【US・China】How to Book Business Travel Arrangements? ~Comparing Business Travel Styles in Both Countries~

- Release date: Dec 04, 2025

- Update date: Dec 04, 2025

- 476 Views

Business travel, which declined significantly worldwide during the COVID-19 pandemic, has recently begun to recover to its previous scale. How do the selection and arrangement of airline tickets and hotels for business travel differ by country? This article focuses on the United States and China, which lead the business passenger market, and delves into the characteristics of each country's business travel style by examining differences in airline selection methods and booking approaches.

目次

1. Trends in Business Trip Frequency Since the Onset of the COVID-19 Pandemic

2. Which countries have the highest frequency of business trips: the United States or China?

3. Which airline should I choose? (FSC or LCC)

4. Direct Booking or App Use? Differences Revealed Through Reservation Methods

5. Summary

1. Trends in Business Trip Frequency Since the Onset of the COVID-19 Pandemic

In 2020, global travel restrictions due to the COVID-19 pandemic led many to believe business trips would be replaced by online meetings. However, the value of face-to-face negotiations and relationship-building was subsequently reevaluated, and business travel demand is now recovering worldwide.

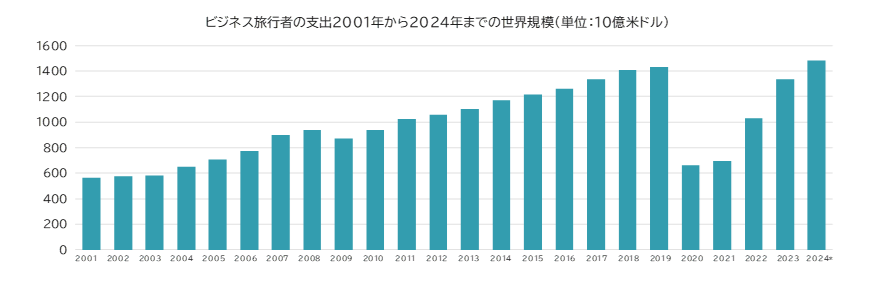

As seen in Figure 1 (Source: Statista), business traveler spending shows a recovery trend starting in 2022. It is expected that demand will continue to return as the optimal form is explored.

Figure 1: Business Traveler Spending Trends

Source: Statista Market Insights (cited from Statista)

2. Which countries have the highest frequency of business trips: the United States or China?

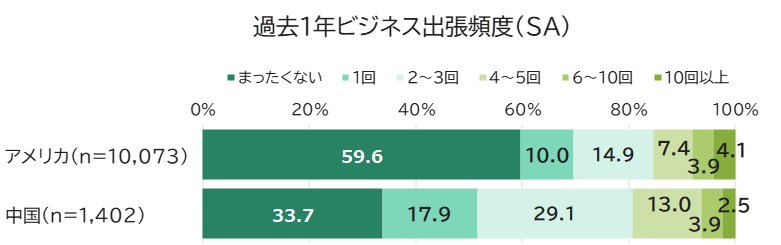

Let's examine business trip frequency in the United States and China. According to Intage's Global Viewer data (2024 survey)* on overseas residents, approximately 40% of respondents in the United States and nearly 70% in China had experienced business travel within the past year, indicating a higher travel rate in China. Breaking this down further, about 50% of respondents in China had traveled for business two or more times, while only about 30% in the United States had done so, showing a relatively lower frequency of business travel in the United States.

Figure 2: Frequency of Business Travel in China and the U.S. Over the Past Year (SA)

(Base: Men and Women Aged 18-64 in Each Country)

Source: INTAGE Global Viewer (2024)

*About Global Viewer

This service provides reports tailored to your issues using questionnaire data on various actual conditions and attitudes of sei-katsu-sha in 11 countries (Asia and US) stocked by INTAGE.

The service covers 400 items, including actual behavioral conditions and awareness, values, and information contact related to various product and service categories.

