[China: World Residence Tour] Explore the high-income consumers' electronics brands that can be found in their rooms.

- Release date: Nov 15, 2021

- Update date: Sep 09, 2025

- 7754 Views

In the past, Chinese brands might have been associated with cheapness, unstylish designs, and poor quality. However, perceptions have changed significantly. Particularly amid the recent “national trend” boom in China, manufacturers are actively working to shed these old impressions. They aim to enhance their image not only in the domestic market but also globally. In specific product categories, Chinese brands capable of competing head-to-head with global brands have emerged. Within this trend, how are high-income consumers selecting home appliances? Let's explore this together by introducing the appliances owned by three Shanghai residents registered with Consumer Life Panorama.

This time, we feature three individuals from relatively high-income households in Shanghai who own advanced vehicles like electric cars (EVs).

Subject's vehicles. From left: Xpeng (CN_28), Xpeng (CN_30), Tesla (CN_54)

(Source: Consumer Life Panorama)

Interior design concepts for the subject's home. From left: CN_28, CN_30, CN_54

(Source: Consumer Life Panorama)

What is Consumer Life Panorama?

This is a website-type database that has accumulated visual data on more than 1,000 sei-katsu-sha from 18 countries around the world. The database includes many 3D models of living environments and 2D data of items owned by each sei-katsu-sha, and is useful for understanding overseas sei-katsu-sha, which is difficult to grasp using only letters and numbers.

Using visual data such as those cited in this column,

Compare the differences in the attributes of overseas consumers

To get a realistic understanding of the actual usage of each category

To understand the overall lifestyle of target consumers

etc., can be utilized as a “no-go” home visit survey.

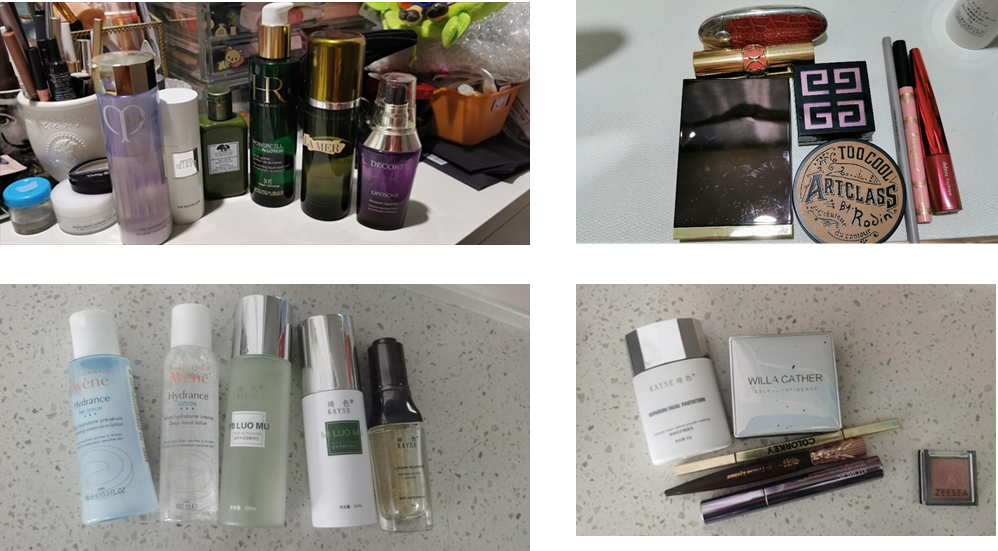

Strengths of Overseas Brands and Areas of Expertise for Japanese Brands

Chinese consumers still place strong trust in foreign brands for home appliances, but the presence of Chinese brands is also growing. First, let's look at major appliance brands. For example, regarding refrigerators, two out of these three households own German or Japanese brands. The same trend is seen for washing machines. Household CN_28 uses Bosch for both their refrigerator and washing machine, while Household CN_30 uses a Panasonic washing machine. On the other hand, Household CN_54 owns two washing machines, but primarily uses an LG model. This can be partly attributed to the common perception that overseas brands, particularly German and Japanese brands, offer superior durability and quality.

Refrigerator (Top) and Washing Machine (Bottom) Brand Nationality List

(Source: Consumer Life Panorama)

