024) V0231

5. Summary

Thailand ranks highest in per capita spending on health supplements, yet surprisingly, health consciousness—particularly regarding diet—is not exceptionally high. This is likely due to the development of a dining-out culture and robust medical infrastructure. The reason Thailand still tops per capita spending on health supplements is probably because people view “health supplements as something separate from regular meals.”

Thais prioritize convenience and taste in their daily meals, supplementing with health supplements to prevent nutritional deficiencies. When experiencing physical discomfort, they seek treatment at medical institutions. This pattern is likely similar in developed countries like Japan. In contrast, Indonesia and Vietnam appear to be more health-conscious in their daily diets and use health supplements less frequently than Thailand.

-

Author profile

Ilina Aleksandra

Born in Russia. Majored in Oriental Studies during university, became fascinated with Japanese culture, and came to Japan. Since 2024, has been responsible for global research in the FMCG sector at INTAGE. Dedicated to sharing Japan's appeal with the world as a lifelong mission.

-

Editor profile

Chew Fong-Tat

Malaysian researcher who has lived in Japan for 14 years and has handled many surveys on ASEAN countries.

Global Market Surfer

Global Market Surfer CLP

CLP