3. Which airline should I choose? (FSC or LCC)

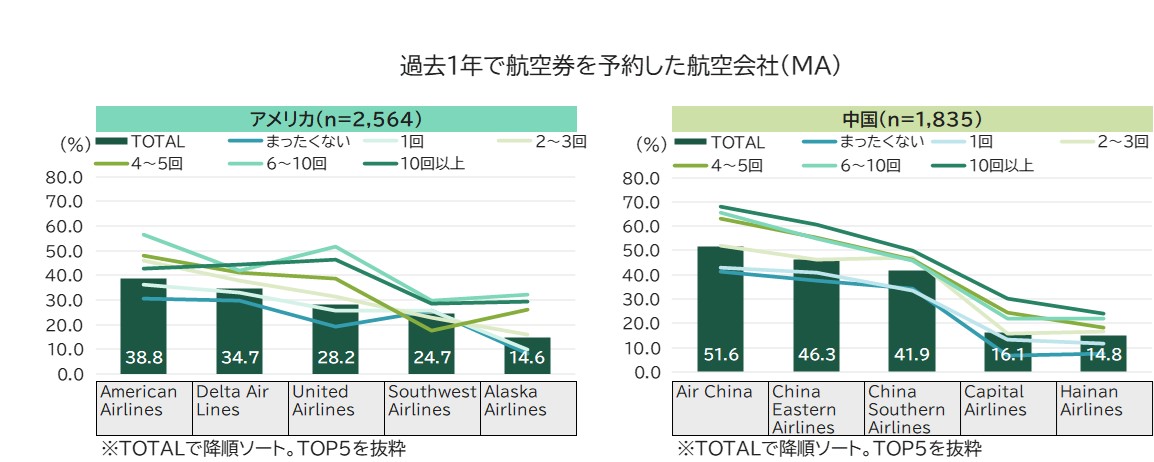

Now, let's examine the characteristics of airline selection in each country by comparing China and the United States.

Looking at airlines used over a year, in the United States, alongside full-service carriers (FSC/American Airlines, Delta Air Lines, United Airlines), low-cost carrier (LCC) Southwest Airlines follows, showing a diversification of airline choices.

In contrast, in China, the three major state-owned carriers—Air China, China Eastern Airlines, and China Southern Airlines—dominate overwhelmingly, with a gap of over 20 percentage points to the next airline.

Differences also emerged in the US when examining usage by business trip frequency.

United Airlines, which trails American Airlines—the most frequently used airline overall—by more than 10 percentage points, achieves comparable usage rates to American Airlines among frequent travelers (six or more trips). This indicates United Airlines is favored by high-frequency business travelers.

Figure 3: Airlines Booked for Air Tickets in the Past Year (MA)

(Base: Men and women aged 18-64 in each country who booked air tickets within the past year)

Source: INTAGE Global Viewer (2024)

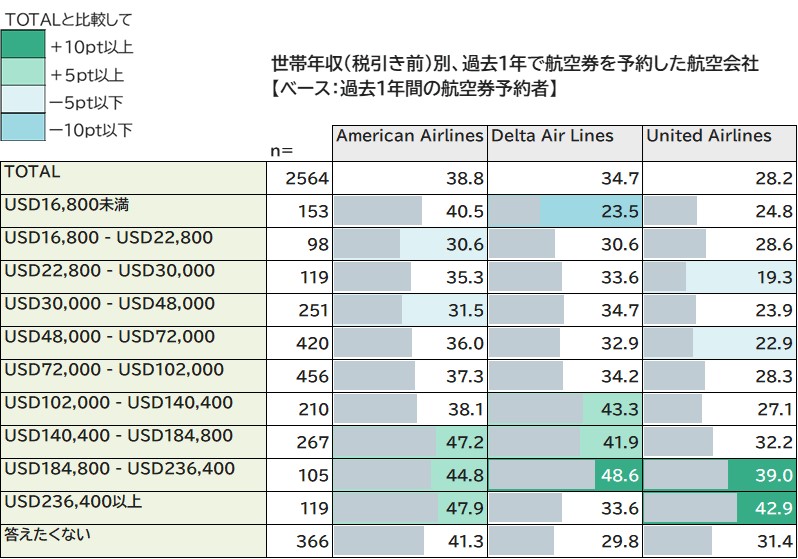

Now, let's examine the usage rates of the three major U.S. airlines by household income.

Figure 4 reveals that United Airlines, favored by frequent business travelers, sees higher usage rates among higher-income individuals. This suggests the airline is successfully capturing premium demand.

Figure 4: U.S. Airlines Booked for Air Tickets in the Past Year by Household Income (MA)

Source: INTAGE Global Viewer (2024)

4. Direct Booking or App Use? Differences Revealed Through Reservation Methods

When traveling for business, you need to book not only air tickets but also hotels and local transportation.