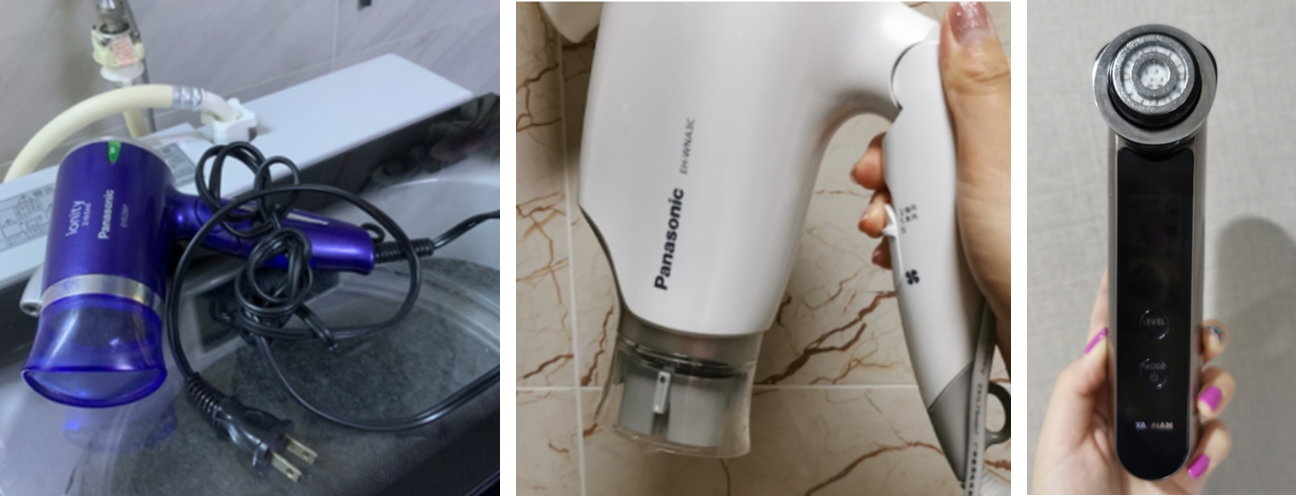

Beyond large appliances, Japanese brands excel in other areas. Beauty appliances represent one such category. Among the three households surveyed, two (CN_30 and CN_54) use Panasonic hair dryers. (The remaining household uses a Dyson hair dryer.) Notably, CN_54 owns not only a Japanese-brand hair dryer but also a Yaman facial device.

CN_30 hair dryer (left), CN_54 hair dryer (center) and facial beauty device (right)

(Source: Consumer Life Panorama database)

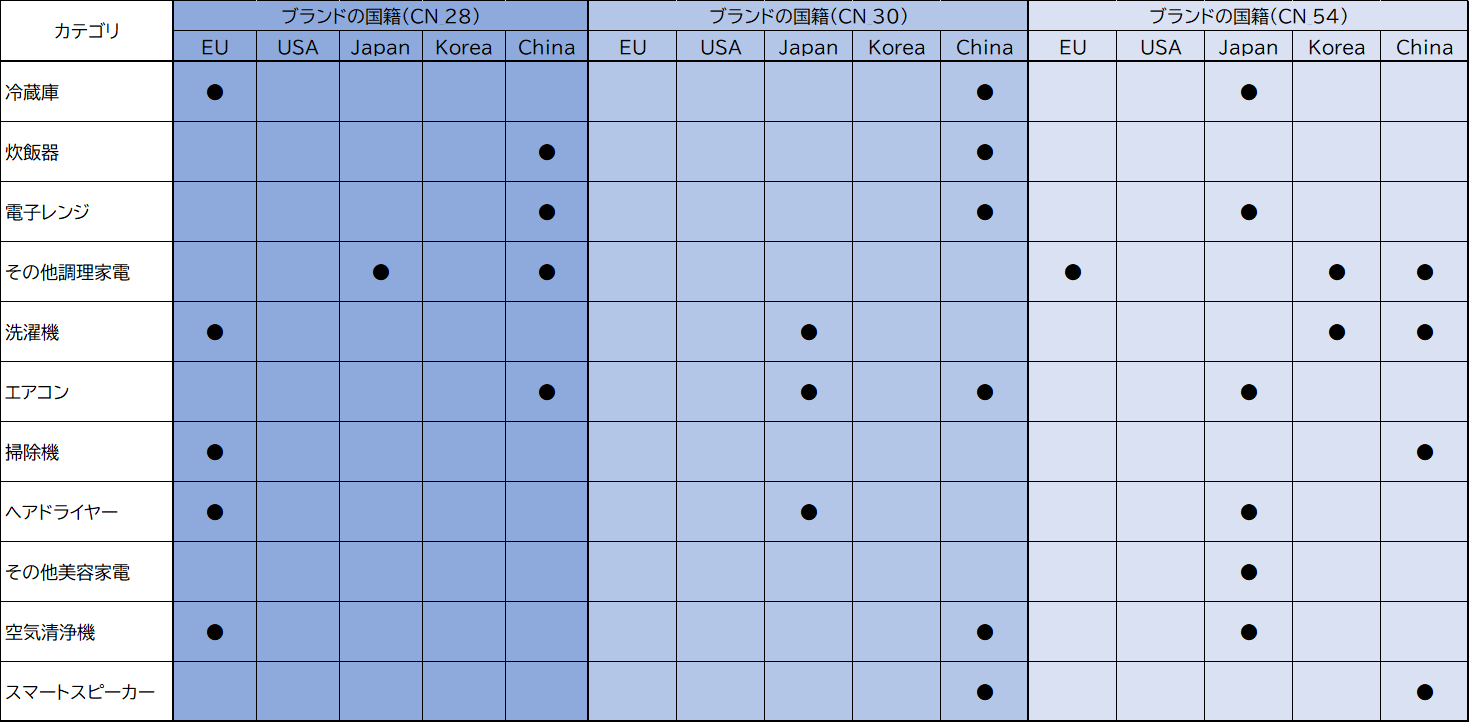

Chinese brands building strengths in specific fields

Meanwhile, Chinese brands appear to be building their strengths in specific areas. When organizing the home appliance brands owned by the three Shanghai households introduced here by category, three main trends emerge.