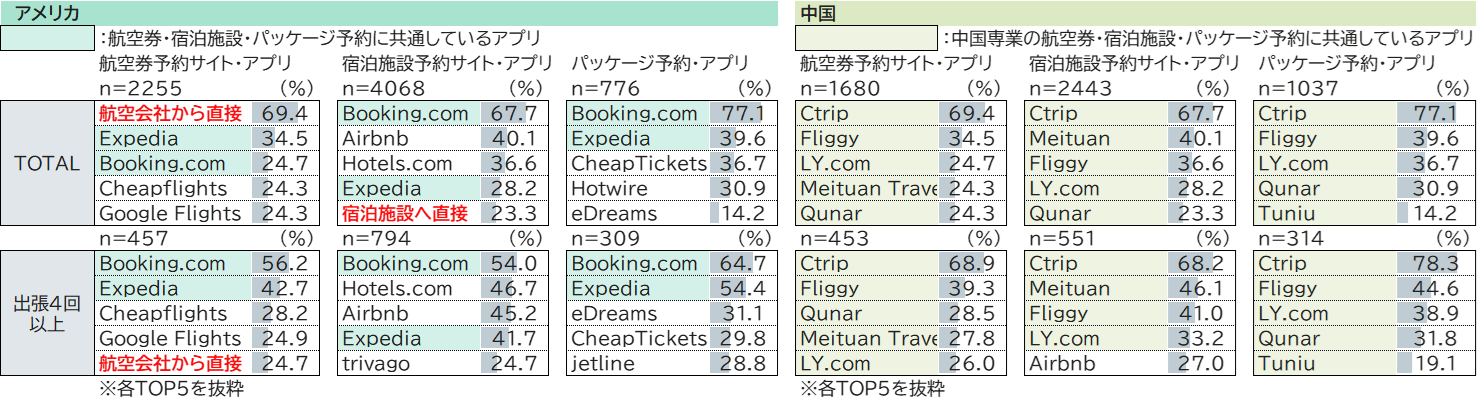

Therefore, we compared the usage of online platforms for booking air tickets, accommodations, and package deals via websites and apps.

In the United States, “direct booking” through official websites ranked in the top 5 for both air and hotel reservations, indicating it is the primary method for making bookings. However, among frequent business travelers (4+ trips per year), there is a growing tendency to use OTAs (Online Travel Agencies) that offer package deals covering everything from airfare to hotels.

In contrast, in China, specialized Chinese OTAs like Ctrip and Fliggy are overwhelmingly dominant, and direct booking does not rank among the top methods.

For business travel as well, it is evident that using super-app-style platforms that allow bundled arrangements for airfare, hotels, rail, and activities is becoming the norm.

Figure 5: Airline Tickets, Accommodations, and Package Booking Sites/Apps Used in the Past Year

(Base: Men and Women Aged 18-64 in Each Country Who Made Online Reservations for Airline Tickets/Accommodations/Package Tours Within the Past Year)

Source: INTAGE Global Viewer (2024)

5. Summary

This comparison revealed the following characteristics in the business travel styles of the United States and China.

・Tendency to compare and select brands that suit them by using different websites and apps

・A significant number of travelers prefer direct booking

・Frequent travelers (4 times per year) also utilize OTAs extensively.

・Travelers have a higher frequency of business trips than in the U.S., with the mainstream style being to arrange flights, accommodations, and other arrangements through China's own OTAs.

Accurately understanding each country's business travel behavior and booking patterns will become crucial for marketing strategies in the aviation and travel industries.

In Japan too, we will closely monitor whether any airline brands emerge that strongly capture the business traveler market.

-

Author profile

Riko Matsushita

Joined INTAGE in 2023. Engaged in marketing research in the DCGS field, primarily focusing on real-world entertainment such as theme parks.

-

Editor profile

Risa Takahama

After working in marketing research support for Japanese FMCG manufacturers (cosmetics, baby products, food and beverages, etc.) in Asia, Europe, and the U.S., from 2019, in his current position, he develops solutions for overseas marketing research for Japanese companies and conducts seminars and other outward communications.

Global Market Surfer

Global Market Surfer CLP

CLP