List of Nationalities of Home Appliance Brands (Compiled by the author based on CLP data)

(Source: Consumer Life Panorama)

First, Chinese brands are quick to grasp changes in the lifestyles of Chinese consumers and release products tailored to them. When it comes to Chinese cooking, it often involves using a lot of oil and cooking methods like stir-frying or deep-frying over high heat. Stir-frying, in particular, requires frequent vigorous shaking of the wok over the flame. For this reason, gas stoves have traditionally been the mainstream choice in Chinese kitchens. However, in recent years, Western cooking methods have gradually become more prevalent, leading to greater diversity in cooking techniques. For instance, beyond traditional stir-frying, baking in ovens is becoming more common. Furthermore, induction cooktops are gaining popularity among some Chinese consumers as an alternative to gas stoves, due to their efficiency, safety, and ease of maintenance.

Chinese Brand Oven (CN_54) and IH Cooktop (CN_28)

(Source: Consumer Life Panorama)

The IH cooktop in the CN_28 kitchen is made by Taigroo, a Chinese brand established in 2015. Taigroo was quick to recognize this trend, specializing in creating high-end IH cooktops and related cooking appliances characterized by simple designs.

Second, Chinese brands are offering products that cater to the unique lifestyles of Chinese consumers.

CN_54 coffee machine (left) and compact washing machine for children's clothes (right)

(Source: Consumer Life Panorama database)

Just as drinking a cup of coffee in the morning is common overseas, drinking soy milk at breakfast is common in China. The dining area at CN_54 features a coffee machine. It's a Onecup brand coffee machine made by Joyong, a Chinese manufacturer. Unlike other brands, this coffee machine can make soy milk as well as coffee. It's become popular in China because it can prepare coffee for adults and soy milk for children in just 30 seconds during busy mornings for dual-income families.

Let me give another example. Perhaps due to the long-standing one-child policy, Chinese families tend to raise their children with great care. From certain perspectives, it would not be an exaggeration to say they are even more cautious than families in Japan.

For instance, CN_54 is a three-person household with a three-year-old child. The parents make various efforts to create a healthy and hygienic environment to support their child’s growth. One area they pay particular attention to is protecting their child from bacteria and viruses. In this household, in addition to a washing machine for adults, they even own a compact Haier washing machine specifically for children’s clothes, equipped with a high-temperature sterilization function.

Third, Chinese brands are rapidly adopting advanced AI and IoT technologies and commercializing them at low prices. China is often called an IT powerhouse. Chinese home appliance manufacturers are also actively incorporating these advanced technologies to evolve their products. Moreover, domestic production keeps costs down. As a result, compared to overseas products with the same functionality, they are often praised for being cheaper and offering better value for money. For example, smart speakers are produced not only by the major BAT companies (Baidu, Alibaba, Tencent) but also by Xiaomi and Huawei. Xiaomi, in particular, has multiple smart home appliances beyond this, forming an entire ecosystem. Similarly, with robot vacuums, models priced the same as overseas brands often offer better smartphone connectivity and more features, making them popular.

Smart speakers (left: CN_28, center: CN_30) and robot vacuum cleaners (right: CN_54)

(Source: Consumer Life Panorama)

Summary

The term “Guochao” refers to a fashion trend incorporating Chinese elements. These elements encompass not only traditional Chinese culture and Chinese-style design, but also China's technological capabilities and expertise. This trend has emerged against the backdrop of China's economic advancement over recent years, where growing prosperity has coincided with heightened patriotism.

At the same time, Chinese manufacturers have shifted from producing low-end goods to challenging higher-value-added products, leading to the growth of high-tech companies like Xiaomi and Huawei. As a result, the perception has spread that Chinese products offer excellent cost performance and quality that rivals foreign brands. Compared to overseas brands, the strength of local Chinese brands lies in their understanding of Chinese consumers and their speed in adapting to changes in their lifestyles.

On the other hand, as mentioned earlier, Japanese brands still possess unique advantages beyond their recognized quality. How to leverage these unique strengths while accurately understanding the needs of Chinese consumers and responding swiftly may be the challenge for Japanese brands going forward.

-

Author profile

Yang Yan

A Chinese researcher living in Japan shares insights on overseas consumer lifestyles, primarily focusing on China. Wanting to watch Chinese TV programs in Japan, I went out of my way to bring a Xiaomi smart TV box from China.

-

Editor profile

Yusuke Tatsuda

Responsible for building the Global Market Surfer website. I'm a milk person in the morning, but this column sparked my interest in homemade soy milk.

Global Market Surfer

Global Market Surfer CLP

CLP